At the Valuation Office Agency (VOA), we regularly update the rateable values of all business and other non-domestic properties in England and Wales to reflect changes in the property market. In turn, this helps ensure that business rates are based on up-to-date information.

The VOA revalued properties every five years from 1990 to 2010, then in 2017 and 2023. Proposed reforms are looking to move the revaluation cycle to every three years.

It also helps redistribute the amount paid in business rates more fairly and ensure that bills reflect relative changes across sectors and locations.

We have recently published the valuations for 2023 before they come into effect on 1 April, with the aim of:

- helping businesses to plan

- giving ratepayers another opportunity to check the details we hold for their properties.

We encourage those with a business property to use our online service, Find a business rates valuation, to check their property details now and get an estimate of what their rates will be.

How do rateable values relate to bills?

Rateable values represent the annual rental value a property could have been let for on the open market at a certain date; in this case, 1 April 2021.

Note that a property's rateable value is not the same as its business rates bill, although local authorities do use the former to calculate the latter. This is done by multiplying the rateable value by a factor set by central government, then applying any rates relief.

Bills will also take into account any reliefs for which a property is eligible. In 2021/22, small business rates relief meant that 740,000 businesses did not pay any rates at all.

Furthermore, if the rateable value goes up it does not necessarily mean that the business rates bill will go up by the same amount.

Increased overall value reflects market changes since 2015

There are 2.14m non-domestic properties in England and Wales. Together, these have a total rateable value of £70.3bn, compared with £65.7bn in 2017. This is a 7.1% increase in total rateable values in England and Wales.

As it has been six years since the last revaluation, the new rateable values will reflect changes in rental values between 2015 and 2021. Most valuations are based on rental values, and if rents have gone up in that time then rateable values will also rise. Likewise, if rents have decreased, so will rateable values.

We do not set the market with our valuations; we reflect the rents being paid by occupiers. The economic factors influencing rents vary by property market sectors and location.

At a revaluation, it is therefore normal to see changes in rateable value differ according to property location and type. Some sectors, properties and places do better than others in the years between revaluation dates, and these differences are reflected in a revaluation.

To ensure that business rates liabilities more swiftly reflect changes in economic conditions, we are moving towards valuing properties more frequently, as the government stated in the October 2021 Business rates review. This will also mean the amounts paid will be fairer, as revaluations redistribute the overall level of business rates collected to reflect changes in relative property values.

Robust response to address pandemic impact

At each revaluation, we usually collect rental and other data over a two-year period around the valuation date. Ministers chose 1 April 2021 as the date in this instance due to the significant impact of the COVID-19 pandemic.

Market conditions on this date meant the evidence has been complex to analyse.

Nevertheless, we are confident that our valuations are robust. We had access to similar amounts of the best rental evidence – that is, evidence that more closely aligns with the statutory definition of rateable value – for this revaluation as for previous ones. And we have looked at more types of evidence than usual because of the market uncertainty caused by the pandemic.

In every sector, though, there are likely to be individual properties that buck the trend, perhaps as a result of their particular characteristics or their location relative to other properties.

RICS and business rates

The cost of business rates and their administration can be substantial, and the system is complex. RICS members play a key role across the business rates sector. They provide professional advice on establishing business rates liability and how assessments may be challenged, as well as members who work for the VOA compiling and maintaining rating lists. We also have members who work for local authorities and those who manage properties on behalf of businesses.

RICS supports the more frequent valuation policy referred to in the article and wider reform of the rating system.

Experts representing RICS and other professional bodies, including the Institute of Revenues Rating and Valuation and the Rating Surveyors' Association, make up the RICS Rating and Local Taxation Forum. The forum supports RICS on business rates matters.

Please contact Charles Golding at RICS with business rates queries related to RICS for any further information.

