Blockchain has gained increasing popularity in various sectors over the past decade. The technology has already brought significant changes to the art market, and promises to offer more.

The use of blockchain can help improve transparency, enabling ownership and provenance to be tracked, while also providing an infrastructure for fractional artwork sales through tokenisation – like other assets, it is possible to acquire shares of an artwork.

Chain offers distinct advantages for art deals

When recorded on a blockchain, all information can be viewed as a digital asset or token that is immutable and secure from tampering. These can be bought and sold, with each transaction recorded on the chain.

Fungible tokens are interchangeable with others of the same type and can be divided into smaller units, such as cryptocurrencies, while non-fungible tokens (NFTs) including collectables, certificates, deeds, rights and artwork possess unique value and cannot be divided.

For this reason, they are of particular relevance for the creative industries, because they can identify unique artworks whose ownership can be recorded on the blockchain.

Art dealers were already using the chain before the pandemic. In July 2018, for instance, blockchain platform Maecenas partnered with Dadiani Fine Art in London to offer fractional ownership of Andy Warhol's 1980 print 14 Small Electric Chairs, payable in cryptocurrencies such as bitcoin and ethereum, with a total value of $5.6m.

In November that year, Christie's New York also partnered with blockchain-secured registry Artory, making art world history by recording all the Barney A. Ebsworth Collection's transactions in 2018, worth $318m, on the blockchain.

Pandemic prompts transactions to move online

With lockdowns and other emergency measures introduced in 2020 to limit the spread of the COVID-19 pandemic, in-person events by auction houses, art dealers and fairs were cancelled or rescheduled. However, these closures also prompted companies and art professionals to improve their online presence and services.

Auction houses and dealers reinforced their digital departments, which resulted in a substantial rise in online sales in the art and antique market worldwide that year. This trend continued in 2021, with online sales accounting for one-fifth of global art sales.

Notably, the UK demonstrated a remarkable surge in online sales value and volume, with France and the US exhibiting similar albeit less significant trends.

Artists may exert greater creative control

While physical artwork can be viewed in museums without owning it, the use of blockchain and NFTs has opened up new avenues for content ownership and distribution.

Acquiring NFTs enables buyers to resell creative content by transferring ownership through the blockchain. Through this system, artists can also exercise greater control and receive a larger portion of the revenue generated by their work, while reducing their reliance on intermediaries such as publishers, distributors and auction houses and avoiding their associated costs.

