The growing popularity of commercial real estate as an investment is hardly surprising given the prevailing central bank policy of maintaining a zero-interest rate environment. Under such conditions, government and corporate bond yields no longer offer the required returns; so investors have been forced to look elsewhere for a secure revenue stream.

Real estate is therefore increasingly viewed as a good bond proxy by many in the broader financial community. However, real-estate valuers, brokers, investors and lenders have no standard quantifiable measures of tenant default risk, which presents a barrier to entry for many as they don’t feel they can accurately underwrite direct real-estate investments or loans.

This is not a new problem for the sector. Indeed, the inability of investors to assess tenant income default accurately in the collateralised mortgage-backed security markets played a central role in precipitating the great financial crisis in 2007/08.

Despite the near-death experience for many in the real-estate investment markets at that time, very little has since changed.

The statistics

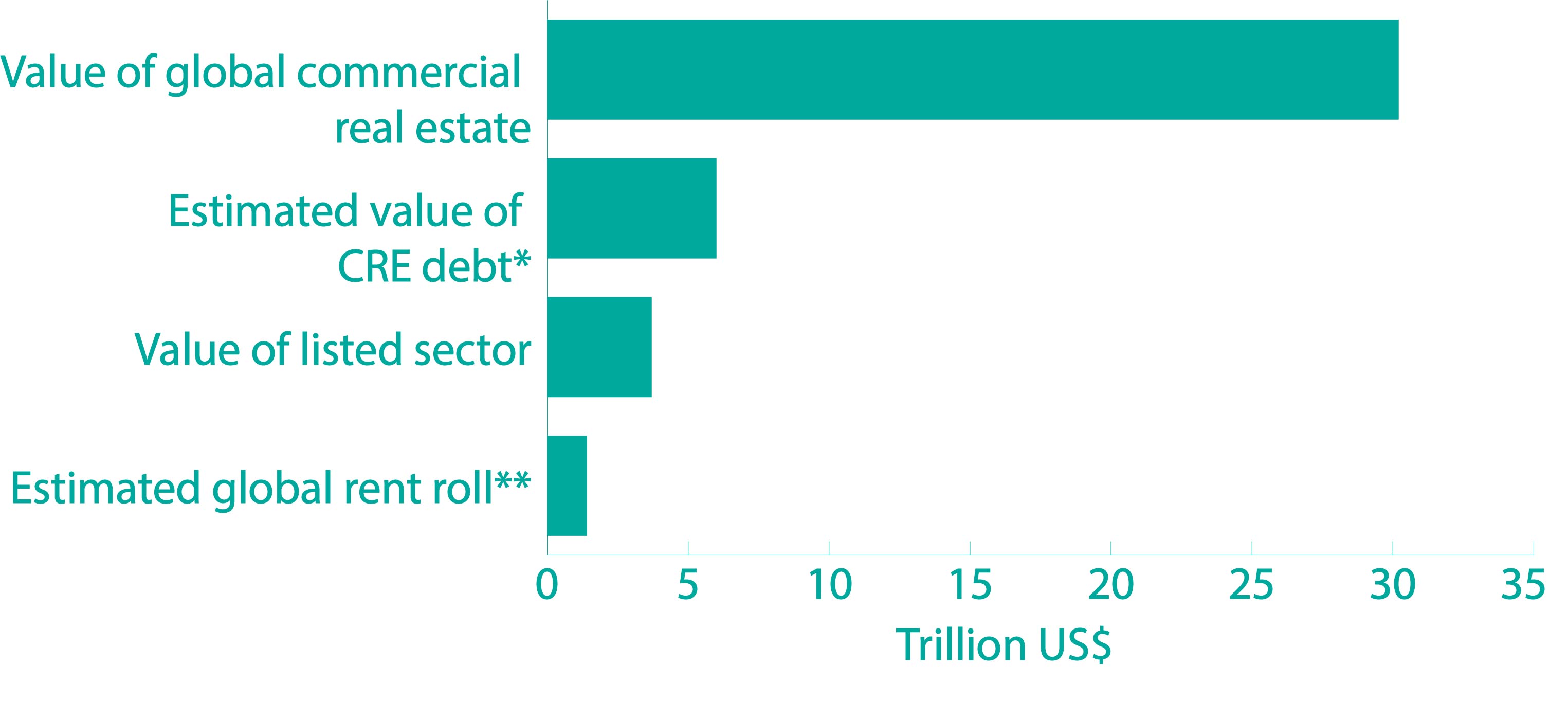

According to the European Public Real Estate Association (EPRA), which represents property companies, investors and their suppliers, the value of global commercial real estate was estimated to be $30.2tr as at December 2018. Using a generous initial yield assumption of 4.5%. this would imply that tenants around the world will pay more than $1.4tr in rent during 2021, as shown in Figure 1.

