RICS recently published the RICS Tech Partner Programme Survey 2024, which provides detailed analysis of emerging technologies, adoption trends and the main barriers to further uptake across the built and natural environment professions.

The insights are based on a survey of RICS Tech Partner Programme members. The survey asked about various aspects of their work, such as their disciplines, the asset types they deal with, their geographical location, and what stage of fundraising they are at. It also looked at trends in the adoption of data and technology last year, and what changes respondents anticipate in the future.

In addition to more than 300 responses to the survey itself, the paper's authors interviewed more than 70 tech partners to provide qualitative insights covering a wide range of practice areas for various markets.

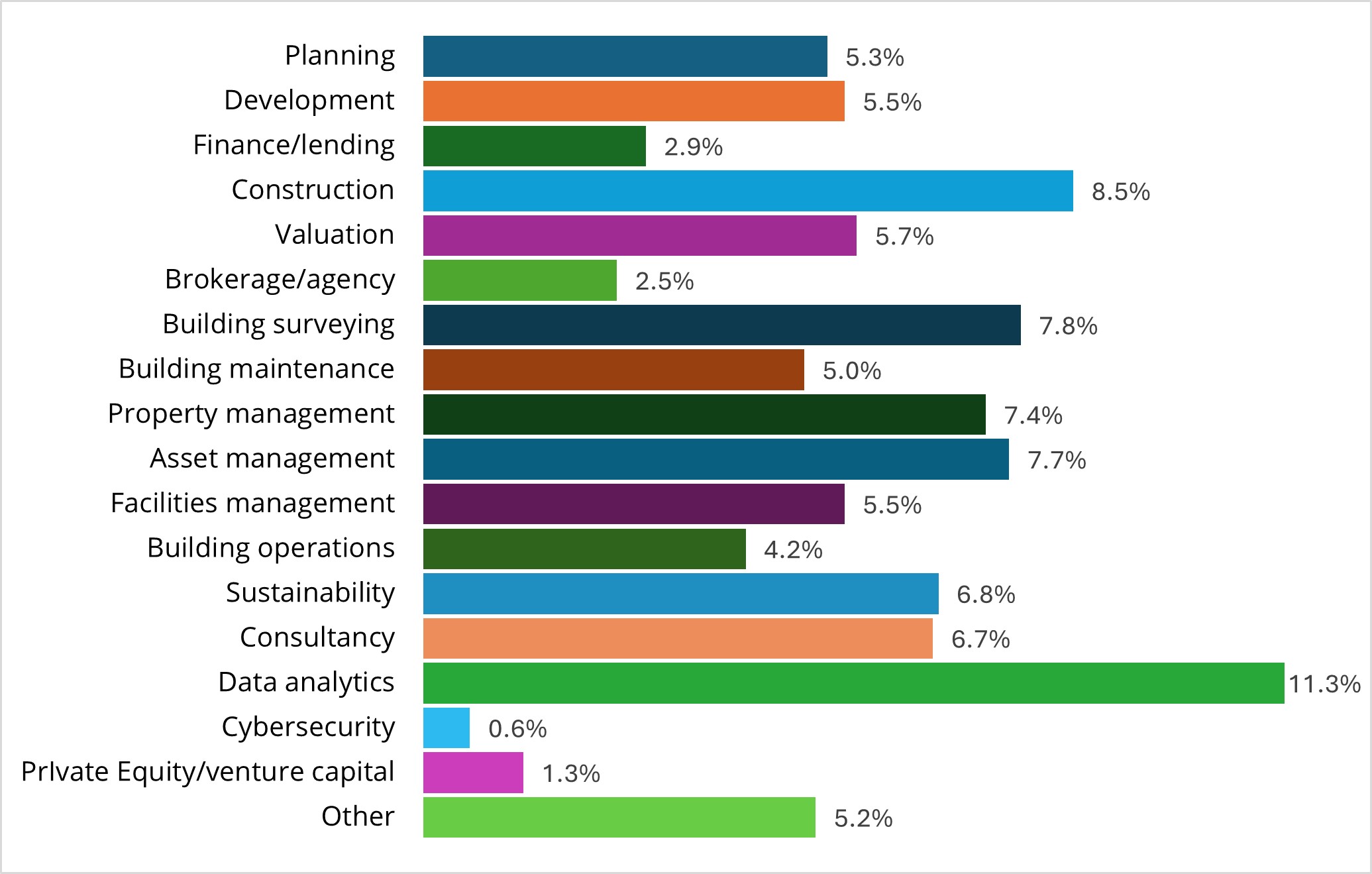

Figure 1: What sectors and practice areas are respondents active in? Source: RICS Tech Partner Programme Survey 2024

