The immediate disruption from the COVID-19 pandemic is now, we hope, coming to an end. But in its wake we are likely to be looking at a changed landscape for commercial property.

Warehousing has thrived, high-street retail has withered, and the outlook for offices and hospitality is uncertain. Those of us who deal with dilapidations will have to adjust to new realities.

While market disruption is nothing new, each crisis affects the various property sectors differently. How might the pandemic affect diminution in value in dilapidations claims made by landlords against tenants at the end of a lease?

In such a claim, diminution in value is the difference between the price that could have been achieved for a property had it been repaired and reinstated in compliance with the lease terms and the likely price in the state it was actually returned to the landlord. It will often be the most appropriate measure of damages.

What affects diminution?

To appreciate what might happen to a diminution-based claim after a sharp adjustment in market demand, we need to understand how changes in value normally influence it.

Diminution is relatively unaffected by market circumstances until it reaches a point that a different type of buyer becomes interested. For example, if a building has a faulty roof but any likely buyer would retain and repair rather than replace it, the sale price will probably reflect the cost of that repair. Whether the property is worth £10m or £5m will not change that.

However, if the value has fallen to the point where a developer that intended to put an additional floor on the building – or even demolish it – would be the most likely buyer, then the condition of the roof will probably not have any further impact on the price paid.

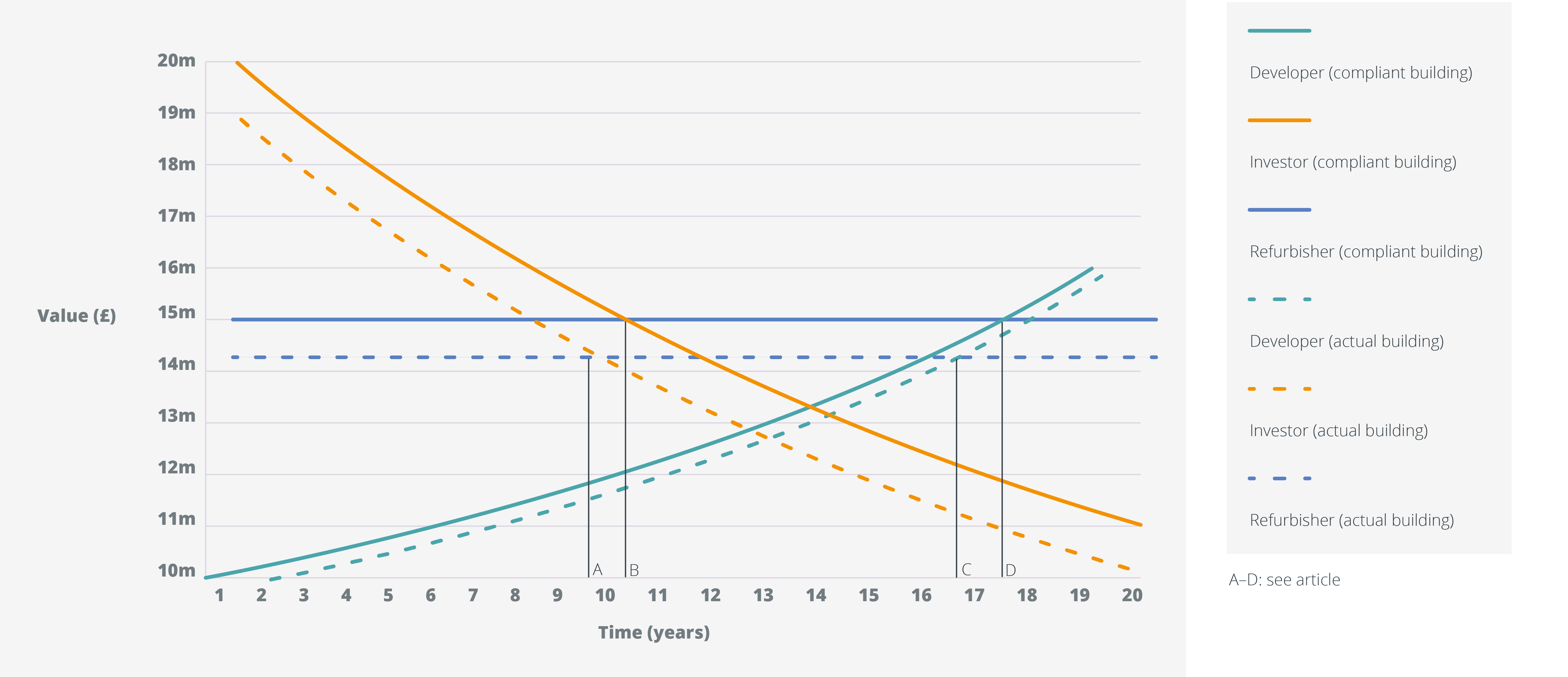

Figure 1 is an illustration of the hypothetical prices three different types of purchaser might pay for an office building over a period of 20 years. I have taken many liberties with market reality to simplify this example: inflation has been ignored, and it is assumed that the price adjustment each purchaser would make for the dilapidations would not change over the two decades either.