Value changes vary across sectors

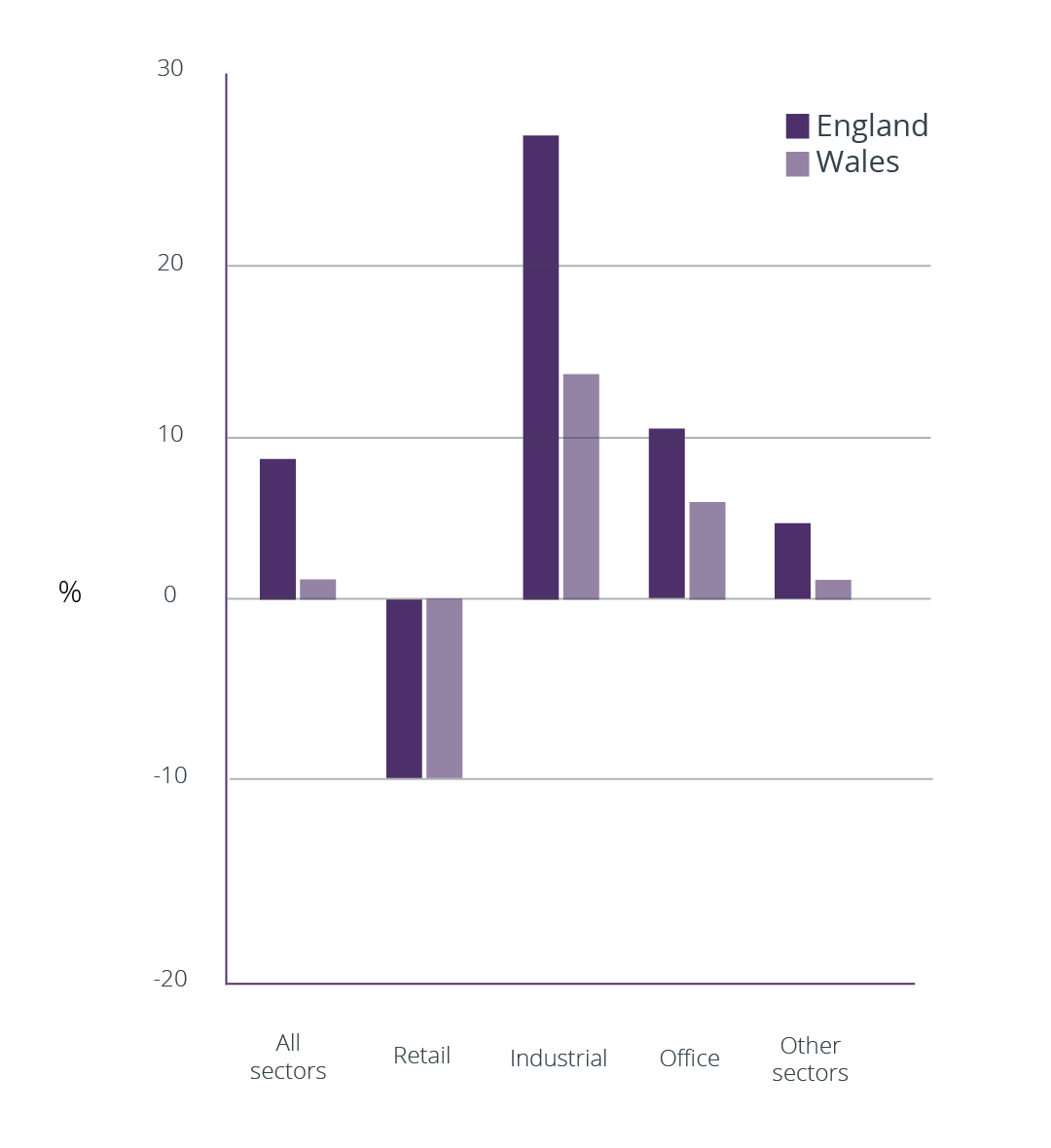

Figure 1 shows the main changes in value for 2023 by sector in England and Wales. But these headline figures only ever tell part of the story.

Figure 1: Percentage change in rateable value by sector for England and Wales Source: NDR Revaluation 2023 (draft list), published November 2022

To break this down by sector: in retail for instance, some subsectors such as shopping malls were already seeing values fall, and the pandemic continued this trend. But this is not universal across retail. There has been a general move towards shopping locally in recent years.

In the 2023 list, the total rateable value for retail is around £15bn, with around 517,000 properties. These have seen an average decrease in their rateable values of around 10%.

Meanwhile, many licensed premises and leisure properties saw growth between 2015 and 2020 – but then the pandemic also had an impact. Some of these properties will see a reduction at revaluation though others will increase. As with retail, this will depend on their location, and how much their growth between 2015 and 2020 was affected by the pandemic.

The VOA has agreed an adjustment for COVID-19 with representatives of the pub sector, and this adjustment has been applied to the valuation of each licensed premises. With around 42,000 pubs, bars, restaurants and similar property, the sector's current total rateable value is £1.3bn. Pubs have seen an average decrease in their rateable values of around 17%.

Industrial, logistics and offices see increases

Properties that are valued according to their building costs have conversely seen their rateable values increase because such costs rose substantially between 2015 and 2021.

These increases reflect higher material and transportation costs. Specialised industrial properties are among those that have been affected by this change, including steelworks, chemical plants, cement works and breweries. Other sectors valued according to their building cost are hospitals, schools, universities and some leisure centres.

Likewise, demand for logistics facilities such as warehouses has been growing for some time. Online shopping was increasing at a steep rate even before the pandemic, and has driven demand for properties in this sector.

This, along with the limited supply of such properties, has meant rents have increased significantly, and the new rateable values reflect this. In the 2023 list, the total rateable value of the sector's 1,550 properties is £2.43bn. Distribution and logistics properties have thus seen an average increase in their rateable values of around 35%.

When it comes to the office sector, London has seen the lowest increase in rateable values, with the pandemic having had a large effect. There were however higher increases in the East and South East of England, with rises in the former region resulting from increases in value along the M1–M25 corridor.

In the 2023 list, the total rateable value is £16.3bn, with around 437,000 office buildings. These have seen an average increase in rateable values of around 10%.

As well as checking your details and rates on our Find a business rates valuation service, you can consult the official statistics we publish on non-domestic rating, which give more information on the data discussed in this article.