The construction industry currently faces growing materials and labour shortages, rising costs and delays. But while Brexit has exacerbated problems in the UK, factors such as increased demand, the impact of COVID-19 and logistics issues are having a global impact.

Product availability is currently undependable, said John Newcomb of the Builders Merchants Federation (BMF) at a Construction Alliance Northeast summit in October.

Timber and metals see price hikes

Timber stock levels are at their lowest in more than 20 years, while supply continues to be tight following summer shutdowns in Sweden. This will only exacerbate the situation in coming months, said Newcomb.

BCIS reports that timber supply remains under pressure in the UK due to increasing reliance on imports to fulfil domestic demand. Some timber-producing countries have also banned log exports.

In November, the UK Department for Business, Energy & Industrial Strategy identified imported sawn or planed wood and particle board among the materials with the greatest price change in the 12 months to September (see Figure 1).

Steel has seen a 77.4% price rise this year. British Steel's decision to add a temporary surcharge of £30 per tonne due to rising energy costs will mean prices continue to increase.

Newcomb also noted the increasing cost of copper, shipping delays in China and a global shortage of semiconductors. All this is putting significant pressure on electronic component production.

Figure 1: Change in construction material price, January to September 2021

Source: BCIS, ONS, Oxford Economics

Brick prices set to rise further

Since February, IHS Markit and the Chartered Institute of Procurement & Supply have reported increased prices and supply shortages of bricks. Brick deliveries in the UK are also subject to lengthy delays.

Newcomb also reported that manufacturers are yet to increase prices in response to current and future cost inflation. Although brick price movements have been relatively modest compared to timber, both BCIS and BMF suggest that price rises may be imminent.

The BCIS General Building Cost Index indicates a rise of 10.2% in September compared to the same period a year ago (see Figure 2). Materials represent the largest contribution to this increase, with the overall cost of those in the BCIS Materials Cost Index rising around 19.7% during this period.

BCIS director James Fiske comments: 'The cost of materials to construct a three-bedroom, semi-detached house has increased by 14% or around £7,300 between January and September. It is expected to grow by further 1% or £600 by the end of this year.'

Figure 2: Selected BCIS cost indices, year-on-year growth rate 2018-23.

Note: Data for January 2022 and 2023 is forecast; BCIS Plant Cost Index is not forecast. BCIS Materials Cost Index is based on the materials component of the Price Adjustment Formulae Indices, using factory gate prices. BCIS Labour Cost Index is based on promulgated nationally agreed wage awards, not site rates. Source: BCIS

Demand for drivers delays road freight

Harry John, senior research analyst for professional community Procurement Leaders, writes that demands on road freight have been steadily increasing. He notes that the US has been more heavily disrupted than EMEA or Asia–Pacific.

Brexit has exacerbated the issue in the UK. However, Politico reports that even in 2019 the 24% figure for unfilled trucker positions in the UK was comparable with the Czech Republic, Poland and Spain.

The international shortage is one reason why there has been almost no interest in UK short-term visas from drivers abroad. However, the fact that it takes around three weeks to process applications for such visas is a delay unique to Brexit.

The impending end of a 12-month grace period agreed by the EU and UK on 'rules of origin' paperwork in January is likely to mean even more difficulty for British imports and exports.

Businesses are working hard to understand the logistical requirements they will face after 2 January. They are liaising with DHL and other couriers to explore the possibility of consolidating shipments. Others are considering removing the UK from their supply chain altogether, taking a short-term hit to relocate to Belgium to ensure long-term flexibility.

