Homes by Etopia are built offsite using the latest eco-technology. Image: Project Etopia

For years now, MMC – modern methods of construction – has been much talked about as a forward-looking solution to many of the building sector’s problems. But so far, it has been mostly just that – talk. Now, though it seems MMC’s time might have finally come.

MMC is a broad term used to describe multiple ways of working, both offsite and onsite, including well understood methodologies such as offsite fit-out of modular housing as well as more contemporary innovations such as digital twins and 3D printing.

Barely a week goes by without another exciting announcement, whether that’s a funding deal, a new factory for modular products, an established industry player going modular or a new entrant vowing to revolutionise development. And there are some who argue that the COVID-19 pandemic could accelerate the adoption of MMC.

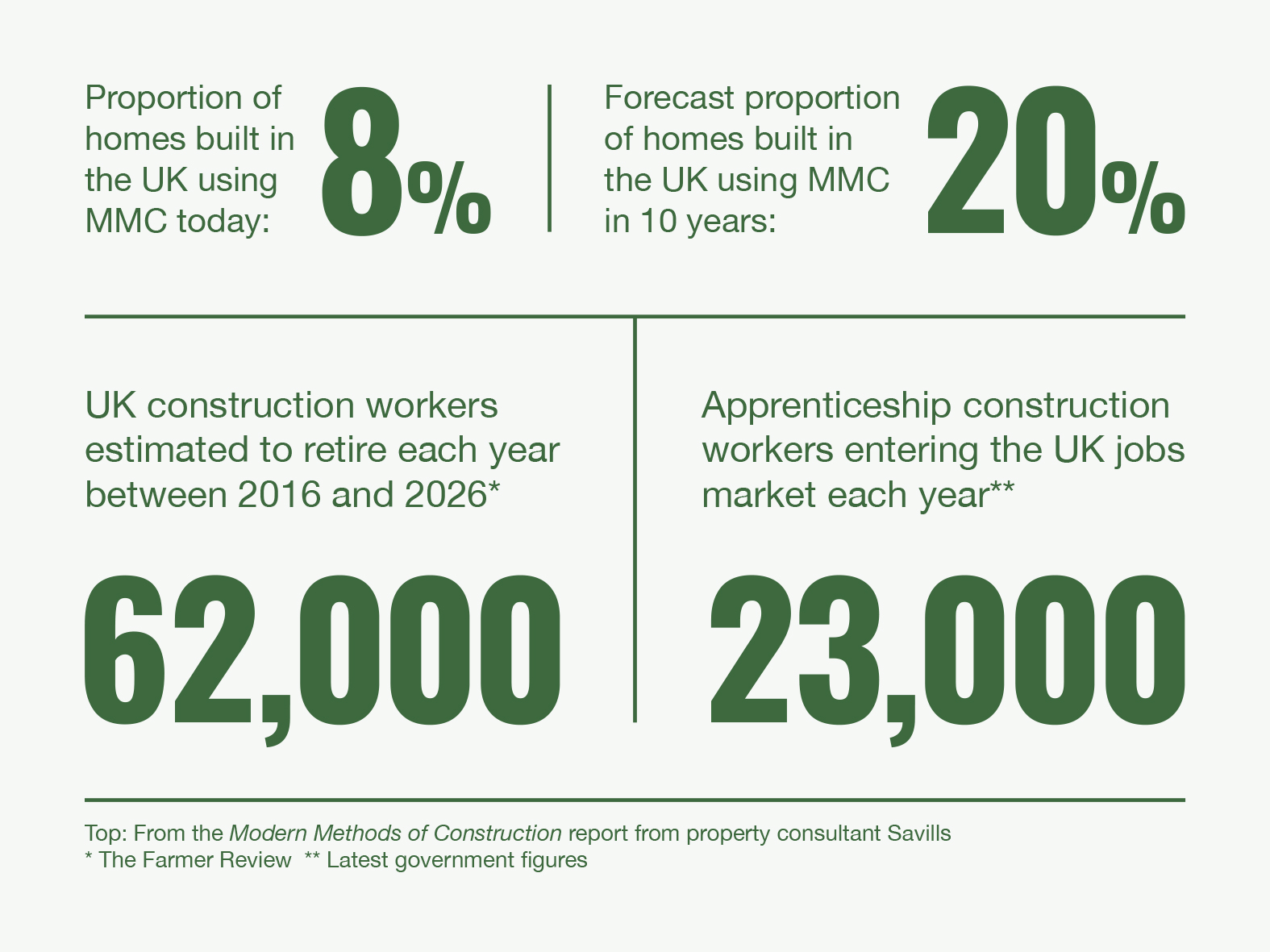

Certainly, the most recent report on the state of play paints a positive picture. Entitled simply Modern Methods of Construction, the report from property consultant Savills forecasts that the proportion of homes built in the UK using MMC will increase from around 8% today to 20% in the next 10 years.

No longer just big in Japan

The report’s authors say that the successful adoption of MMC in other countries around the world – Japan, Germany and the Nordic block are most often cited as examples – was driven previously by three factors: the cost and availability of labour, housing supply shortages and regulatory and governmental intervention. They also note that those three factors are currently in play in the UK.

For its part, RICS has long recognised the potential of offsite construction. Having published its own research paper on MMC, called Forward Thinking Solution to the Housing Crisis, it has called for the government to “support MMC, both directly through investment and indirectly through planning, education and construction and design quality standards and programmes”.

In its policy statement, RICS says, “The stage is set for MMC homes to achieve scale. The concept has potency in the generation of a new model of home design, selection, and consumption especially in the submarkets of ageing population, social housing and build to rent.”

Of course, investing in MMC doesn’t come cheap, and while labour is cheap the impetus for investment simply isn’t there. However, if labour availability diminishes and costs increase, at some point contractors and developers reach a tipping point where spending the money up front becomes the sensible thing to do in the medium- to long-term.

