In 2017, the Bank for International Settlements' Basel Committee – which provides guidance on international financial regulation – proposed a new definition or framework for real-estate valuations for the purpose of bank lending. This would use prudently conservative valuation criteria or, to put it more simply, prudent value.

The European Central Bank has accepted prudent value within its new Capital Requirements Regulation and the expectation is that the Bank of England will also implement it in January 2025 in the EU and possibly summer 2025 in the UK.

Committee sets criteria for prudent approach

Basel 3.1 suggests that 'valuation must be appraised independently using prudently conservative valuation criteria'. To ensure this, it sets the following four criteria.

- The valuation must exclude expectations of price increases.

- It must also be adjusted to take into account the potential that the current market price is significantly higher than the value that would be sustainable over the life of the loan.

- National supervisors, such as regulators and potentially bodies such as RICS, should provide guidance, setting out prudent valuation criteria where such guidance is not already in place.

- If a market value can be determined, the valuation should be no higher than this.

The exclusion of expected price increases and adjustments to account for the potential difference between current market price and sustainable value over the period of the loan clearly distinguish prudent from market value.

The first criterion specifically excludes positive growth forecasts, but not negative predictions of falls in value. This is a major issue, though, as most prices are based on the expectations of investors, which may include the prospect of value increase in the future.

If this criterion is taken literally, the growth expectation element within prices must be ignored and so the capitalisation rate should be based on long-term fixed rate discount rates derived from risk-free rates plus risk premium.

This criterion, therefore, illustrates some basic misunderstanding of the dynamics of real-estate pricing and intrinsic value.

However, it could be seen to represent a hope that valuations are produced which restrict the valuation to a figure that takes no account of unreasonable or economically unrealistic expectations of price increases.

The second criterion is more attuned to that objective, as it talks about 'significantly above' a value sustainable throughout the loan period.

The third and fourth criteria make market value a prerequisite for prudent value, meaning that the latter can be produced by reference to an adjustment to the former. As such, market value should be part of every prudent valuation report.

Market value implicated in global financial crisis

Research undertaken in the UK – funded by the property industry through the Investment Property Forum (IPF) – and further research on the implementation of prudent value – funded by the IPF and the Property Research Trust – has concluded that prudently conservative valuation criteria can be best addressed through a long-term through-the-cycle equilibrium type market analysis model applied at a market segment level rather than at an individual property level.

This research was aimed at commercial and not residential markets.

The concept of long-term value may seem alien to the valuation profession, which operates on the basis that an asset is worth what you pay or can get a purchaser to pay for it, i.e. market value.

However, there are many occasions where markets have been proven to be over- or underpriced at a particular point in time and long-term value attempts to identify where prices should be based on longer-term economic trends, removing short-term cyclical variations.

The most obvious of these periods of over-pricing was in the period leading up to the global financial crisis.

Since then, regulators have realised that real estate lending plays an important role in the financial system – and had played an equally important role in undermining it.

Overlending in the up-cycle – informed by market values based on inflated prices – was identified around the world as a major contributor to the global financial crisis as the loans granted in the latter part of the upcycle went into negative equity when real-estate prices crashed in 2007/08.

Regulators have since questioned whether market value is the correct basis, and Basel 3.1 took note of the existing alternative model of long-term sustainable value – also known as mortgage lending value – when creating the new criteria.

Mortgage lending value, which is used as the basis for valuation in a few mainland European countries such as Germany, is therefore a possible contender for prudent value.

However, mortgage lending value has a number of elements which require significant prescription and the research on long-term sustainable value recommends a through-the-cycle equilibrium value approach characterised in the RICS' Bank lending valuations and mortgage lending value paper as 'economic fair value/investment value'.

'Long-term value attempts to identify where prices should be based on longer-term economic trends, removing short-term cyclical variations'

