With more than 300,000 mortgage approvals recorded during the last three months of 2020 – the highest quarterly total in almost 13 years – the UK housing market has experienced a rapid rebound in activity amid the chaos of the pandemic.

Nonetheless, beneath the strong headline figures there is growing evidence that lockdowns and the associated lifestyle changes have caused a notable shift in the type of properties that house buyers are seeking. As people spend more time at home, features such as a garden or space for an office are increasingly desirable.

Garden space in demand

In fact, research conducted by property portal Zoopla found "garden" was the top feature that buyers and renters alike searched for when hunting a new home in 2020. This has left the flats and smaller homes that lack outside space much less appealing, and therefore they are not seeing the buoyancy found more generally across the residential market.

On this front, Zoopla data shows that prospective flat buyers are struggling to find a property that can meet their desire for access to private outside space. This is reflected in trends for price growth and average length of time to sell: four-bedroom houses in the UK sold 33% faster in 2020 compared to the previous year and, in a complete reversal of trends, now take less time to sell than a one-bedroom flat. Moreover, according to Zoopla's estimates, growth in house prices as of November 2020 was more than twice the rate for flats, at 4.3% against 1.8%.

Flats dropping

Other evidence in support of this trend can be found in a recent report by Hamptons International. Its analysis showed that average gross profits on the sale of a house in England and Wales increased by more than £2,000 between the third quarter of 2019 and quarter three in 2020. Conversely, there was a £3,000 reduction in average profit margins for those selling flats over the same time frame.

The preference for larger homes with more space is also borne out in the January 2021 RICS Residential Market Survey results. Whereas an average net balance of 60% of respondents have noted an increase in prices for three- or four-bedroom housing over the past two months, the figure stands at 35% for one-bedroom properties.

London market most changed

The outperformance of larger homes over smaller properties is perhaps most pronounced in London. Across the capital, a net balance of 18% of respondents have reported a decline in prices for homes with just one bedroom over the past two months, while homes with four bedrooms or more have seen a small rise in prices. This represents a turnaround on the position 12 months ago, when properties with four or more bedrooms in London displayed the weakest price trends across all categories tracked while one-bedroom properties were ranked highest.

In many ways, it is understandable that flats and smaller homes have fallen in the pecking order while lockdown orders remain in place. Whether this turns out to be a relatively short-term pattern or a lasting shift remains uncertain at this point. As it stands, RICS members working in the residential sector are anticipating that prospective buyers' search for greater space will continue over the longer term.

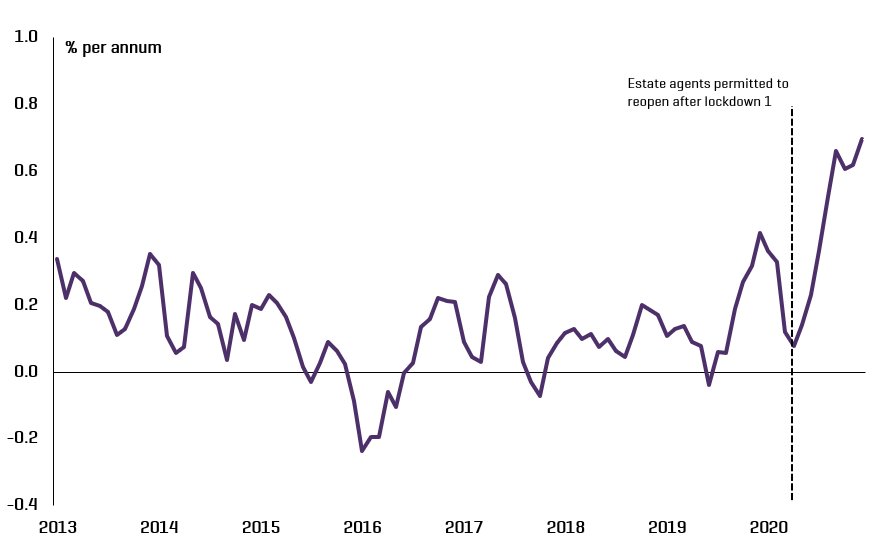

Going back to the RICS survey data, although reasonably solid price growth is still anticipated for one-bedroom homes over the next five years, this is likely to lag larger properties by a clear margin. Figure 1 displays the difference between five-year price growth expectations for one-bed and four-bed properties, and shows that recent months have seen the widest gap in favour of larger homes since the series began in 2013.

Again, this is even more marked in London, where homes with four or more bedrooms are now estimated to see a cumulative 24% price increase over the next five years, while one-bedroom house prices are projected to rise by 16% on the same basis. Moreover, a net balance of 75% of respondents to the August 2020 UK Residential survey foresee demand for homes in tower blocks falling over the next two years.

If this contrast in fortunes were to be sustained, it could begin to reshape housebuilding activity significantly. Indeed, developers may well be compelled to move away from dense urban living and put greater resources into providing larger, more spacious units instead.