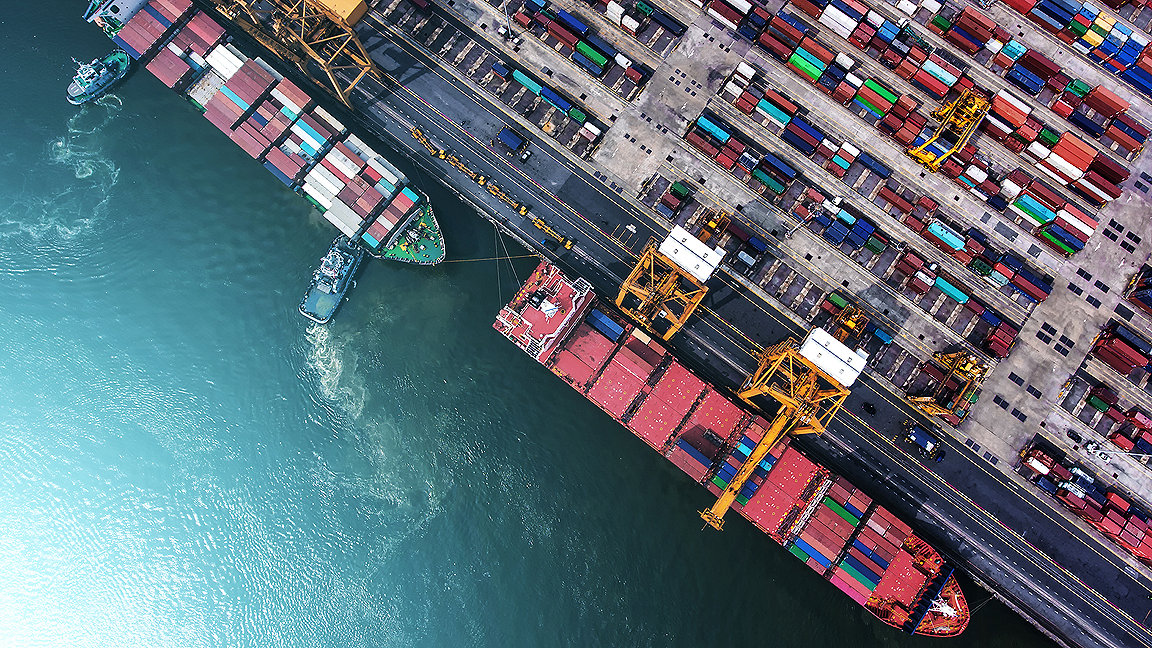

Switch from air to sea freight clogging ports

John also reports that exporters switched from air to sea freight seeking lower prices or more dependable journeys at the start of the pandemic. However, this has instead caused increased disruption, inefficiencies and record costs for marine transport.

Many ports have been clogged for months at a time, with ships that need to be unloaded but cannot access the docks. Newcomb observed that ports are dealing with a backlog due to volatility in arrivals, a lack of empty containers, and the relatively small number of ports that can handle 12m (40ft) containers.

Alan Murphy of research analysts Sea-Intelligence reported that in August, 12.5% of global shipping capacity was unavailable due to delays. Based on previous disruptions, he expects that it will take at least six months to resolve this issue, but warned it could even take 18–30 months for rates to normalise.

Because of extensive delays and increased shipping costs, manufacturers and wholesalers in the US have started to expand inventory holdings. However, the increase is already starting to cause warehousing shortages.

The UK warehouse sector faces a similar issue. The increased cost of building materials and supply chain disruption has itself slowed development of more warehouses. Cushman's reported recently that the UK may run out of space within a year.

'The cost of materials to construct a three-bedroom, semi-detached house has increased by 14% or around £7,300 between January and September'

Pandemic keeps crews out at sea

In September 2020, the International Maritime Organization reported that these delays had led to a humanitarian crisis. Around 400,000 seafarers were stuck on ships around the world and required to keep working until they returned to home port.

Standard contracts for such workers generally require six months on board and six months off. However, since the outbreak of COVID-19 hundreds of thousands of seafarers have been forced to work more than 17 months without a break, far in excess of the Maritime Labour Convention's 11-month limit.

In addition, many if not most of these 400,000 were not likely to be paid until their ships reach their home port. This also meant an equal number of relief crew could not leave port and were also going without pay.

Although the number of seafarers stuck at sea has fallen from the high of January 2021, as recently as June AP news reported that tens of thousands were still affected.

Any new travel restrictions introduced as a result of the Omicron variant or future new strains of COVID-19 could push this number higher.