Figure 1: The global commercial real-estate market in 2018

Source: EPRA – global real estate, total markets table, December 2018, Income Analytics

Notes: * Estimate based on 20% of global market value ** Estimate based on global market value and an initial yield of 4.5%

Incredibly, only a fraction of this income will have been rated or analysed beyond a cursory look at historic accounts or a company credit rating for a particular point in time. Yet it is these income streams that underwrite not only the direct real-estate market but more than $3.7tr of listed real-estate investment trusts as well as trillions of dollars on bank loan books and in the securitised debt market.

The problem

As it stands, real-estate professionals, investors and lenders cannot quantify the probability of failure or default – and the subsequent loss of rental income – for most of their tenants. While bond ratings are available for major companies, there are few resources to help most market participants assess the risk associated with the private businesses, LLPs or SMEs that constitute the majority of the underlying cash flow in most real-estate portfolios.

The traditional approach to underwriting tenant income risk is to buy a company credit report from a credit reference agency such as Dun & Bradstreet, Experian, Credit Safe or Equifax. These provide a lot of useful background information for an agent, investor or lender. But they are not designed specifically for real estate, so cannot answer more obvious questions such as "How likely is my tenant to default or fail during the course of my five-year lease?" or "How does the probability of default compare with other asset classes such as corporate bonds?"

More importantly, most of the risk metrics provided tend to be subjective in nature – low risk, medium risk and so on – rather than offering a quantifiable, percentage probability of default or failure that can be readily applied to cash-flow modelling or used for investment underwriting.

A new approach

In December 2019, the research team from Income Analytics led by chief information officer Chris Arnold set out to try to find a solution. Using raw UK company-level data from Dun & Bradstreet, the team examined what additional value could be extracted and repurposed to help real-estate professionals, investors and lenders make better-informed letting, investment and lending decisions.

Their first conclusion was that rather than focusing on the rating in standard company credit reports, the real-estate investment community would be better served by concentrating on the probability of company failure. This metric is readily available in the scorecards produced by most credit reference agencies as a projected 12-month percentage probability of failure, but is largely overlooked in favour of the credit rating.

The advantage of using a failure score rather than a credit rating is that it is based on the actual data of how often similar companies fail and for what reason. Given that the primary concern of most landlords, investors and lenders is whether or not they will get paid, it made more sense for the team to focus on a measure of absolute failure or loss rather than a relative measure such as the credit rating. More importantly, the failure score provides a quantifiable measure of tenant default risk that can be deployed in cash-flow modelling and investment underwriting.

"The advantage of using a failure score rather than a credit rating is that it is based on the actual data of how often similar companies fail and for what reason"

Measures specific to real estate

Having quantified the risk of tenant failure or default risk, the team set about applying the data to solve a set of specific problems faced in real estate.

- Long-term forecast of tenant failure or default: by studying the historic patterns of company failure across the 14.4m UK companies between 2007 and 2020, the team could project the percentage probability of tenant failure or default and quantify the likelihood of it happening for up to 10 years into the future. This finally provides the real-estate sector with a long-term quantifiable measure of failure or default risk that can be applied to cash-flow models, valuations and investment underwriting models.

- Global standardisation of risk scores: the percentage probability of failure or default could be mapped on to similar data in other countries, thus enabling professionals to compare the quality of current or prospective investments across borders and over time. This has proved an important consideration in an increasingly globalised real-estate investment market, where the willingness or ability of tenants to pay their rent may be determined by events in New York, Tokyo, Shanghai or Singapore rather than the UK.

- Bringing real estate in line with capital markets: the percentage probability of failure or default could also be mapped on to the corporate bond markets to create an equivalent bond rating. This provides fixed-income and equity investors with context, and allows them more easily to understand the risks of failure or default associated with a specific cash flow or collection of cash flows. With fixed-income investors becoming an increasingly important source of capital for real-estate investment markets, their ability to measure potential default risks easily should not be underestimated.

