As a result of the discussions surrounding the 2008 global financial crisis, there have been significant changes to the regulatory environment for banks.

Real estate lending is central to the operation of financial markets. The lending process requires reliable and financially sustainable valuations at origination and for monitoring existing loan books. Property valuation has been included among these regulatory changes.

In 2017, the Bank for International Settlements' Basel Committee on Banking Supervision (BCBS) produced global guidance for the regulation of the financial industry, including banks, known widely as Basel 3.1. Many countries use this guidance to produce their capital requirements regulations (CRR).

However, not every country has adopted all the detailed guidance in Basel 3.1. As a result, the regulations, including those relating to the valuation of real estate, may vary and it is impossible to produce detailed guidance at a global level. However, it is possible to identify the themes running through the changes to property valuation for bank lending purposes.

RICS has responded through two publications. The first is an updated edition of RICS' Bank lending valuations and mortgage lending value.

This revised professional standard updates the detail surrounding the use of mortgage lending value (MLV) by some countries, in particular how the EU has organised its CRR following the adoption of Basel 3.1. The standard solidifies the use of MLV in the covered bond market.

The second relevant publication is RICS' Bank lending valuations: Basel 3.1 prudently conservative valuation criteria adjustments.

This is a new global practice information paper that addresses the revisions in the Basel 3.1 accord, which have introduced new prudently conservative valuation criteria (PCVC) for the valuation of real estate.

These revisions in Basel 3.1 are in the process of being adopted for both the origination and monitoring of real estate loans by numerous countries and regions, e.g. the EU, but not in the UK.

The revisions have already had a significant impact on the use of MLV in the revised EU CRR, as set out in the RICS professional standard on bank lending valuations, including mortgage lending value.

The impact of the Basel 3.1 PCVC is not yet clear, so the new RICS practice information on the Basel 3.1 criteria addresses the challenges of implementing the criteria globally and provides high-level, research-based principles that accord with existing knowledge on long-term, through-the-cycle real estate valuation.

Prudently conservative valuation criteria

Basel 3.1 proposes four criteria to be applied to property valuation. The current edition of RICS' Bank lending valuations: Basel 3.1 prudently conservative valuation criteria adjustments sets out the new criteria and discusses the existing definitions of market value and MLV and how they differ.

The new criteria are as follows.

- 'To ensure that the value of the property is appraised in a prudently conservative manner, the valuation must exclude expectations of price increases'. As there is no explanatory text in Basel 3.1 or the revised EU CRR to accompany the criteria, the meaning of each criterion must be assumed. Given the cyclical nature of property prices and the recognition that economic crises are precipitated by unrealistic price escalation above long-term equilibrium price levels, with escalated property prices attracting ever-increasing loan support, the intention is surely to restrict the valuation to a figure that takes no account of unreasonable current price levels.

- The second criterion states that property valuation should ignore the 'potential for the current market price to be significantly above the value that would be sustainable over the life of the loan'. This fits with the first criterion's aim as it states significantly above rather than just above.

- The third criterion states that 'national supervisors should provide guidance, setting out prudent valuation criteria where such guidance does not already exist under national law'.

- The fourth criterion states that 'if a market value can be determined, the valuation should not be higher than the market value'.

The fourth criterion, therefore, sets out the relationship between the Basel 3.1 property value and market value.

The RICS practice information concludes that, although it is not a requirement, every property valuation formed using the Basel 3.1 criteria should include a market value, with the property value being framed as an adjustment (where appropriate) to market value.

According to the fourth criterion, the property value could be equal to or lower than market value, but not higher.

Implementation of Basel 3.1 property valuation criteria

Industry professionals and academics undertook research before Basel 3.1 into what have been called long-term valuations. Most of that research was based on UK market data, with the UK real estate industry and academe working together.

The long-term valuation research programme, sponsored by the valuation industry through the Investment Property Forum along with Bank of England involvement and encouragement, produced reports in 2017 and 2020 setting out how longer-term trends using established market analysis models could be compared to actual price levels across different segments of the real estate market to identify over- and under-pricing in current markets.

Since the EU decided to adopt the Basel 3.1 property valuation criteria in 2019, long-term value research funded by the Property Trust and Investment Property Forum has analysed the criteria and how they might be applied to mainland European markets.

The recommendations of the research into long-term valuations and PCVC have been incorporated into both RICS publications mentioned above.

