While large-scale intergovernmental modelling of climate change in the atmosphere and ocean is already well established, initiatives that address impacts at the level of the individual property are less developed. At this letterbox level, property professionals in the UK are not yet ready to assess the risk of climate change over the coming decades.

Therefore, the property risk team at the Nationwide Building Society has since 2014 been collecting best-in-class data on such perils. This work was designed and managed in conjunction with two lead consultants, Airbus Defence and Space Ltd and Property Risk Inspection Ltd (PRI), with technical support from JBA Risk Management and Cranfield University's geohazards team.

Addressing the agenda

On 15 October 2018, the Bank of England published for consultation a draft supervisory statement on climate change expectations and financial institutions' responsibilities.

- governance: board-level engagement with climate risks

- risk management: a strategic approach to risk appetite

- scenario analysis: conducting bulk tests of back books against climate planning scenarios

- disclosure: transparency in releasing planning information.

In the same year, Nationwide commissioned Airbus and PRI to examine the impact of climate change at address level, in line with the Bank of England's advice that account holders lenders and insurers should put climate change research, planning and action on the agenda of financial institutions' boards. By identifying risks at a letterbox level, the project sought to inform mortgage-lending and property risks, providing greater confidence for the consumer and lender than a standard mortgage application.

"The project sought to inform mortgage-lending and property risks"

The need to use sophisticated and fast-moving climate change modelling techniques required Nationwide to invest in modernised software systems and properly curated and geocoded information on property and perils. This is key for any financial institution and its professional advisers, given the challenge of strategically assessing climate change impacts at the level of the unique address – specifically, where individual families reside and where mortgages are written.

Legacy systems and peril data sets are insufficiently accurate to allow modelling or scenario planning below the portfolio or acquisition level. The letterbox level is essential to the complex data relationships that modern geospatial and risk systems require and regulators expect to see.

- investigation of reliable big data resources as the basis for improved decision-making

- appointment of data provider partners

- use and evolution of geospatial big data systems

- improving internal use of data

- developing new operational systems and approaches to increase the accuracy and resilience of the mortgage-lending process

- planned research, development and implementation of appropriate mortgage-lending policies

- links with, and the inclusion of, insurance as a financial safety net for the present and future.

It is important to note as well that the UK has one of the most sophisticated general insurance markets in the world, with ordinary cover for flood, subsidence and other perils available to almost all addresses on a pooled basis. Critically, however, it is often overestimated that paying an insurance premium generates an awareness of risk among homeowners.

The government and its agencies are strongly committed to the property sector and its security. The continuing availability of general cover should remain a central protective feature of the public and property sectors into future decades. It is therefore also important that any central risk management strategy aligns with the UK's general insurance risk modelling frameworks for residential management of major perils and climate change.

- inability to travel due to flood or storm damage to infrastructure or private transport

- commercial property and employment impacts from flooding

- outages to services and utilities disrupting routines.

Once the investment in systems has been made and the importance of the relationship between insurance and mortgageability is understood, the organisation will be better placed to govern, manage risk and test scenarios strategically. At Nationwide, these investments meant that a model for scenario planning and risk analysis could be developed over a mortgage book that was fully geocoded with peril layers, where insurability was understood at the individual security address.

There are many places on this planet where settled and stable weather systems dominate. However, with the Gulf Stream bringing warm and wet air from the Atlantic, high-pressure systems carrying warm settled air from the equator and cold settled air from the Arctic, alongside other intercontinental influences at play, it is challenging to prepare reliable short-term forecasts for the UK. The country experiences a unique annual range of ocean and atmospheric currents and high- and low-pressure systems that determine the type of weather year that each region experiences. The model assumes that surge years for subsidence, flooding and storms will continue, with the frequency likely to increase and insurance claims growing in amount and number.

