Despite the potential benefits of modern methods of construction (MMC), and it being the subject of a plethora of reports and white papers in the past decade, its adoption and application across the construction industry has been far from universal. The shift from traditional methods to digital and manufactured solutions has not been a simple act of technological substitution for early adopters; it has challenged organisations to adapt their culture, mindset and behaviours.

Market commentators such as Savills predict that housebuilding will double its adoption of MMC over the next ten years, and while changes in technology have typically driven complementary change in the social, economic and environmental landscape, the impact of COVID-19 has reversed the rules. The use of MMC may have reached a tipping point.

The rallying cry from UK Prime Minister Boris Johnson to “build back better, build back greener, build back faster” places the construction industry at the epicentre of the UK economic growth strategy. Reinforced by the CLC’s Roadmap to Recovery, the government has signalled a clear ambition to catalyse industry modernisation – to realise transformational change through adoption of MMC.

Seeking to mitigate supply issues – such as labour shortages and uncertainty of input costs – and address a burgeoning demand, the housing sector has begun to gravitate towards MMC to deliver better quality and low carbon products. Anticipated shifts in user demand have similarly driven private sector clients to explore innovative opportunities through MMC as they reappraise project value.

With a shift in focus rippling along the value chain, several large organisations have acted swiftly in announcing their intentions to intensify a focus on MMC. While market movements are often perceived through the lens of large companies, MMC also offers small and medium-sized enterprises (SMEs) opportunities and challenges.

Statistics produced by the Department of Business, Energy and Industrial Strategy (BEIS) identify that SMEs represent 99.9% of businesses working in construction in the UK and almost 75% of turnover. With over a million SMEs in the construction industry, small and medium enterprises represent the lifeblood of the sector and the heart of both local and national economic growth. Typically, SMEs in construction fall into one of six sub-segments, each of which has varying characteristics and needs, as shown in Table 1. The opportunities and benefits that MMC may offer SMEs are similarly varied.

"While market movements are often perceived through the lens of large companies, MMC also offers SMEs opportunities and challenges"

Table 1: SME sub-segments, characteristics and needs

Source: McKinsey & Company, Unlocking growth in small and medium-size enterprises

| SME sub-segments | Core characteristics | Needs |

| Early-stage, innovative start-ups | Have an early business plan and are developing a service or solution |

An ecosystem that fosters entrepreneurship |

| Established, successful start-ups | Established a market position and model | Established processes and access to finance, resource and pipeline visibility |

| Self-employed | Most common, estimated at 19% of construction SMEs | Continuity of workload and support for customers and suppliers |

| Locally-focused, small businesses | Low staff numbers | Dependant on service niche and circumstances |

| Static or struggling medium-sized companies | Mature, sizeable and have ceased to grow or are struggling with revenue or profitability | Support in business improvement, including pipeline, productivity and service offering |

| Growing medium-sized companies | Mature with business models that provide a competitive edge and moderate growth | Advisory support to enable sustainable growth |

Table 1: SME sub-segments, characteristics and needs

Source: McKinsey & Company, Unlocking growth in small and medium-size enterprises

| SME sub-segments | Core characteristics | Needs |

| Early-stage, innovative start-ups | Have an early business plan and are developing a service or solution |

An ecosystem that fosters entrepreneurship |

| Established, successful start-ups | Established a market position and model | Established processes and access to finance, resource and pipeline visibility |

| Self-employed | Most common, estimated at 19% of construction SMEs | Continuity of workload and support for customers and suppliers |

| Locally-focused, small businesses | Low staff numbers | Dependant on service niche and circumstances |

| Static or struggling medium-sized companies | Mature, sizeable and have ceased to grow or are struggling with revenue or profitability | Support in business improvement, including pipeline, productivity and service offering |

| Growing medium-sized companies | Mature with business models that provide a competitive edge and moderate growth | Advisory support to enable sustainable growth |

An enabler not an outcome

MMC is a term used broadly to describe contemporary innovations in construction, including new technologies – such as digital tools and techniques – offsite manufacture and use of efficient processes to deliver more productive, more sustainable and generally better outcomes.