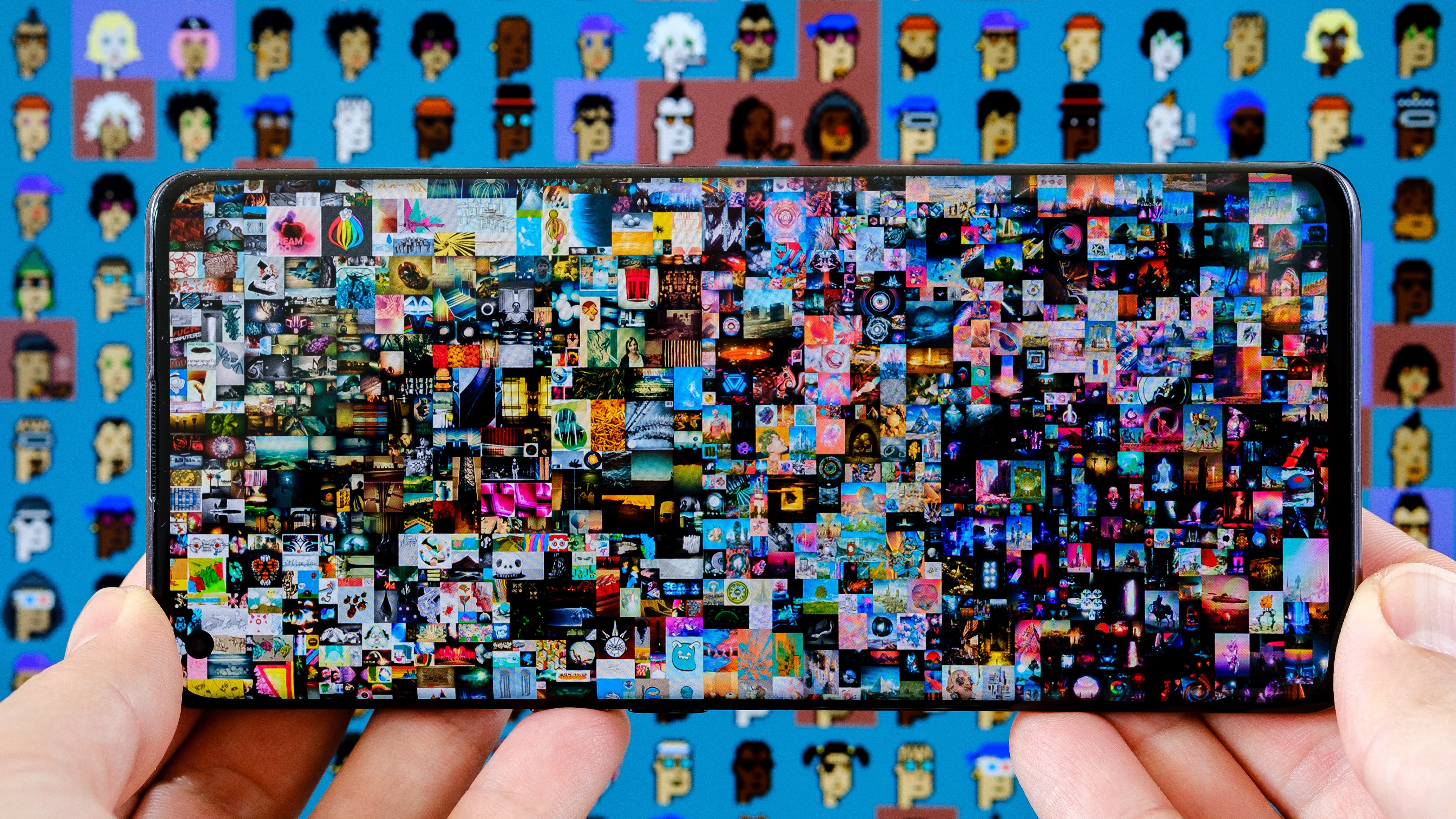

In March 2021, Christie's auctioned the digital artwork Everydays: The First 5000 Days by artist Michael Winkelmann, aka Beeple, as an NFT for a record-breaking $69m. The artist created a single NFT that represents the ownership and rights associated with the digital artwork, which can be viewed by anyone on the internet.

The challenge with digital art is that it can be easily copied, distributed and shared on the internet, making it difficult for artists to maintain any control over their work and earn revenue from it.

The concept of digital scarcity addresses this issue, however, by using blockchain technology to create a limited number of unique art pieces as NFTs, the registry of titles – the legal documents that confirm ownership or right to ownership of a property – can be maintained on the blockchain database. This ensures that an artwork's ownership is linked to its registered provenance on the chain.

Notably, a recent report suggests that the NFT bubble may have burst. DappGambl examined 73,257 NFT collections and estimated that 95% of these investments are now worthless.

The report's results underline the volatile nature of the NFT market at present and the need for collectors to carry out the required due diligence before investing in this sphere.

However, the report also predicted that NFTs still have a place in the art market going forward and that to survive moments of market volatility they need to be historically relevant, true art or have genuine utility.

'The challenge with digital art is that it can be easily copied, distributed and shared on the internet, making it difficult for artists to maintain control over their work and earn revenue from it'

Technology supports management of collections and data

The versatility of blockchain technology also makes it suitable for application in different cultural heritage organisations, ranging from museums and art galleries to theatres and public monuments.

Its potential uses include managing collections and promoting collaborations among various partners, such as universities, governments, associations, museums and collectors. Tracking exchanges may be difficult during collaborations, but blockchain could solve some of the associated issues.

Such collaborations raise the problem of tracking exchanges. Blockchain allows for the design of a system that combines this technology and the internet of things to allow the exchange cultural of artefacts among museums and clarify the responsibilities of lenders, exhibitors and carriers.

The technology can also enable data to be shared for research purposes in a secure, transparent and decentralised manner. With the growing need for data-driven research in multiple fields, blockchain offers a way to manage and share large datasets securely and efficiently.

Traditional data-sharing methods often rely on centralised systems that are vulnerable to security breaches and data loss. Blockchain, on the other hand, distributes data across a network of nodes – that is, servers and individual computers that contribute their computational resources to secure the network – making the chain more secure and resistant to hacking or tampering.

In addition, combining blockchain technology with the internet of things – comprising online devices – could allow systems to support the exchange of cultural relics among museums and clarify the roles of lenders, exhibitors and carriers.

For example, scanning a QR code attached to a physical artwork could enable its journey from one museum to another to be tracked, registering at each stage details about the transfer such as duration, temperature and humidity rate.

'Blockchain distributes data across a network of nodes, making the chain more secure and resistant to hacking or tampering'

Governance and security remain issues

Although blockchain technology offers as yet unexplored avenues for application in the art sector, it also introduces new challenges and potential risks, and may take a significant amount of time before it achieves its full potential.

The technology is potentially vulnerable to cyber-attacks aiming to take control of the network and create fraudulent transactions.

Additionally, its introduction and use raise important questions about governance. Due to the decentralised nature of the technology, community governance mechanisms are critical to its security.

In a public blockchains, the community is open, and users can be virtually anyone. In permissioned and private blockchains, users can be filtered and access restricted.

These mechanisms will determine who has a voice or vote in changes to the underlying code or the way problems and errors are resolved. All these aspects will need to be considered during the design and implementation of specific uses of the technology.

Claudia Giannoni MRICS is a doctoral researcher at the Institute of Finance and Technology UCL

Contact Claudia: Email

Francesca Medda is professor of applied economics and finance at the Institute of Finance and Technology UCL

Contact Francesca: Email

Silvia Bartolucci is lecturer in financial computing at the Department of Computer Science, UCL

Contact Silvia: Email

Related competencies include: Personal property, Technology, Valuation