HMRC says that so-called missing trader VAT fraud in the construction industry is an issue that costs it many millions of pounds a year in lost revenue. Such fraud occurs when a subcontractor provides services – usually labour only – to another contractor, charging for those services with VAT at 20 per cent and, rather than paying that VAT on to HMRC, the tax and the company concerned go missing.

In order to combat this, the government is introducing a domestic reverse charge (DRC), which represents a major change in the way that VAT is accounted for in the construction supply chain, specifically in relation to subcontractors. This new measure will affect all VAT-registered construction companies undertaking building work.

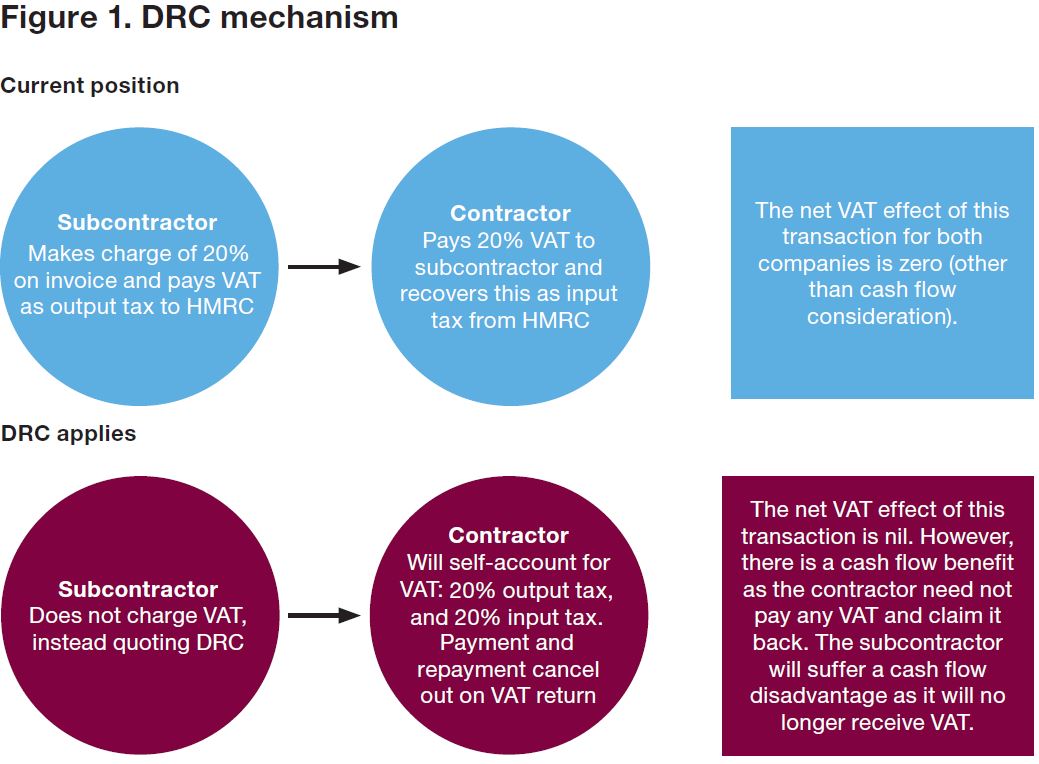

The current position is that a subcontractor will generally charge VAT at 20 per cent on its works, and the customer – for example, a main contractor – will pay the price for those works plus the VAT component. The subcontractor will then pay the VAT it has collected from its customer to HMRC in its next VAT return, while the main contractor will reclaim the VAT it has paid in its own return. The overall effect for the subcontractor, contractor and HMRC is nil, assuming there is no missing trader fraud.

Once the new measures are introduced, the subcontractor will no longer charge VAT on its invoice for works, so it will have no VAT to pay to HMRC. In order to maintain the integrity of the system, the main contractor will record the transaction in its VAT return as if it has paid out and simultaneously reclaimed the tax – the result being a nil effect on cash flow.