Having reviewed the long-term valuation research in its consultation and presumably deciding that the difficulties of implementing the criteria were too great, the UK government decided not to adopt the revised Basel 3.1 PCVC in its revised CRR.

Bank lending valuation methods remain largely unaffected in the UK for now, although overseas property owners may require additional advice to comply with their own financial regulations.

The current position in jurisdictions that have adopted the Basel 3.1 PCVC, such as the EU, is as follows.

- The valuation criteria within Basel 3.1 do not accord with the definition of market value or the definition of MLV. There are some sound, practical solutions to the implementation of the PCVC that have been thoroughly researched and tested against past cyclical downturns in real estate markets.

- The solutions are based on an adjustment to the existing basis of market value. The adjustments require the analysis of real estate markets, and the adjustment factors are not grounded in individual property characteristics. The adjustment factor should be based on long-term market trends compared to current prices. The analysis should be implemented nationally or regionally and not left to individual valuers. This requires data over the long-term, and data availability differs widely globally.

Although national supervisors have the responsibility for the Basel 3.1 criteria, they may pass this responsibility to lenders, who may pass it down to valuers. At the time of writing, it appears that lenders are beginning to take responsibility for PCVC adjustments and not leaving it to individual valuers, e.g. the Association of German Pfandbrief Banks.

Implications for valuers

Where valuers rather than regulators or lenders take on the responsibility for the PCVC adjustments to market value, they should be aware of the inconsistencies between the Basel 3.1 criteria and the existing bases of market value and MLV.

- Check instructions – in view of the current lack of national guidance as to its application, valuers should clarify the nature of their instructions and whether it requires a market value or an adjusted market value.

- Assess competence – valuers must be clear that if accepting instructions that require an assessment of whether an adjustment is required and the quantum of that adjustment, they must have the knowledge and information required to make those judgements.

- Recommended RICS response – where individual valuers do not feel they have the capability or support to determine the adjustment factor, they should decline the whole instruction or offer to provide a market valuation only. When providing a market valuation only, valuers should explicitly state in their instruction and reporting process that they are not considering the PCVC and rather providing only a market valuation under the International Valuation Standards definition of market value, which is reproduced in the RICS Valuation – Global Standards (Red Book Global Standards).

RICS has taken the view that instructing individual valuers to make the PCVC adjustments to their market valuations would lead to significant inconsistencies in approach and outcome. Therefore, unless they are supremely confident in their ability to identify cyclical over- or under-pricing, valuers should not provide the adjustment.

This position could change in the future. The practice information paper provides detailed reference to research on long-term, through-the-cycle valuations that could be harnessed nationally and regionally by regulators, lenders and valuers to provide a sound and rational basis for those adjustments to counter any procyclicality in property prices, which are the comparable basis for all market valuations.

'Where valuers feel they lack capability or support to determine the adjustment factor, they should decline the whole instruction or offer to provide a market valuation only'

Professor Neil Crosby MRICS is professor emeritus at University of Reading and lead author for RICS' Discounted cashflow valuations, Bank lending valuations and mortgage lending value and Bank lending valuations: Basel 3.1 prudently conservative valuation criteria adjustments

Contact Neil: Email

Related competencies include: Valuation

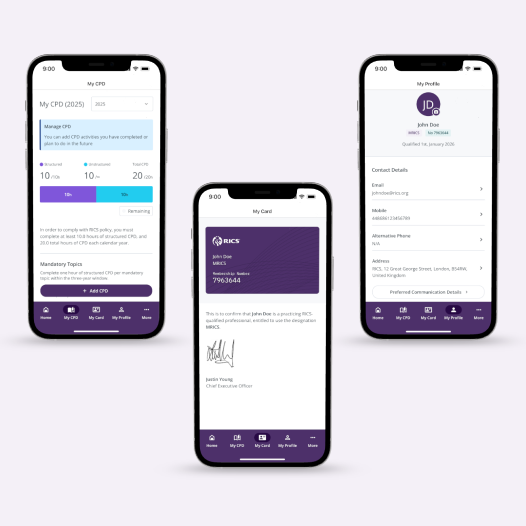

Discover the new RICS Member App: CPD on the go

RICS has introduced a refreshed CPD approach that prioritises meaningful, high-quality learning that genuinely benefits your work and is tailored to your specialism, career stage, and the real-world challenges you face.

The new app makes logging CPD simpler and more intuitive, so you can focus on the development that matters to your practice.