At the start of the 20-year period, the building is already 15 years old. Initially, the buyer that would pay the most is an investor, as indicated by the orange line. The building is still up to date and such a buyer could relet easily without improving the original specification. An investor would have paid £20m for the building had it been compliant with the lease terms. In the actual state, it would only pay £19m – a diminution of £1m, as indicated by the broken orange line.

The other two potential purchasers are an investor that intends to refurbish, shown in blue, and a developer that would convert the property into flats, in green. The refurbisher is intending to replace most of the building's services and internal finishes, so would just make a price adjustment of £500,000 for the dilapidations. The developer would only retain the main structure and exterior, and its price adjustment would be £250,000. Again, the price each purchaser would pay for a compliant building is shown by a solid line, with the diminished price reflecting the actual dilapidations being indicated by the broken line underneath.

'Diminution is relatively unaffected by market circumstances until it reaches a point that a different type of buyer becomes interested'

At the start of the 20-year period, the investor would pay the most, and the diminution in value for a few years would be £1m. As the building's services and finishes age, the price an investor would pay falls but would initially have no effect on the diminution given that no other type of buyer would be willing to pay more. The price that a refurbisher unconcerned with the condition of services and finishes would pay remains constant.

After about nine years, at point A, the price a refurbisher would pay for the dilapidated building is more than the investor would, and the diminution will reduce until the price it would pay for the compliant building is the same, at point B. The refurbisher's price adjustment of £500,000 will then become the diminution.

Over time, the area in which this building is located has started to gentrify and flat prices are increasing. Around the 17th year, at point C, the developer would pay more for the dilapidated building than the refurbisher, and the diminution would again reduce until point D, when the price a developer would pay for the compliant building is equal to the amount the refurbisher would. From this time onwards the diminution would be equal to the developer's adjustment at £250,000.

Diminution in a disrupted market

This illustration explains why the type of purchaser is the most important factor in assessing the diminution. In this simplified example it is only when the value change brings another type of buyer into contention that the diminution alters.

After a period of market disruption, as has recently occurred, predictions about the type of purchaser most likely to buy a property – and thus the diminution – can be difficult. An event such as the COVID-19 pandemic may significantly reduce the demand for office space but leave residential demand relatively unaffected, for instance.

Such a situation would probably be reflected in Figure 1 by a sharp drop in both the orange and blue lines. The green line – the price a residential developer would pay – would be unaffected. Immediately after the event, the most likely type of buyer will have changed and the diminution could then be only a quarter of the previous amount.

But how might the pandemic's effects actually play out?

Retail: redevelop or relet?

In some areas, the value of vacant shops may now have fallen to their underlying site value for an alternative use, because the only buyers in the market are attributing negligible additional value to the building. This does not mean that there is no diminution: while a buyer might only pay the underlying site value with the building in disrepair, they might conceivably pay a higher price if the building were in good enough condition to make letting a possibility.

There are some shops, particularly larger ones, where converting the upper parts to residential would be difficult and expensive, but where the value of the ground floor retail area has been sufficiently above the underlying site value to make wholesale redevelopment unviable. I expect this will change in some cases, and developers will be able to acquire retail properties at prices that allow them to redevelop the site with more efficient use of the upper parts for residential. Where that occurs, the diminution will probably be very low.

Demonstrating the viability of conversion or redevelopment for an individual retail property is still likely to present a challenge for a diminution valuer, even though the retail property market in general may have become very weak. While many areas have too much retail space, few shops have obvious redevelopment potential in isolation. Repurposing redundant space will probably require area action plans and deployment of compulsory purchase powers.

The overall demand for warehouse space meanwhile has proved resilient. Many landlords are considering the merits of repurposing some retail warehouse space for trade-counter occupiers or as last-mile delivery hubs. Where such repurposing occurs, it will probably have implications for diminution. Retail fit-out will need to be removed, which could increase or decrease the diminution depending on the exact circumstances.

Office situation remains uncertain

The effect of COVID-19 on office space has been to reduce demand in the short term. Organisations have become more comfortable with remote working, but few people want to work from home permanently. Many firms will adapt the space for greater flexibility and more meeting and socialising areas.

Companies may eventually decide they need less space, but I think the effect of the pandemic on diminution valuations of modern, well-located, offices will manifest itself mostly in the timing of owners' plans. If the market is uncertain, owners may shelve or revise intended refurbishments in favour of trying to relet the space with its existing specification – at least in the short term. That may have the effect of increasing diminution in situations where a lot of repairs are required, but could reduce it where removing fit-out is the main issue.

If the demand for offices does fall over time and residential prices continue their upward trend, conversion of more offices may become viable. That will invariably reduce the diminution.

Conclusion

An event such as the pandemic can change the intentions of those in the market for a particular property abruptly, with an equally unexpected impact on a dilapidations claim. However, it is not inevitable that a weak market generally will lead to a lower claim – it may increase it. If a fall in the value of a property for its existing use results in interest from buyers with alternative uses in mind the diminution will probably reduce. If the effect is to make refurbishment unviable the diminution may well increase.

Simon Crust FRICS is executive director at ProMission Surveyors

Contact Simon: Email

Related competencies include: Valuation