Under this mechanism, no VAT will pass from the main contractor to the subcontractor to HMRC and then back to the main contractor, and the opportunity for it to go missing is therefore removed. Essentially, the VAT becomes a compliance and accounting point for the customer of any subcontractor.

Scope of services

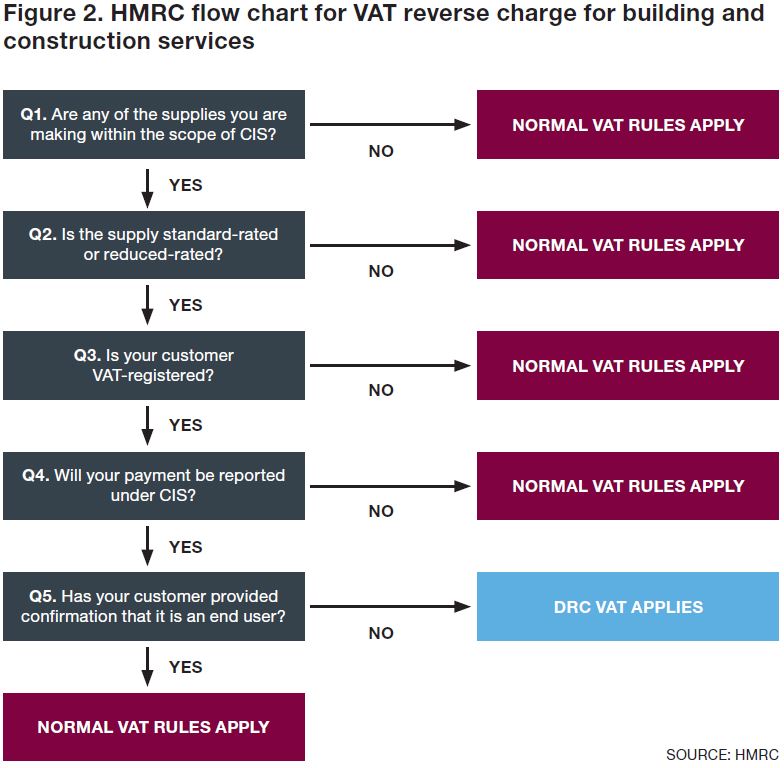

The DRC will apply to the provision of most construction services, including any materials supplied along with those services. It will only apply to payment that is standard- or reduced-rated and not to zero-rated supplies, and will not apply to payments for the separate supply of building materials or for professional consultants such as architects or surveyors.

The scope of services affected is set by reference to that covered by the already well-established Construction Industry Scheme (CIS). The CIS is relevant to income and corporation tax as the DRC scope is defined by reference to the scheme's definition of construction operations. It is another anti-fraud measure, which can require contractors to make deductions from the payments to subcontractors and give this money to HMRC as advance payment of that subcontractor's tax bill.

- construction services are supplied to the end user, such as the property occupier, or directly to a property developer that sells a newly completed building to the customer; this will vary depending on a contractor's contractual relationships

- the recipient makes onward supplies of those services to a connected company

- the supplier and recipient are landlord and tenant or vice versa.

Effect on construction firms

The proposed changes are significant in terms of the way VAT is collected, and will require contractors to familiarise themselves with an involved set of rules as well as amending their invoicing and accounting processes.

- subcontractors will suffer a loss of cash flow where VAT is no longer collected and held before paying it to HMRC

- main contractors will get a cash flow benefit as less VAT will be paid out

- the recipient contractor applying the reverse charge and subcontractor will still need to consider whether supplies made are zero-rated or reduced-rated, as this affects the content of the VAT return and the invoicing detail

- contractual agreements may need revising to reflect the new contractor–subcontractor relationship and whether any party is an end user and thus not subject to the DRC.

In summary, contractors and subcontractors should prepare for change and disruption as these measures are implemented. They will need to be much more aware of the nature of their suppliers and customers to ensure they are not charged VAT incorrectly, and that they do not charge it themselves unless their customer falls outside the DRC regime.

Julian Potts is director at Landmark PT julian@landmarkpt.com