RICS-registered valuers know that residential and commercial real estate valuations are not simple – some can be straightforward, but most are challenging.

In developed markets, this may be because there is a lack of reliable direct open-market comparable evidence, or the comparable evidence is inconsistent in nature.

In less-developed markets, where real estate valuations are more aligned to costs, such information may be lacking or inconsistent. Such is the life of a professional real estate valuer.

However, these issues are trivial in comparison to having to value real estate in extreme conditions, such as close to war zones or where there have been natural catastrophes.

While the fundamental principles of real estate valuation remain unaltered, this article explores the challenges involved where valuers are required to undertake valuations in extreme conditions.

Insufficiency of uncertainty caveats

This article was inspired by an email that RICS received from a member in Jamaica following the effects of Hurricane Melissa last October, which devastated the island.

The member asked how accurate valuations can be calculated amid such devastation, especially when the majority of infrastructure has been damaged and there is no idea about when it will be fixed and by whom.

The email was discussed by the members of the Global Valuation Standards Expert Working Group (GVSEWG), whose members represent RICS and practise real estate valuation all over the world.

While the recent events in Jamaica are highly relevant, these circumstances will apply to most, if not all, similar natural disasters.

Therefore, the GVSEWG's discussion expanded from the specific issue of the Jamaican hurricane disaster to include circumstances of severe fires, flooding and war zones.

The group's consensus was that accurately valuing real estate in such locations in such circumstances is highly challenging and that it is too simplistic merely to include a standard caveat in the relevant valuation report regarding valuation uncertainty, although the insertion of appropriate uncertainty wording is recommended.

VPGA 10 of RICS Valuation – Global Standards (Red Book Global Standards) covers a number of different scenarios where a suitably worded material uncertainty clause should be inserted in a valuation report.

The use of such clauses is usually at the valuer's discretion, but RICS did issue a practice alert in 2020 in connection with the huge uncertainty caused by the COVID-19 pandemic.

Notwithstanding these events, the world moves on and for example, while war rages in eastern Ukraine and martial law has been imposed, the property markets in the other parts of the country continue to function.

So how can the challenge of valuing property in such circumstances be alleviated? Perhaps we should look to actual cases – such as the earthquakes in Christchurch, New Zealand, the devastating hurricanes in the Caribbean or the COVID-19 pandemic – where valuers needed to adjust their standard valuation protocols relative to:

- their methods

- how they assimilated and analysed evidence

- the adoption of special assumptions in their valuations

- how they interpreted any significant changes in these markets.

However, even by adopting such adjustments, it does not necessarily follow that the valuer will arrive at the correct valuation figure.

Thus, it is likely to be necessary for the valuer to consider adopting the following additional measures:

- the use of alternative valuation methodologies as cross-references

- peer review

- enhanced diligence

- flagging up the presence of contamination or hazards

- future planning assumptions on which the valuation is based, particularly in redevelopment scenarios

- specific reporting requirements from the client, which would likely incorporate one or more special assumptions, such as the valuation basis pre- or post-disaster or post-remediation, e.g. while the basis of market value does not change, it is likely that a special assumption or a series of special assumptions would be required to clarify the context of the valuation reported.

Framing uncertainty

The uncertainty concept has been around since at least the Second World War. In February 2002, the then US Defence Secretary Donald Rumsfeld summarised it as follows.

'There are known knowns; there are things we know we know. We also know that there are known unknowns; that is to say, we know there are some things we do not know. But there are also unknown unknowns – the ones we don't know we don't know'.

The uncertainty concept can be applied to real estate valuation in war zones and natural disaster areas. In such circumstances, the real estate valuer must still follow the mandatory contents of Red Book Global Standards.

However, these protocols are arguably insufficient on their own when market conditions are suspended or significantly adversely affected, and comparable open-market comparable transactions or cost information is lacking.

There is also no relevant RICS practice guidance or professional standard in this regard, nor is there an intention – at present anyway – that RICS will prepare such a document.

Given, however, that extreme events are becoming more prevalent globally, RICS should now arguably give this issue greater consideration.

Applying the knowns

As well as the obvious challenge of surveying safely in extreme conditions, in such circumstances there will almost always be a paucity of directly comparable open-market sales, lettings or cost evidence, as local market conditions are likely to have been suspended or significantly reduced in activity.

The example of the major earthquakes and associated devastation in 2012 in Christchurch is that local valuers were fully aware that the city was prone to seismic activity, and the market had accordingly taken account of this for some time before the 2012 disaster.