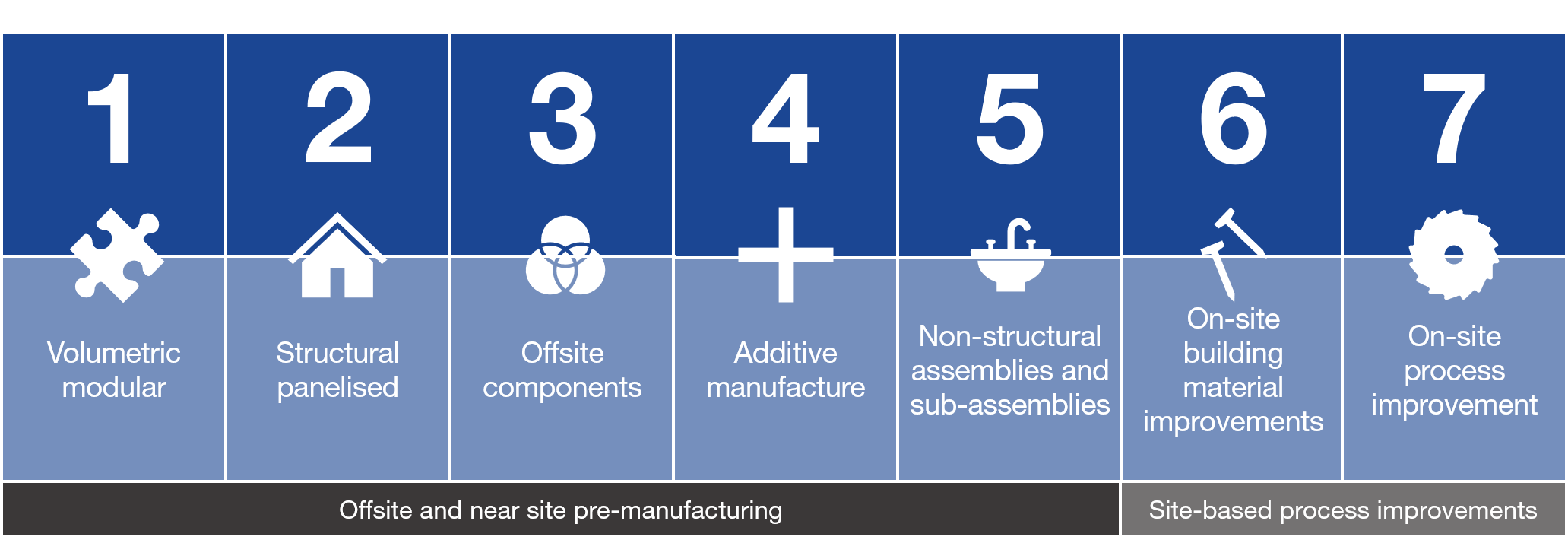

Recognising the importance of standardising terminology, last year the Ministry for Housing Communities and Local Government (MHCLG) published the MMC definition framework. For housebuilders this identifies seven categories of MMC, as seen in Figure 1, the first five of which apply offsite and near site pre-manufacturing techniques.

Figure 1: seven categories of MMC

The range of MMC categories reflects the variety of available tools, techniques and processes that can be applied to realise better outputs and outcomes. As the understanding of digital and manufacturing techniques evolve and market matures, the depth and breadth to each category will undoubtedly grow. It is this growth that affords SMEs opportunity.

- What are the company’s business goals, objectives and desired outcomes?

- How can MMC enable the company to realise these?