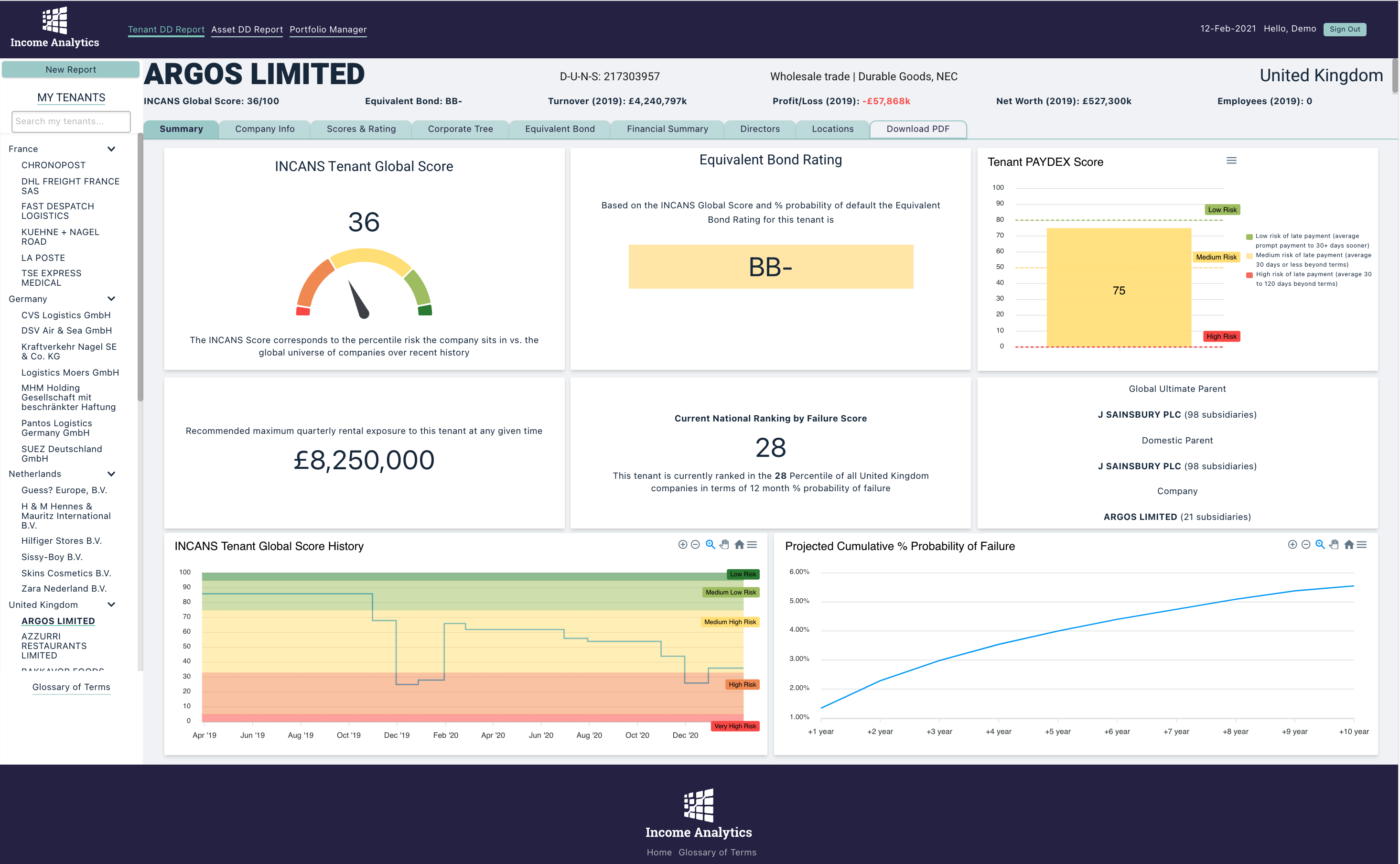

Figure 2 illustrates how this scoring of tenant income risk has been brought together as a highly visual and easy to understand dashboard. The dashboard summary highlights the key scores that Income Analytics has created (INCANS Scores) and alongside this there are additional data tabs that provide company information that is viewed in a traditional credit report as well as a corporate family tree that illustrates the true counter party risk all the way up to the parent along with any subsidiaries, wherever they may be in the world.