In the UK, labour availability was already an issue before the 2016 Brexit referendum. Since the UK voted to leave the EU, it has become ever more pressing. Modernise or die: the Farmer Review of the UK construction labour model, published around four months after the vote, said that between 2016 and 2026 around 62,000 construction workers would retire each year. Contrast that with the latest government figures on apprenticeships, which show that only around 23,000 new apprentices are coming on stream annually.

Brexit and the shortage of labour

The labour shortage is likely to be exacerbated by the changes to the immigration system set to come into force at the end of the year when the transitional arrangements with the EU come to an end – deal or no deal. Around 10% of the UK construction workforce come from abroad and the Institute for Policy Research thinktank has forecast that 59% of the current construction workforce that has migrated from the EU would be ineligible for a visa under the proposed new rules.

In terms of housing supply, the UK’s shortages are well documented. The government’s official annual target for new homes stands at 300,000 and many industry experts think that is too low. Delivery has ticked up in recent years, but the Savills report says that it still needs to increase by a further 24% if the 300,000-unit target is to be achieved. “This is going to be an extremely tall order using traditional construction alone,” it says.

Building greener and safer

Then there is regulatory and governmental intervention. As a signatory to the 2016 Paris Agreement, the UK is committed to achieving carbon neutrality by 2050, something that will require concerted effort in every sector of the economy. In development, MMC has the potential to deliver huge carbon savings due to the fact that factory-produced units are capable of far higher levels of energy efficiency than traditionally built homes while at the same time pushing down on costs. That’s one reason why the government recently introduced a presumption in favour of offsite building techniques in government tenders.

But what about COVID-19? It was notable during the lockdown that, for economic reasons, the government never actually mandated that building sites had to close even if 2m social distancing couldn’t be maintained – which in many instances on a traditional building site it couldn’t. With factory-built components that simply need to be fixed together, however, such social distancing is possible, as demonstrated by other advanced manufacturing companies.