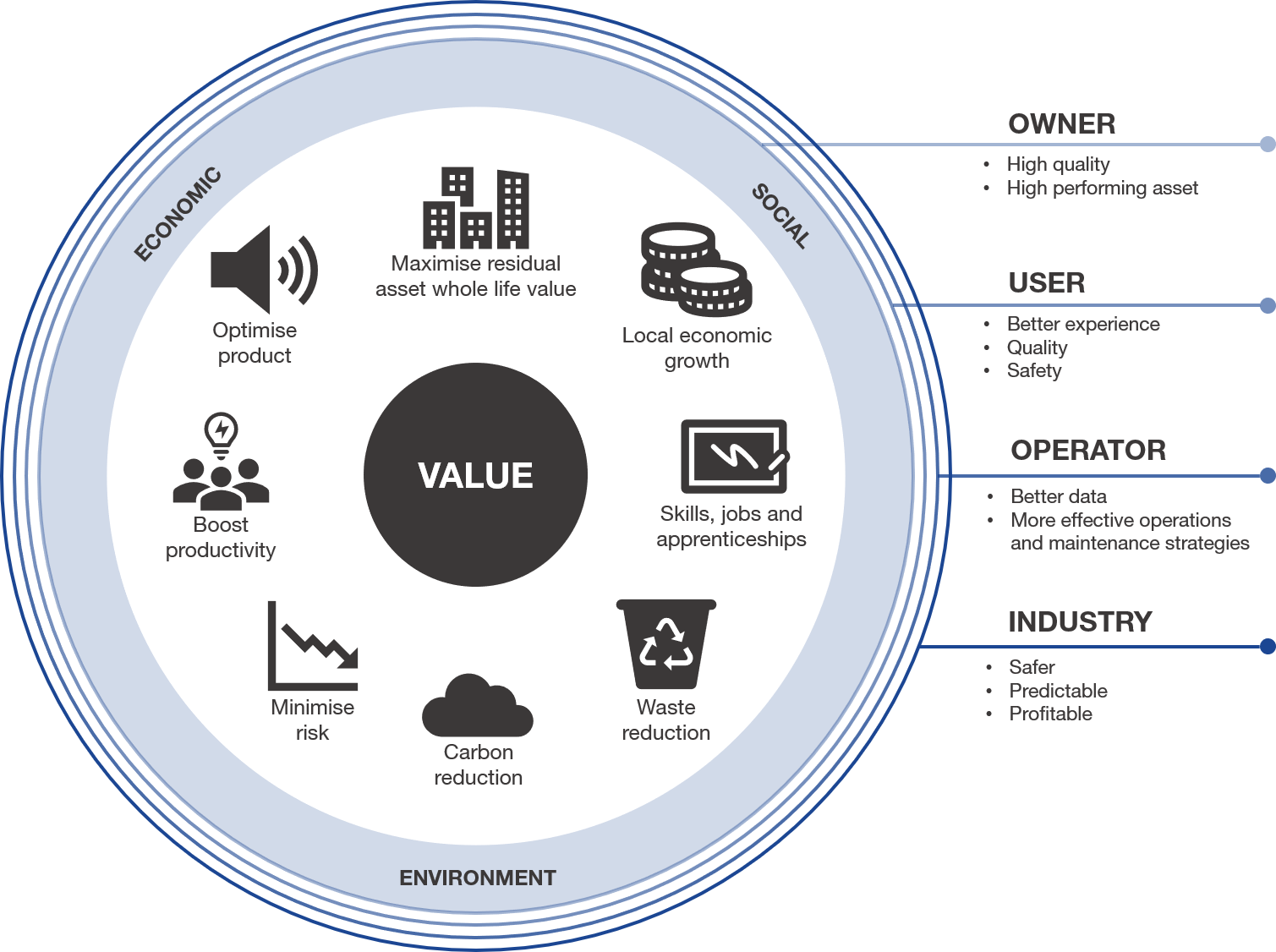

Figure 2

MMC presents agile and lean opportunities

Many SMEs are flexible and nimble and can respond to market changes quickly. Nonetheless, embracing innovation necessitates a different complement of skills and changes in team dynamic and mindset that can be disruptive. Adoption of digital solutions over recent years, for example, has challenged many organisations as they seek to apply a fresh approach; MMC introduces similar challenges.

Adopting and integrating MMC to deliver sustainable benefits is rarely a matter of technological substitution – it requires new points of team engagement, interrelationships and activities. Adapting old habits and retraining to develop new skills and create new behaviours requires commitment and potential investment; both culturally, to ensure the change is realised, and financially.

Integration of manufactured solutions infers investment in factories, plant, machinery, automation equipment and technology to develop in house capabilities. While some have chosen this path, significant capital outlay is not necessarily a precursor to MMC adoption. Some SMEs are managing their financial investment by developing strategic alliances and collaborative partnerships with producers, others by developing “knowledge factories” rather than investing in production facilities. The Supply Chain Sustainability School, itself an SME, is one example of a growing knowledge economy around offsite technologies that offers support to companies as they seek to expand their knowledge and capabilities to maintain a competitive advantage.

With greater awareness and understanding, SMEs can begin to reflect upon how MMC can influence and alter fundamental business dimensions, such as their processes, their value proposition and business model, to create and realise new opportunities. The adapted business model canvas, as detailed below, illustrates the interconnectivity between key building blocks of a business model and how MMC is transforming each. Truly exploiting the opportunities that these changes afford requires a strategic view of the following.

-

Key partners

Partnerships and collaborations are emerging as businesses develop their strategies around MMC. While some are moving to adopt vertically integrated structures, competitors, as uncommon allies, are beginning to collaborate in common territory to maintain pipeline surety or meet supply demands from their customers that exceed their capacity.

-

Key resources

Adoption of digital- and manufacturing-based processes and solutions is necessitating new knowledge, competency, skills and resource.

-

Key activities

The RIBA DfMA overlay illustrates how adoption of MMC is changing the profile of key activities, with earlier integration to facilitate manufacturing and assembly in lieu of construction.

