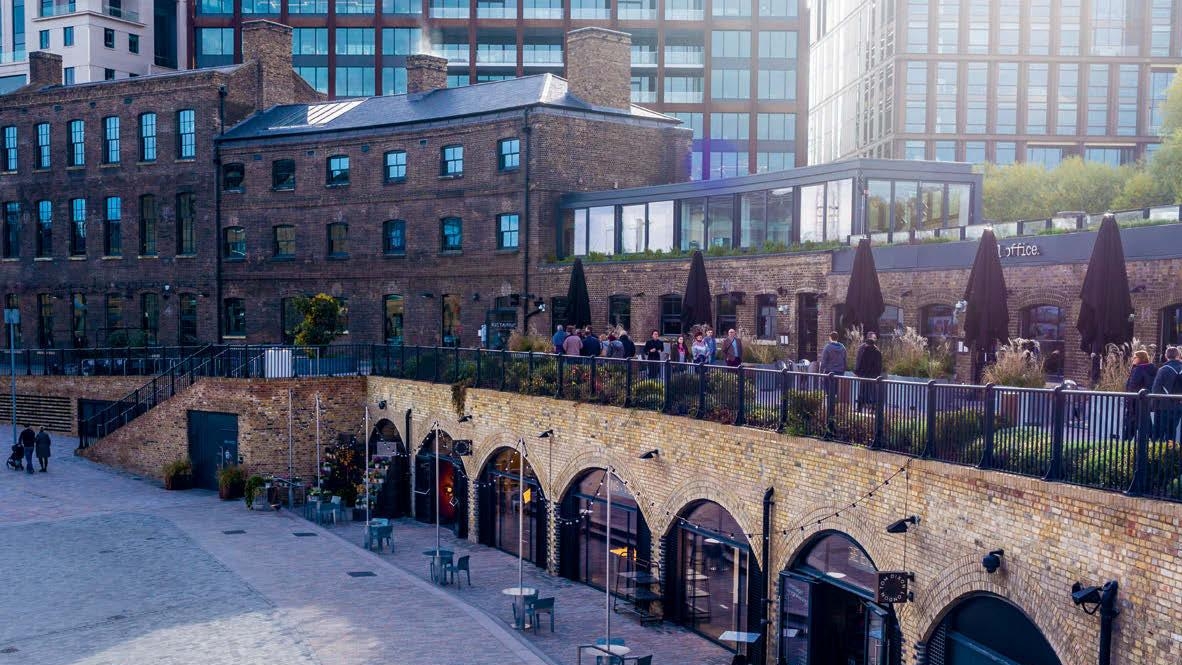

Coal Drops Yard in central London is a prime example of contemporary mixed-use developments, offering food, drink and experience-based shops along with pop-ups and flexible workspaces

Like other sectors, real estate must move with the times to keep up with demand. While recent headlines speak of the death of the high street, the narrative is much more nuanced than that. Dr Lee Elliott at Knight Frank, for instance, comments: "Shorter business planning horizons together with the emergence of new more agile corporate structures have driven demand for flexible space which enables companies to react to change quickly."

Retail innovation

Major brands are stepping up to the plate and organising events such as Staples' Happiness Pop-Up Experience; this showcased methods for promoting workplace happiness, with a supporting webpage where products could be purchased and was earlier this year able to make use of temporary retail space thanks to the creative legal structure of a flexible lease. Another prime example is Coal Drops Yard, the new mixed-use scheme in Kings Cross, that provides a variety of long and more flexible leases allowing it to regenerate itself multiple times a year and host a range of operations – retail pop-ups, live events, offices, experiential stores and food and drink offerings – under one roof.

With the surge of online shopping and booming digital markets, brands are diversifying their investments with digital and wholesale as well as retail offers. Physical stores are now spaces to raise brand awareness and improve customer engagement rather than simply generate sales. Some retailers have found their website just as important as, if not more important, than their high-street shop. Without the burden of rent payment dates looming, retailers are able to invest time and money into making their spaces more personalised and experiential to provide the feel-good factor customers crave. Happy customers mean happy employees, happy employees mean happy employers, and happy employers mean happy landlords.

Changing workplaces

This revolution is not just happening in retail. With the rise of flexible working policies, companies are also reducing their office space and promoting efficiency to reduce overheads. The European Medicines Agency, for example, has recently approached multiple potential occupiers including WeWork to offload its burdensome lease in Canary Wharf. This could be an option for other struggling landlords which could lease out spaces to multi-use occupiers such as WeWork that in turn sublet the space.

British Land, along with competitors including CBRE, the Crown Estate, Legal & General and the Office Group has joined WeWork in moving into flexible office space. The flexible leases that British Land offer include services such as cleaning and wi-fi as well as the option to leave any time on a month's or three months' notice.

Essentially occupiers want more flexibility in the way they use their premises. For example, a major arts and crafts retailer now runs workshop events in store, helping increase revenues by more than 7%. However, traditional landlords believe that short leases lower the value of a building. Most lease structures are not yet able to cater for creative innovative spaces, and landlords are therefore often slow or even reluctant to adapt. Those that don't keep up could get left behind if these innovative spaces eventually become the norm.

"Occupiers want more flexibility in the way they use their premises"

Smart spaces

The snowballing trend for smart spaces is likely to help to regenerate and reinvigorate the marketplace. Not only will this maximise underused space, it will also lead to increased footfall and generate more vibrant environments in which to work shop and even rest. The mixture of flexible leases may also allow entrepreneurs, small businesses and large retailers, which often compete for space, to co-exist with minimal conflict.

Standard commercial leases usually constrain use to one or two classes and require a landlord's consent for any change to this. Landlords need not be reasonable when refusing such consent, so the law favours those of them who are reluctant to change. Many lease negotiations will also require the consent of a superior landlord, a lender, or both, which is old-fashioned and time-consuming. The same may apply where landlord's consent is required to make alterations to the premises.

These leases need to be flexible enough to cater for more creative retailers. Perhaps an all-in-one package of managed personalised space will become more popular once the market begins to catch on providing a balance between a leased space and a serviced office with fewer upfront costs.

To allow retailers to use their space more flexibly, landlords might need to offer shorter, more accommodating leases, perhaps with break options and provisions for personalisation in fit-outs. In a volatile political climate, businesses are not keen on long-term commitments as they want to be able to move quickly.

In addition, the new International Financial Reporting Standards on accounting will bring all leases on to a company's balance sheet, increasing assets and in turn liabilities, particularly for large retailers. Shorter-term commitments with or even without security of tenure and break options may be the way to go.

Tenants should, however, be aware of the legal implications of such shorter, more flexible leases. Due diligence should still be carried out, service charge budgets scrutinised and access provisions negotiated. Repairing obligations should be negotiated to the bare minimum, while photographic schedules of condition should become the norm to show the state in which the tenant is required to hand back the property.

In lease terms, shorter does not always mean better. Tenants who are prepared to take briefer, more flexible leases may have to forgo the benefit and certainty that longer leases provide. If the lease does not offer security of tenure, there is a risk that the tenant will not be able to stay beyond the term agreed, potentially harming the growth of its brand at a crucial time.

In this age of disruption, traditional retail and office space will have to adjust to cater for demand. Landlords and tenants alike will therefore need to work together and adapt to the benefit of both. Keeping pace with new trends is all about being flexible and smart.

Markus Klempa is managing associate at Stevens & Bolton markus.klempa@stevens-bolton.com

Related competencies include: Landlord and tenant, Leasing and letting, Strategic real estate consultancy, Workspace strategy