“MMC gives you better controlled environments in which you can manage the health risks with regards to COVID-19,” says Jamie Hillier FRICS, founder of MMC consultant Akerlof, adding that the pandemic driving many professionals to adopt digital working is another factor. “There are more businesses now looking at the shift from bespoke individual solutions to more of a digitised, standardised, repeatable platform solution,” he says. “Some of that drive has been accelerated by virtue of COVID-19.”

A campaign put in place in response to the pandemic could also provide a steady pipeline of work, thereby incentivising companies to invest in MMC. The Homes for Heroes initiative, set up by an alliance of housing associations, offsite manufacturing firms and many others across the property sector, is calling for 100,000 new affordable homes to be delivered for key workers across the country using MMC. The idea is primarily aimed at supporting frontline workers, but proponents also argue that it would accelerate change in the development industry.

“The initiative sits well with the heightened mood of public gratitude towards the nation’s key workers,” says Mark Farmer MRICS, CEO of Cast Consultancy, author of the Farmer Review and the UK government’s MMC champion for homebuilding. “At the same time this initiative can unleash the full potential of the emerging advanced manufacturing modular housing market, delivering quickly at scale a new generation of homes that are of high design quality, fire-safety assured, sustainable and affordable.”

It isn’t just about MMC allowing construction to continue safely during a pandemic. MMC also allows homes to continue to be built no matter the weather. “Visiting an MMC factory in Peterborough recently, I saw an array of trades working effectively in challenging weather conditions, conditions that might have shut down a normal site,” says David Churchill, partner, planning & development at Carter Jonas. “It enables peak production to be carried out all year round.”

"There are more businesses now looking at the shift from bespoke individual solutions to more of a digitised, standardised, repeatable performance solution. Some of that drive has been accelerated by COVID-19"

Modern times are here

However, the momentum behind MMC is no longer theoretical. In the past year, clear progress towards adoption has been demonstrated by multiple companies operating in the area. One interesting example is to be found at Apex Airspace, which has pioneered the idea of using modular construction to fit additional storeys to existing residential blocks.

The company’s efforts paid off at the end of June, when it was confirmed that a new permitted development right for housing block owners to construct an additional two storeys would be forthcoming in short order. “Having pioneered the blueprint for airspace development, which is essentially based on modular, off-site manufacturing, we have the opportunity to accelerate housebuilding and build the momentum we need to address the chronic shortage of genuinely affordable housing,” says Apex Airspace’s CEO, Arshad Bhatti.

“Materials are manufactured at a consistent quality and at a swift rate, and installation involves less labour and time on site, saving further costs, with minimal disruption to residents. A tertiary benefit in the current climate is particularly beneficial, as less personnel means social distancing measures can be adhered to while still providing high quality new homes.”

Then there is the progress being reported by relative newcomer Project Etopia, which recently had the first homes on its Etopia Corby project independently assessed for their energy performance certificates (EPC). In June, the MMC specialist developer announced that the homes had received a score of 103 out of 100, meaning that they put back more clean energy into the network than they consume.

For Joseph Daniels, founder and CEO of Etopia, the result was proof of concept. The company has a factory in Cheshire and recently acquired self-build specialist Tribus Homes, which will enable it to produce 200 new homes a year at its manufacturing facility in Devon.

“Our system was designed to combine energy, construction and intelligence to provide a truly scalable, green and economically viable building system,” says Daniels. “Our homes at Corby embody the huge potential of offsite construction and we have proven that modern housing can help tackle climate change while providing the homes of the future that will end the housing crisis.”

In terms of more established companies, Manchester-based Urban Splash – a developer usually associated with regeneration projects – has also been making progress in the MMC space, with its House by Urban Splash product. In May last year, the company struck a deal with Sekisui, one of Japan’s biggest housebuilders and a pioneer of modular housing. Sekisui invested £22m of new equity into Urban Splash, alongside £30m of equity and debt funding from the government’s Home Building Fund, which is administered through agency Homes England.