-

Channel

Procurement routes and models are expanding for MMC – for example Department of Education MMC schools, Building Better Alliance Procurement for Housing or LHC Integrator – opening new opportunities for SMEs.

-

Customer relationships

Alongside earlier engagement, adoption of MMC is changing the relationships between the project team. New roles, such as integrator, are emerging as new actors are introduced.

-

Value propositions

In responding to client’s shift in value, alternative value propositions are emerging within the market. New specialist consultancies have formed, with design houses also moving to offer a broader service, applying parametric design to align with standardised repeatable solutions. Contractor models are evolving – as profits have become diluted at one stage in the value chain, companies have sought to position themselves at an adjacent stage.

-

Customer segments

The profile of customers engaging with MMC is changing. The government presumption in favour of MMC is stimulating activity as private sector gains traction. Alongside new market entrants such as TopHat and Project Etopia, firms such as Ilke Homes have seen significant growth, while more traditional contractors, such as Kier, have started to embrace change. Opportunities for SMEs in consultancy design and delivery are both growing and expanding.

-

Revenue streams

Intertwined with the value proposition, businesses are looking at alternative revenue streams to realise and enhance profitability. While businesses owning factories have attracted headlines, certain businesses have instead sought to embrace MMC in transitioning from low-margin delivery to higher-margin services such as consultancy and digital technology solutions.

-

Cost structure

With evolving value propositions the cost structure of businesses may similarly change. In seeking to vertically integrate and manufacture, certain companies have sought to assume an increased overhead, while others have moved to divest and remain nimble.

Reds10: A better, more sustainable product solution

Overhead photo of Green Park Village Primary School

As a vertically integrated volumetric manufacturer, Reds10 applies MMC to offer clients a full turnkey service, focused on providing “better, faster and more affordable solutions with less carbon”.

The recent completion of Green Park Village Primary School resulted in nominations for Education project of the year and Best use of volumetric technology at the Offsite Awards.

In developing a market differentiator, Reds10 are currently collaborating with accommodation operator HOST to develop a proof of concept project that produces a living digital twin of Sedgemoor Worker Accommodation Campus. This well help to create real-time insight, improving the quality of service and enabling optimisation of value and performance of the built asset.

While MMC is at the core of their business, they have consciously chosen to apply, adapt and develop their approach to perceived customer needs to deliver a better, more sustainable product.

PCE Ltd: A unique value proposition and better product delivery

While remaining an SME, PCE Ltd is a market leader in applying MMC through design and build of offsite hybrid engineered structures. Their business strategy is consciously structured around principles of design for manufacture and assembly (DfMA) with intent to realise productivity improvements, higher quality control and repeatable efficiencies in delivery.

At Plot NO.6 in East Village, PCE have applied a kit of parts approach, integrating precast concrete together with unitised facades as preassembled subassemblies. Simple principles have been innovatively extended to the mechanical and engineering building systems, with distribution modules installed within precast prior to site assembly. Working in partnership with Mace Tech and Oranmore Precast on this project, PCE have demonstrated a unique market proposition – applying MMC to cultivate differentiators to their peers and, in so doing, establishing new relationships, customer reach and work activities.

PCE apply these principles across the wider business portfolio, spanning multiple sectors including the delivery of architectural excellence and quality at Kingston University and at scale at HMP Wellingborough, incorporating more than 12,000 components.

Future Joinery Systems: Integrating value-chains digitally

Through the adoption of digital solutions, SMEs are transforming relationships and interactions along the construction value chain in delivering manufactured products. Future Joinery Systems (FJS), as designers of specialist joinery, typify this innovative approach.

Their unique business model seeks to add value along the supply chain by reducing interface friction by use of bespoke digital tools – bridging the gap between design and manufacture by providing connectivity between designers, working in their native files, and a network of fabricators.

Consciously embracing digital solutions to create a new interaction model, FJS have cultivated a niche market position and specialisation. While a micro business, FJS have committed to the Construction Innovation Hub platform project; working as a design team member with other key industry players – including PCE – to develop a new model of operation. They have similarly invested in R&D – funded by Innovate UK – to support development of their platform solution in transforming interaction between participants along the value chain.

MMC can address deprivation

As clients seek to realise value through MMC, the basis of engagement with the supply market is evolving – new procurement channels are emerging that offset historical bias within frameworks towards large scale business and instead afford greater opportunities to SMEs. The DfE framework for offsite schools – less than 6,000m2 – includes 80% SMEs; while the Crown Commercial Service framework for Modular Building solutions and Hyde Housing MMC framework are both balanced at similar proportions.

