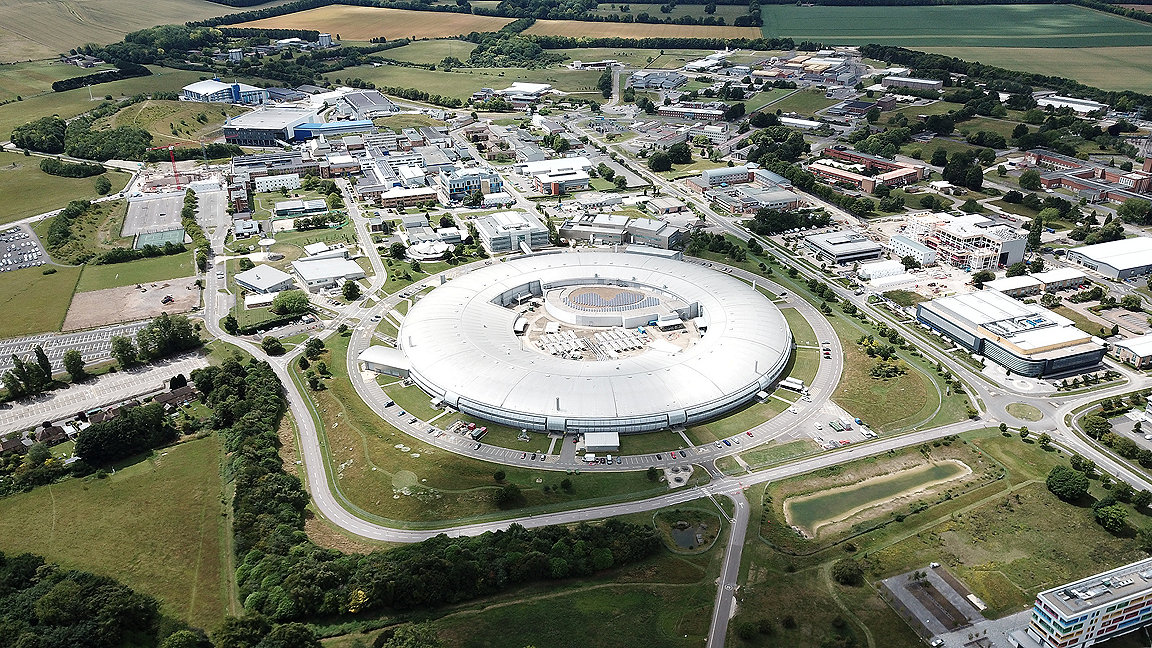

Harwell Campus, with Diamond Light Source visible in front centre © Harwell Campus

In the wake of the pandemic, billions of pounds have been invested in the life sciences to fast-track the likes of virus testing, vaccine research and manufacturing.

Before last year, the provision of research and development (R&D) premises was left to a few niche operators, usually in partnership with academic institutions. But as demand continues to grow, the real-estate market needs to respond and evolve.

Rising demand

Academic spinouts – businesses that have developed from within another organisation – are driving this increased demand, especially across the Oxford–Cambridge Arc. Leading institutions such as the University of Oxford and the University of Cambridge have an anchoring effect, both creating and attracting innovative businesses in a wide range of sectors.

Notable successes from 2021 include Oxford Nanopore, which is involved in DNA and RNA sequencing and has raised more than £800m in investment to date; it is now preparing to float on the London Stock Exchange. Meanwhile, Exscientia, which is using artificial intelligence to develop new drugs, has received more than £275m, with notable investors including BlackRock and Softbank Vision Fund.

With investment from financial institutions, private equity, venture capital and private investors, the knowledge economy has seen record growth in recent months. Bidwells tracked £2.4bn of activity throughout 2020, reflecting a 56% increase from the previous year.

Beauhurst tracks high-growth companies in particular, and has seen an explosion in the life-sciences sector since 2019 that shows no signs of stopping. There were almost 90 investments announced in the first half of 2021, worth a total of £1.4bn – representing double the amount invested in a similar time frame for 2020. Life sciences have received the third highest amount of equity investment in 2021 so far, close behind financial technology and artificial intelligence.

This surge in cash flow has been of considerable help to companies in developing their property strategies, with many taking surplus accommodation to enable their projected growth.

Specialist spaces

The building specifications required in the knowledge economy are diverse, and change as those entering the market at seed stage evolve into mature corporate entities.