"It is challenging to prepare reliable short-term forecasts for the UK"

We are well served in the UK by a tightly integrated general insurance market, a sophisticated claims management market and modern governmental structures and agencies skilled in understanding climate change. As such, it is possible to plan scenarios at the portfolio and new acquisition levels using the now very sophisticated climate, soil, water flow and geospatial data overlaid on the UK residential and commercial portfolio.

The key scenario perils

Subsidence is a class of ground instability that includes any disruptive, differential movement, in any direction, of the supporting soil on which property foundations rely. It is typically caused by heave, shrinkage, landslip, geological holes, or historic mining failure. For landslip swallow holes and other geological holes mining and other impacts caused by human activity, the geospatial centres tend to be distinct, while the risks are well known and understood.

The most important form of subsidence at the statistical or cost level to general insurers on an annual basis is caused by clay shrinkage. Clay soils have the ability to shrink and swell depending on the temperature and precipitation cycles. Intense periods of hot, dry weather lead to shrunken, cracked soils underneath foundations, and an increase in subsidence claims as a result.

Flooding is another key threat in which water damages buildings, internally or externally, damages or disrupts infrastructure including power networks, disables vehicles or otherwise affects residents' ability to live in their homes, travel to work or socialise. Flooding events have exceptional impacts on communities and regions. The recurrence of storm and flooding episodes has been a major factor in the environmental protection measures taken by the UK government, business and the general insurance market.

Proof of concept

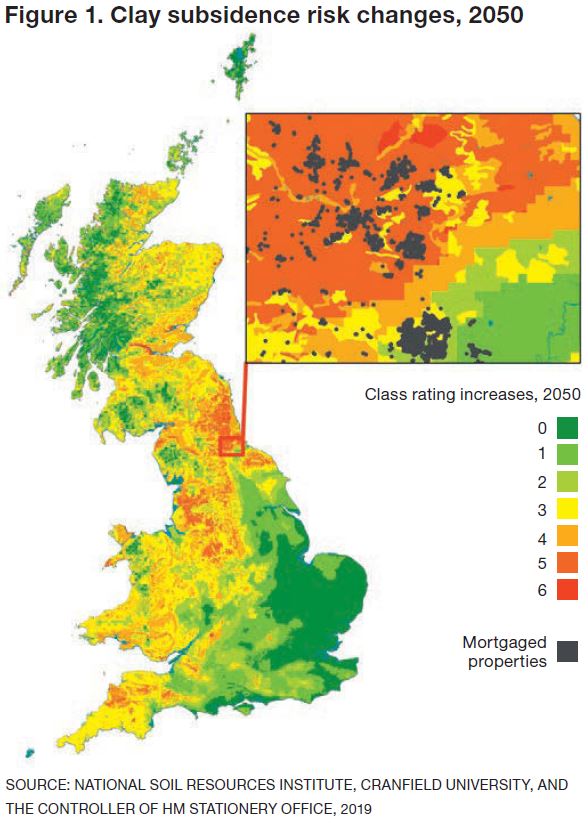

The proof of concept data processing for this report has been based on both JBA Risk Management and Cranfield University data predictions, allied with claims data from PRI and geospatial and satellite earth observation from Airbus, for any period to 2050. Figure 1 shows the degree of change and the locations where that is expected for clay subsidence, as a sample peril. The classes range from a very low increase, 0, to very high, 6. The representative area enlarged has been overlaid with the locations of properties that have a mortgage as part of Nationwide's back book; risk can then be ascertained and scenarios planned into the future at scale.

Property professionals will in coming years be better served by sophisticated modern geospatial and data library integrations at lender level. These screens and systems will allow triage of portfolios and valuation cases never previously imagined. It is essential, therefore, that property professionals recognise these changes in approach so they can be better placed to add value to portfolio and mortgage origination decision-making.

Graeme Winser is director strategy at Propria graeme.winser@propria.co.uk

Gill Dickson is sales manager finance & insurance sector at Airbus Defence and Space gill.dickson@airbus.com

Related competencies include: Insurance, Sustainability