Recent weeks have seen an encouraging uplift in UK economic growth forecasts as policymakers gain confidence, supported by significant progress in the vaccination rollout.

In its May monetary policy report, the Bank of England raised its projections for UK GDP growth in 2021 to 7.25% from February's figure of 5%. If this proves accurate, we will see the economy return to pre-pandemic levels during the final quarter of the year, with GDP then forecast to grow by close to 6% in 2022.

Consumers set for key role

Aside from the pick-up that will naturally occur as different sectors of the economy reopen, a significant determinant for long-term recovery will be consumers' appetite to spend additional savings accrued over the past 15 months.

Excess household savings – simply defined as the rise in savings above the pre-pandemic average – are a result of people's precaution and enforced spending cutbacks on restricted services such as pubs and restaurants since the first lockdown. Meanwhile, government assistance has also played an important role in protecting household incomes in aggregate, with a cumulative 11.5m jobs supported by the Coronavirus Job Retention Scheme since its introduction.

In addition, £6.2bn in grants have been issued through the self-employment income support scheme up the January this year. Needless to say, the financial impact of COVID-19 has not been even across society, with existing inequalities largely exacerbated by the pandemic. The latest survey of British households shows that despite the government's support policies, those in low-income employment, the unemployed and furloughed workers have on balance seen savings decrease.

Conversely, increased savings have been concentrated among middle- and high-income employees, as well as retirees. As it stands, Morgan Stanley estimates that collective excess savings are now equivalent to roughly £170bn, or 8% of UK GDP. This improvement in households' balance sheets overall would appear to put consumers in a solid position to support the recovery.

Increased spending expected

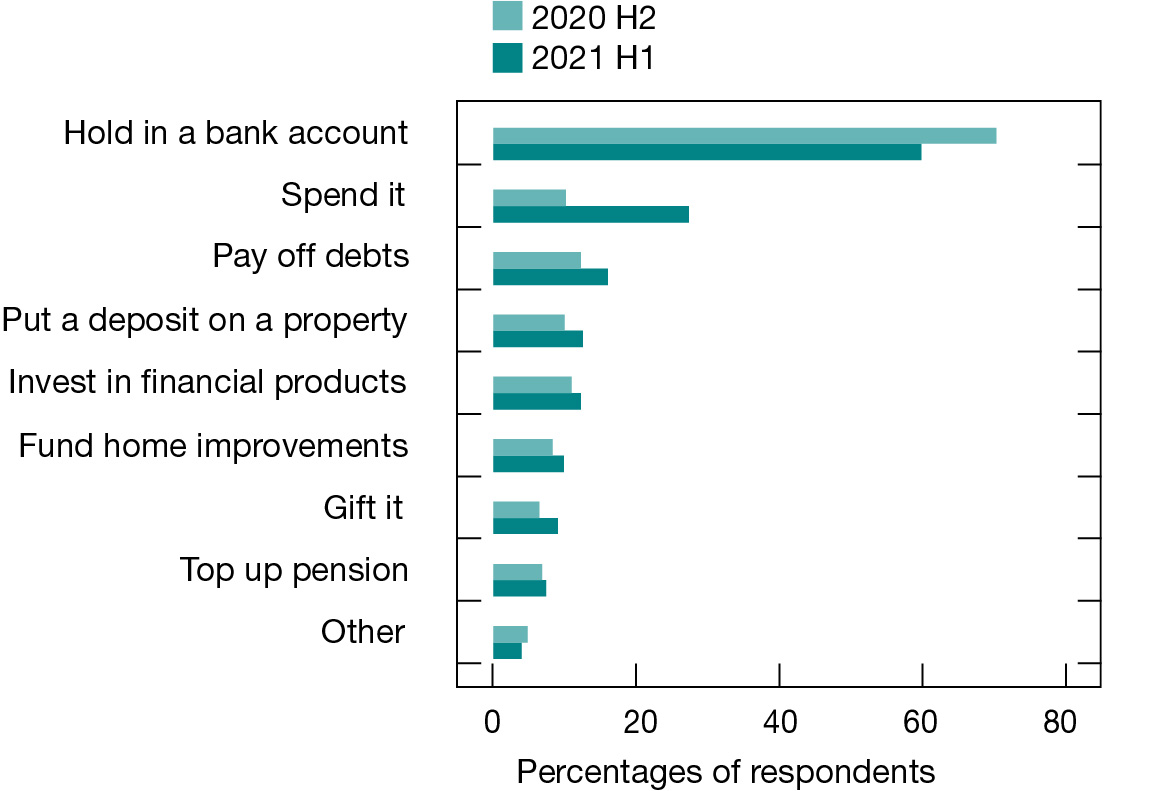

Crucially for the economic outlook, the Bank of England's monetary policy report has also signalled that households are now more inclined to spend these savings (Figure 1).

During the second half of 2020, of the households that had managed to increase savings during the pandemic, only 10% said they planned to spend at least some of this money, while 70% intended to hold it in a bank account. Since then, intentions have shifted, with the share of households planning to spend their savings rising to 27% in the first half of 2021, although 60% still expect to hold the money in a bank account.

Nevertheless, even for those who plan to hold on to savings, research suggests this might still result in a larger share of the balance being spent given time. Taking all this into consideration, the Bank of England's Monetary Policy Committee now projects that 10% of the additional savings accumulated during the pandemic to be spent over the next three years, an increase on its February forecast of 5%.

Global outlook

Many other advanced economies have seen a sharp rise in additional savings during the pandemic. Oxford Economics calculates a global total of $4.7tr in excess has been accumulated up to this point.

People in the US, the world's largest economy, are currently holding additional savings close to 12% of its national GDP. Therefore, any running down of this stored wealth through consumption would have a substantial impact on growth in the global economy.

Likewise, the Eurozone economy could benefit considerably from a rundown in savings, with the European Central Bank already forecasting that private consumption will pick up by nearly 9% over the next two years.

Furthermore, as household consumption tends to be import-intensive, the upturn in spending should raise world trade and help spread the benefits to emerging markets, where fiscal support during the pandemic has not been as generous as in high-income economies.

Risks remain despite positivity

Although there is growing optimism that vaccination programmes will soon enable economies to reopen without limitations, the possibility of ad hoc restrictions to curb future outbreaks remains a substantial risk. Provided such setbacks can be avoided, however, there seems a reasonable chance that global growth forecasts will continue to be upgraded.

In April, the International Monetary Fund revised its expectations for global economic growth in 2021, up to 6% from January's projected 5.5%, while estimates for 2022 were raised marginally to 4.4% from 4.2%.

Indeed, modelling from Oxford Economics predicts the global economy could receive a GDP boost of up to 1.5% by the middle of 2022 if consumers were to treat additional savings like regular income once conditions normalise. Under such a scenario, the UK economy would be expected to expand nearly 7% next year.

After a prolonged period of seemingly relentless bad news for both the domestic and global economies, it appears the outlook may at last be taking a more convincing turn for the better.

'A significant determinant for long-term recovery will be consumers' appetite to spend additional savings accrued over the past 15 months'