Early-stage companies, for example, want fitted laboratory and write-up space for administration and reporting on research, on flexible leases or licences. The model is not dissimilar to traditional serviced offices, but with add-on facilities including equipment sterilisation, laundry for scrubs and lab coats, and specialist waste disposal such as autoclaves. The market for such spaces is itself at an early stage of development, and is usually linked to academic institutions, although there are a few niche private operators such as Bruntwood Scitech.

Laboratory-enabled buildings have key structural requirements that include reinforced concrete floor slabs, increased floor-to-ceiling heights, modular mechanical and electrical services and plumbing, three-phase power supplies for high-power equipment, and external storage for gases and additional plant. Development of these buildings therefore needs to be bespoke, and is capital-intensive. The potential for retrofitting surplus office buildings to accommodate such facilities is also limited.

Fitted or serviced labs up to containment level 2 (a laboratory standard for the containment of medium-risk substances, agents or organisms) available on flexible lease terms are the answer for most seed-phase occupiers; however, the extremely high fit-out costs and short lease lengths make this a significant risk for landlords. From an investment perspective, the benefits of this model may appear limited when analysed in isolation. But in a wider context, dedicated science parks may have to absorb this risk to attract the best operators and enlarge their tenant pool.

Companies at the growth and venture stages require larger laboratories as they scale up. Timing tends to be critical, so they will focus on lab-enabled buildings, or those offering a basic fit-out specification that includes everything up to anti-static flooring and benches.

Laboratory fit-outs can take between four and six months, so lab-enabled options are in high demand, allowing companies to be ahead of the curve when bidding for and fulfilling essential contracts. Such buildings must remain adaptable, to allow future occupiers to benefit with minimal reconfiguration or wastage. Currently, the market is just about meeting demand, with Savills estimating that vacancy rates for laboratory space in the 'golden triangle' of Oxford, Cambridge and London rarely exceed 2%.

At Harwell Campus, we have recognised this trend and constructed R&D buildings speculatively to accommodate the surge in demand. Our campus sits on a site of almost 300ha with a commercial development pipeline of more than 130,000m2. Occupier demand has encouraged the development of Tech Edge and Quad 2, which will provide more than 23,000m2 of R&D buildings, suitable for labs, offices and engineering space, with additional residential and leisure developments aimed at creating live/work amenity for occupiers as well as food and beverage outlets open to the local community. Tech Edge will provide research and development buildings with clear eaves height of up to 10m, while Quad Two is a grade A office building which can also accommodate dry labs.

Established companies in the sector tend to have stabilised revenue streams and steady forecast growth. This enables them to commit to longer lease terms of ten years or more, with the ability to fit out more elaborate premises or commission design and build opportunities. Oxford Nanopore and instrumentation manufacturer Agilent Technologies are examples of the latter, both having bespoke buildings on Harwell Campus.

Prepared for the future

Private and public sector support alike is essential to the growth of the knowledge economy. Academic spinouts face huge costs for specialist equipment and laboratory fit-outs, while at the same time having to pitch for funding and commercial contracts to sustain cash flow. Harwell and similar science parks can support such companies in their transition into small or medium-sized enterprises and larger organisations.

The Science and Technology Facilities Council (STFC), a division of UK Research and Innovation, is in a joint venture between Harwell and private stakeholders Brookfield, which purchased a 50% share in the campus in 2020. This collaboration has enabled fast-growing organisations in the space, energy, life sciences and quantum sectors to be cultivated and scaled up on campus.

The STFC provides more than £2bn worth of national open-access facilities, allowing organisations to use sophisticated technology and clean-room facilities such as those at Diamond Light Source and the National Satellite Test Facility, both situated at Harwell, as well as real estate that is tailored to their requirements as they grow.

Harwell Campus began life as RAF Harwell, which was transferred to the Ministry of Supply on the closing of the Second World War. Shortly thereafter in 1946, the Atomic Energy Research Establishment was founded, joined two years later by the Medical Research Council’s Radiobiology unit.

Since Harwell Campus was founded research carried out there has been instrumental in scientific breakthroughs, such as the uncovering of X chromosome inactivation by Dr Mary Lyon, the world's first experimental fast nuclear reactor ZEPHYR, and the discovery of the largest prime number.

The UK has always been a nucleus for research and innovation. With robust real-estate infrastructure and support, this legacy can continue.

'Academic spinouts face huge costs for specialist equipment and laboratory fit-outs'

Paddy Pringle is leasing manager, Harwell Campus

Related competencies include: Strategic real estate consultancy