UK public-sector valuation is currently in a state of transformation. With consultation ongoing in an HM Treasury review of operational asset valuation, potential changes could have a significant impact for RICS members working in this area.

The review began in late 2021, when the Treasury announced that it would be examining the valuation of non-investment property for financial reporting purposes in the public sector.

There had been widespread delays in the local authority auditing process related to the annual asset valuation exercises in England: only 9% of audited 2020/21 accounts were published on time.

These delays are generally perceived by RICS members working in valuation to have been caused by an increase in the degree of detailed audit scrutiny, following a tightening-up of the audit profession's work by the Financial Reporting Council. The situation was exacerbated by funding cuts and resourcing issues, as well as the impact of the pandemic.

Alternative valuation bases proposed

The purpose of the Treasury review has been to consider the costs and benefits of the current regime and explore possible alternatives, including whether to continue measuring the value of public sector operational assets in financial reporting terms in financial statements via current valuations as opposed to reverting to historic cost as a form of measurement.

The Treasury issued an update on the review process late last year setting out its headline conclusions. This indicates there is a strong case for change, to meet the needs of users and producers of the financial information while ensuring value for money and timely reporting.

The Treasury launched its consultation on a range of options in early March 2023 following a year-long review – and some of these, if approved, would have a radical impact. Specialised assets would no longer be revalued; that is, the regime would transition to deemed cost, with future expenditures recognised at depreciated historic cost.

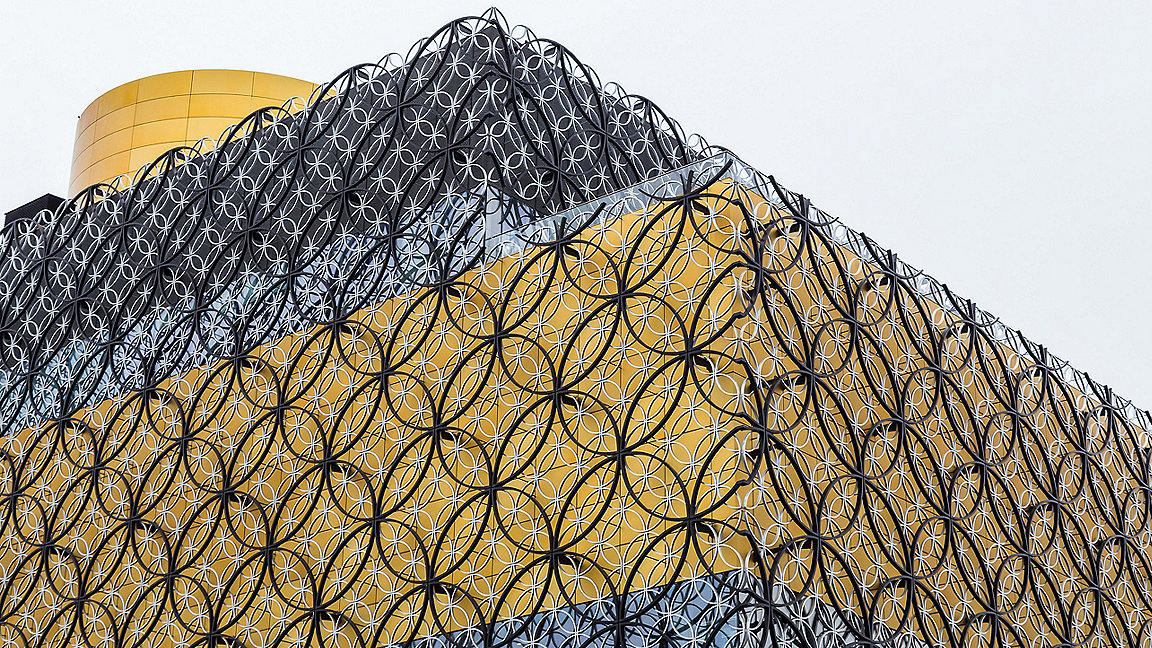

As a result, public sector 'specialised' operational assets which typically don't transact in the open market – e.g. town halls, schools, cemeteries and libraries – would no longer be reported in financial accounts by way of current valuations and would be replaced by referring to their historic cost as a basis of measurement. Other non-specialised operational assets – e.g. offices and shops – would still be valued but fair value would replace existing use value as the relevant basis of valuation.

The consultation runs until 18 May, with the Financial Reporting Advisory Board due to meet in June to consider feedback and agree proposals, which would take effect in April 2025.

RICS producing guidance to clarify practice

A further potential cause of public-sector audit delays has been the implementation of International Financial Reporting Standard (IFRS) 16 for leases, which aims to bring these on to balance sheets and recognise their value. Although some of the UK public sector adopted IFRS 16 on 1 April 2022, local authorities ultimately pushed it back until April this year in a further attempt to alleviate audit delays.

RICS has produced practice information in this area, IFRS 16: Principles for UK real estate professionals to help public-sector valuers comply with the standard.

A further issue in the public sector that RICS' valuation team has been focusing on is the treatment of the EUV basis of valuation. This currently remains the basis in the UK public sector, in an otherwise IFRS-dominated reporting environment.

Stakeholders in the valuation of operational public-sector owner-occupied properties have alerted RICS that valuers and auditors are sometimes interpreting the definition and conceptual framework in RICS Valuation – Global Standards (Red Book Global Standards): UK National Supplement VPGA 6 in different ways.

As Property Journal reported recently, RICS convened an expert working group to produce further guidance and clarification, which is the subject of consultation until 1 May.

On a global basis, the RICS valuation team has also been helping the International Public Sector Accounting Standards Board (IPSASB) in creating a globally applicable public-sector valuation basis, known as the current operational value, as an alternative to fair value. This is being especially designed to help public-sector entities estimate the value of non-financial assets in achieving their service provision objectives.

Over the past 12 months, RICS has also been liaising with public-sector valuation members to make technical updates to relevant material in the Red Book: UK. It established a working group and consulted with members working in this area on various proposed technical updates to:

- UK VPGA 4 Valuation of local authority assets for accounting purposes

- UK VPGA 5 Valuation of central government assets for accounting purposes

- UK VPGA 6 Local authority and central government accounting: existing use value basis of value

- UK VPGA 17 Local authority disposal of land for less than best consideration in England and Wales.

The UK public sector valuation space is currently a fast moving and dynamic area and it appears valuers need to prepare for further potential changes ahead. In their ongoing consultation, HM Treasury clearly feels that in view of the time and costs associated with operational property valuations in the UK public sector, the time is ripe to think about the cost–benefit balance in producing this financial information.

The key challenge in potentially changing the current valuation framework to assist in improving the timeliness of accounts is achieving a balanced approach, which ensures the provision of a 'true and fair' view of the financial position of public sector assets.