Modular homes are already being marketed at New Islington in Manchester and Port Loop in Birmingham, while homes are being delivered at Northstowe in Cambridge and Wirrall Waters in Liverpool. In the wake of the COVID-19 pandemic, Urban Splash also set up a virtual viewing platform whereby buyers can both view and reconfigure potential homes.

“In the long term, we may develop the software to allow for the customers design to be sent straight to the factory for construction which will also speed up delivery,” says Urban Splash co-founder, Jonathan Falkingham. “These new ways of working will play a huge role in our industry moving forward.”

Meanwhile, financial services giant L&G has become a pioneer in the MMC sector. L&G Modular Homes is currently stepping up its activities, having been initially forced to close its factory in Sherburn-in-Elmet in North Yorkshire. The factory has now re-opened and L&G gained planning permission for 154 homes at an 8 acre site (3.2ha) in nearby Selby in May. Ultimately, the company hopes to be delivering 3,000 modular homes a year from 2024. In total, 350 units have been added to its pipeline so far this year.

In what’s fast becoming the UK’s modular mecca, 30 minutes up the road in Knaresborough, North Yorkshire, is Ilke Homes’ 250,000 sq ft (23,225 sq m) factory. The facility is capable of producing a complete home in seven days, with six coming off the production line each day. In July 2020 it signed a deal with Network Rail to build 40 homes for a 2.2 acre (0.9 ha) site in Beeston, Nottinghamshire.

Also keen to capitalise on the UK’s modular mood shift is BokLok, a joint venture between Ikea and Skanska which this summer received planning permission for its first site in the UK, in Bristol. The partnership has been running since the early 1990s, and has already produced 12,000 homes throughout Sweden, Finland and Norway.

No longer abnormal

It is clear that the rise of MMC is no longer just a theoretical proposition – it is something that is already happening on the ground. And what’s remarkable is the kind of companies, the ones with both plenty of money to invest and manufacturing expertise to offer, that are making it happen: the regeneration company joining forces with the Japanese modular pioneer; the institutional investor taking matters into its own hands; and the flatpack furniture behemoth growing into new markets. MMC, it would appear, is going mainstream.

As Hillier puts it: “For me, one of the key blockers for MMC used to be around social bias. If you adopted it, you were abnormal rather than the norm. Now, there has been this dramatic shift. It has become the social norm. I think it will definitely start to grow in terms of adoption.”

Lessons from Japan

When it comes to modern methods of construction, many UK professionals are convinced that many countries around the world “get it” in a way that we do not. However, there are remarkably few international studies; most in the UK draw a blank when asked for evidence of their assertions.

One recent study is worth digging out, though. In April last year Innovate UK sent a delegation, led by its Knowledge Transfer Network, to Japan to understand how the country’s construction industry operates and what lessons and opportunities for collaboration there might be for the UK.

The ensuing report was particularly illuminating when it comes to housing. Much like the UK, in the aftermath of the Second World War Japan needed to build a lot of new homes very quickly, the report found. And again like the UK, many of these mass-produced, or pre-fabricated, homes were of poor quality.

Unlike the UK, however, Japan doubled down and vowed to improve quality rather than abandon the idea. The result is that the proportion of new homes built using MMC in Japan each year is roughly double that of the UK. “Approximately 15% to 20% of new homes, perhaps as many as 190,000, were constructed offsite from mass-customisable kits in 2018,” the report states.

Accordingly, Japan has numerous mature offsite construction companies that focus almost exclusively on the residential market, among them Sekisui, which has recently invested in Urban Splash in the UK . And, because of that maturity, they are able to dedicate significant capital to research and development. “The market has been able to support investment in networks of sophisticated offsite facilities, exploiting advanced manufacturing processes to produce kit buildings in a factory setting,” says the eport.