There are other parts of the world where similar factors exist, including the regular flooding of large parts of southern Bangladesh, hurricanes of varied ferocity in the Caribbean and tornadoes in the midwestern United States.

However, due to climate change, we are experiencing more extreme and regular catastrophic weather events, ranging from the wildfires in Australia and southern Europe, to flooding across many parts of Asia, such as the recent catastrophic flooding in Sri Lanka, Indonesia, Thailand and Malaysia, which resulted in more than 1,000 deaths and affected millions of people.

The COVID-19 pandemic falls into the category of known unknowns. While we realise – perhaps now far better – that there could be future pandemics, we don't know when or what type of pandemic there could be.

Many real estate valuers will remember that immediately following the COVID-19 pandemic, in early 2020, RICS issued advice to members regarding the inclusion of an appropriate valuation uncertainty clause as the majority of Western governments implemented severe lockdown measures, with the consequence that most of their real estate and financial markets froze.

Dilemma of unknown unknowns

Unknown unknowns are, by definition, the most difficult to deal with, as they are things that we do not know that we do not know.

It is generally accepted that we live in an uncertain world, and there is arguably greater global uncertainty at present than normal – the high gold price being a reflection of this – but valuers, like the rest of the population, do not have crystal balls into which to see the future.

Therefore, logic suggests that valuers working in all locations should give greater consideration to the likelihood of extreme events.

That does not mean that valuers should make the market – instead, they are expected to determine value from their analysis of open-market lettings and sales that have previously transacted and should always follow the market.

In addition, valuers need to give ESG factors, future building safety regulations, supply chain impact and potential changes to planning and zoning a higher degree of importance in the valuation process than perhaps they do at present.

Valuers also have a remit to report correct and accurate valuations – otherwise negligence actions can arise – and are thus obliged to consider all relevant and pertinent factors that may affect value.

This is especially considered the case when valuing real estate assets in extreme circumstances.

'Logic suggests that valuers working in all locations should give greater consideration to the likelihood of extreme events'

Critical importance of sound professional judgement

Unfortunately, the GVSEWG has no silver bullet to resolve the unique challenges faced by real estate valuers undertaking valuations in the extreme conditions referenced in this article.

According to the Red Book Global Standards, real estate valuation is not a fact, but a professional opinion based on the valuer's experience and expertise.

Therefore, when preparing valuations in areas of natural disaster or close to war zones, diligent research, the thorough compilation and detailed analysis of all relevant direct and indirect evidence that may be available and discussions with other related professionals working in the area will inevitably come to the fore.

The level of client confidence in a valuation will be determined by the degree of reliance that clients place on the valuer.

The fundamental principles of property valuation remain unaltered no matter the circumstances.

However, in all likelihood valuations undertaken in extreme circumstances will be heavily relied on and it follows that valuers must hone their professional skills in this regard and use all the tools in their valuation toolbox.

Therefore, valuers with experience of and expertise in working in such markets are most likely to produce correct and accurate valuations.

As always, the central maxim for real estate valuers is to know in detail the property markets in which you practise.

Keith Petrie is a consultant at FG Burnett

Contact Keith: Email

Related competencies include: Valuation

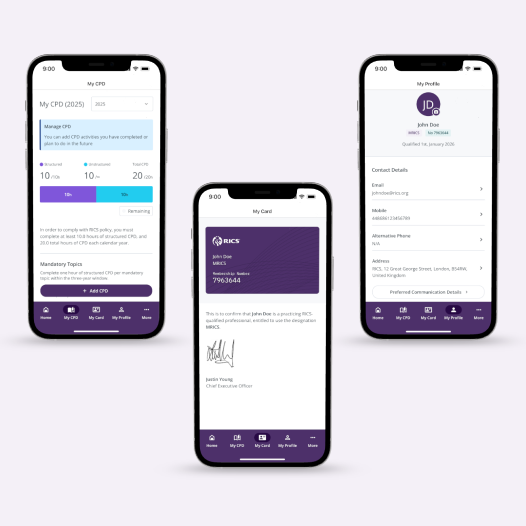

Discover the new RICS Member App: CPD on the go

RICS has introduced a refreshed CPD approach that prioritises meaningful, high-quality learning that genuinely benefits your work and is tailored to your specialism, career stage, and the real-world challenges you face.

The new app makes logging CPD simpler and more intuitive, so you can focus on the development that matters to your practice.