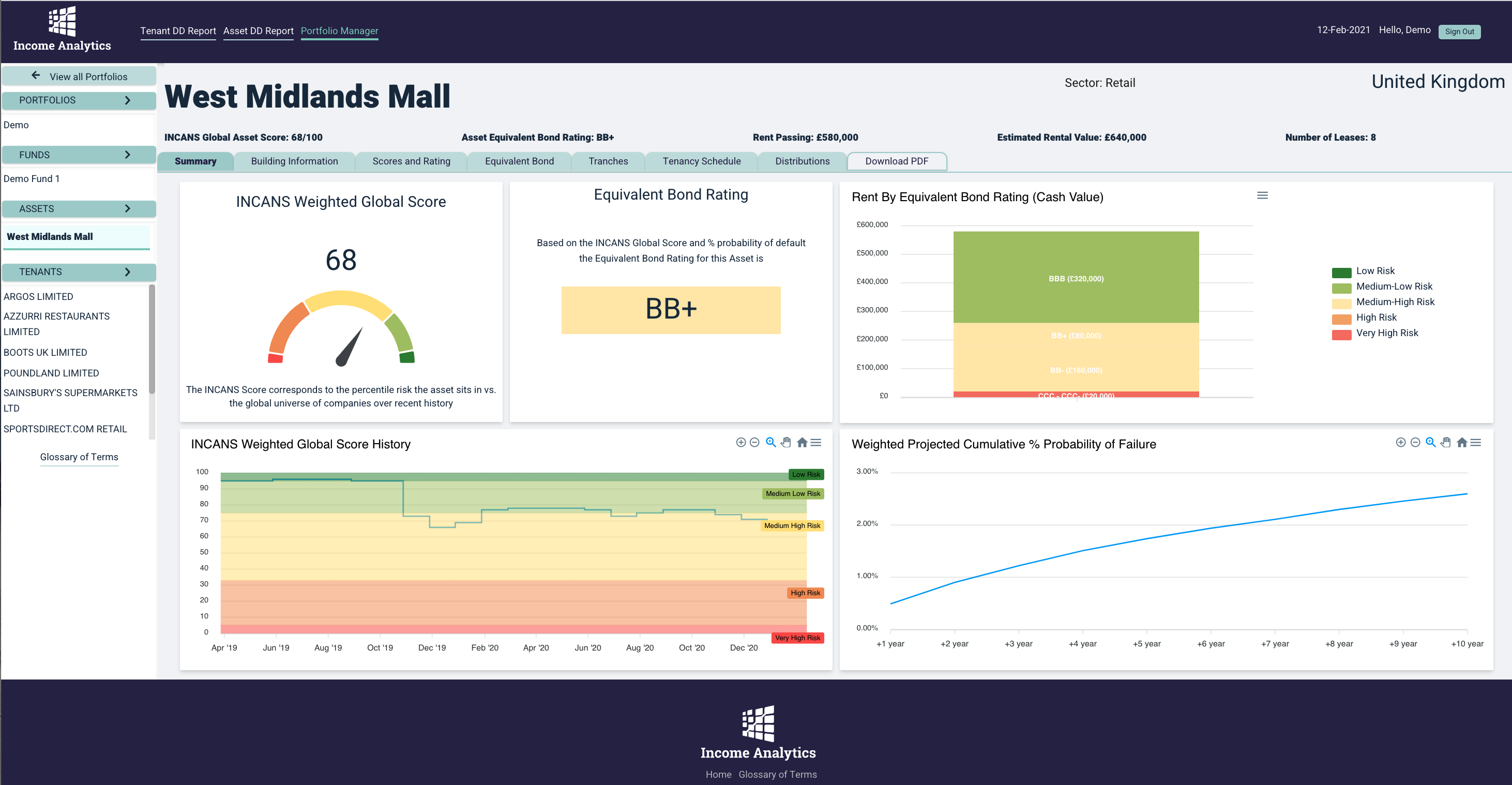

The same metrics can be also aggregated to assess and monitor the risk of rental loss at asset or fund level, as in Figure 3.

Figure 2: A case study of key tenant risk metrics for Argos Limited, February 2021

Source: Income Analytics, February 2021

Figure 3: A case study of key asset risk metrics for Demo Property, February 2021

Source: Income Analytics February 2021

Looking ahead

In a world where the demand for income is increasingly driving investment strategies, we believe that adopting a standardised measure of tenant default risk using quantifiable metrics rather than subjective labels offers significant benefits for commercial real-estate markets.

- model, price and monitor letting and investment risk more accurately

- compare the risks associated with real-estate income to those of equity and debt instruments

- increase transparency for investors and lenders

- develop multi-asset investment strategies combining equity, debt and real estate into single vehicles

- bring commercial real-estate investment markets into line with broader financial markets

- increase market liquidity.

Related competencies include: Data management, Strategic real estate consultancy