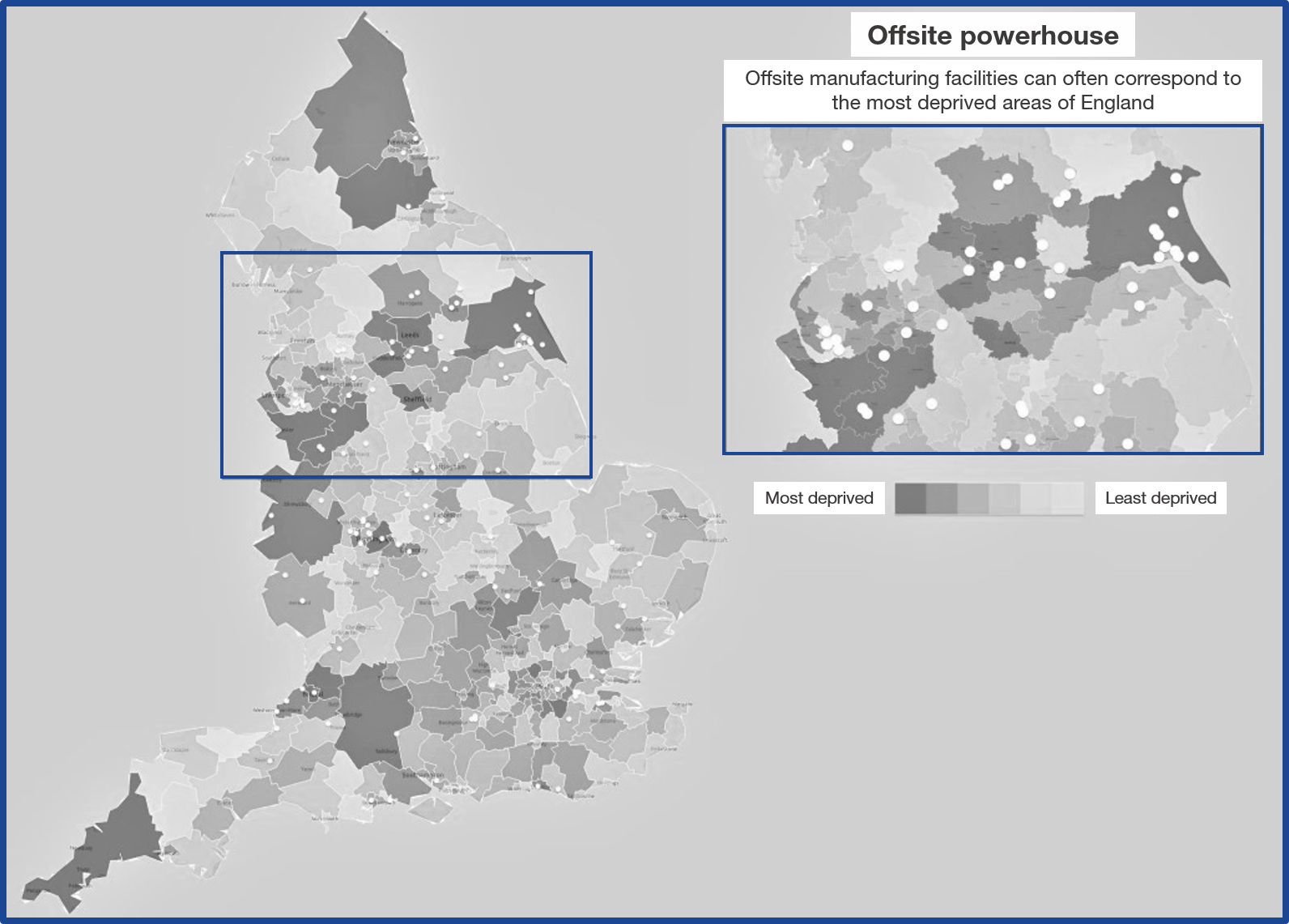

Similarly, by embracing solutions that are manufactured beyond the confines of the site hoardings, investment can be channelled towards local SMEs in supporting growth in areas of economic deprivation. The UK has a landscape of regional imbalance, as seen in Figure 3, which has typically hampered the ability of SMEs in many areas to grow, recruit, innovate and be profitable.

With a high proportion of MMC specialists rooted in the industrial heartlands of the Midlands and North, the potential to support a rebalance aligned to the government’s “levelling up” agenda is real. Embracing modern methods can certainly support the strength and resilience of local economics and, specifically, the opportunities for those SMEs within them.