Cyclical analysis advocated as best model

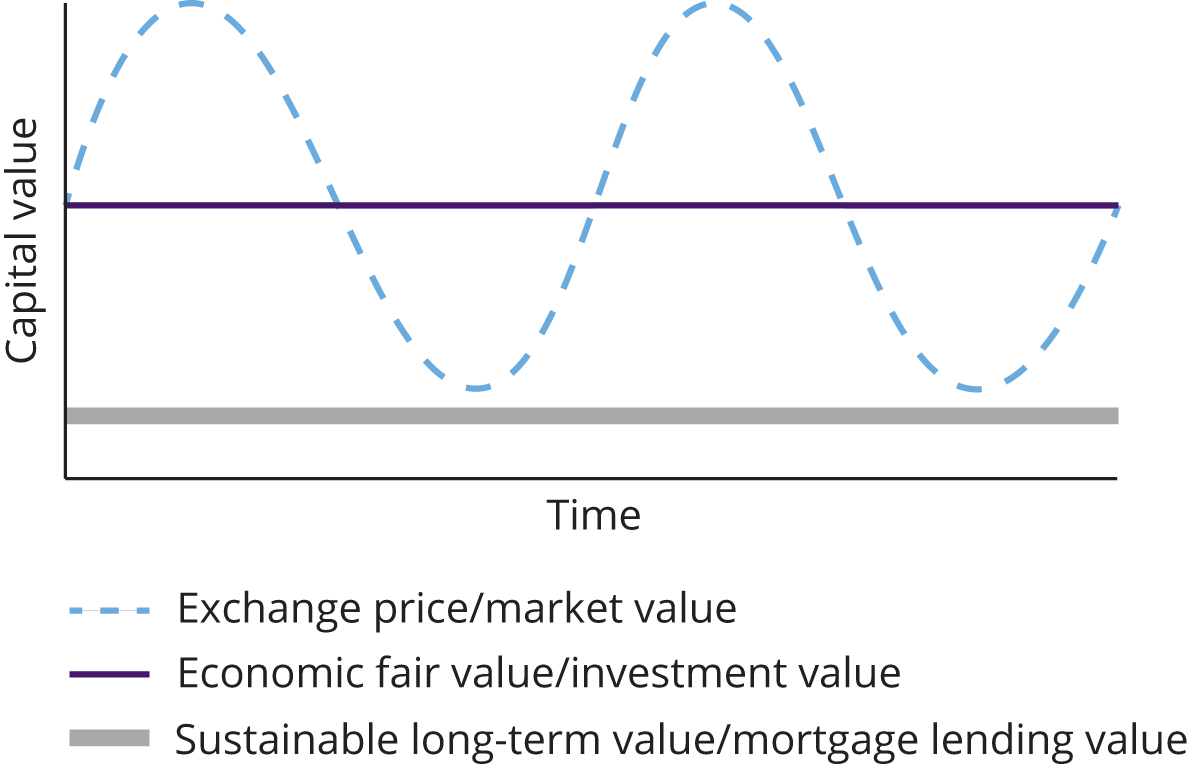

These three concepts of value, i.e. exchange price market value, mortgage lending value and long-term through the cycle value, are illustrated in Figure 1, taken from the current edition of RICS' Bank lending valuations and mortgage lending value.

Figure 1: A stylised view of the different approaches to long-term value. Source: Bank lending valuations and mortgage lending value, RICS professional standard

The volatile cyclical short-term price movements are represented by the exchange price and market value line, while the current mortgage lending valuation regime operated in some countries in mainland Europe is represented by the line which runs under the market value series.

The long-term through-the-cycle value is an attempt to identify where long-term equilibrium values are placed and this has been recommended in the research as the preferred approach.

The prudent value criteria state that it cannot be higher than market value, so the obvious definition for prudent value is the lower of long-term through-the-cycle value or market value.

EU and UK move towards new valuation regime

Most professional and real-estate organisations across Europe have accepted the research recommendations and the need to assess prudent value in two stages; determining long-term value and then comparing with market value to assess whether it is higher or lower.

The exception is the European Group of Valuers. The other organisations have concluded that prudent value is not a valuation as such; rather, it is a market analysis to be undertaken at a market segment level and then applied to individual market valuations as an adjustment factor.

The first stage is therefore no change with the valuer assessing the market value of an individual asset to provide an objective, unbiased opinion based on price levels at the date of that valuation, taking into account the asset's individual characteristics.

The alternative is the provision of prudent values for each individual property undertaken by the valuer. The spectre of individual valuers calling the level of mispricing in the market fills many at the RICS and other professional institutions and organisations with dread.

If some valuers identify market overpricing and others do not, inconsistency will be rife and potential negligence claims could follow. Valuers who predicted correctly a future downturn could then be cited as evidence of the incompetency of others, who did not call it.

To avoid this, the necessary second stage is a centrally produced, periodically revised market-based prudent value adjustment factor or factors. However, this needs to be developed by valuer and lender organisations in consultation with regulators.

This process is under way in both Europe and the UK. The European Mortgage Federation, with the collaboration of organisations such as the International Valuation Standards Council in Europe as well as RICS in the UK, supported by lenders and investors, are developing a framework for the production of these factors to help adjust market to prudent value. This will help valuers establish the new valuation regime.

Professor Neil Crosby MRICS is professor emeritus, University of Reading, and lead author for the new RICS practice information on DCF valuations

Contact Neil: Email

Related competencies include: Valuation, Valuation of businesses and intangible assets