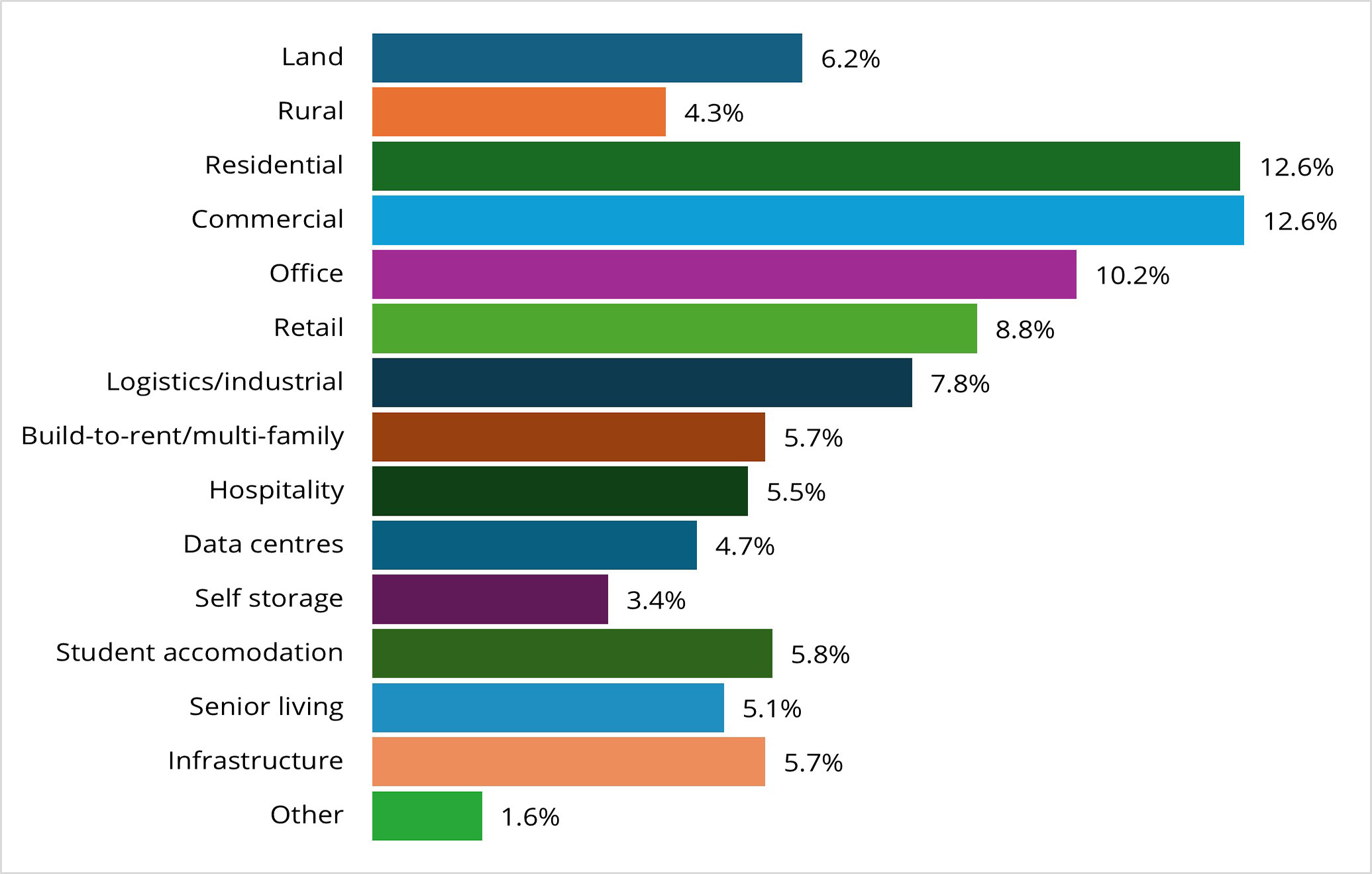

Figure 2: What asset types are respondents active across? Source: RICS Tech Partner Programme Survey 2024

Practitioners benefit from range of advances

'Many customers are seeking to use technology to drive productivity,' a tech partner commented. 'The rise of AI has opened up new interest and conversations about how technology can assist.'

Artificial intelligence (AI) is having a notable impact across a wide range of industries, including the built and natural environment sector, with machine learning, generative AI and large language models advancing the most in the last year. These technologies have a wide range of applications. For example:

- machine learning can be used to forecast trends around property values

- generative AI can be used to quickly automate valuation reports

- large language models can be used to summarise and extract information from property documents.

Some 73% of RICS tech partners say they are now using AI as part of their services as follows.

- Machine learning: referring to the ability for machines to learn from data to make predictions, this technology is regularly used in automated valuation models. Using historical property data, the model trains itself to recognise patterns and relationships between multiple variables to predict how they will affect the value of a property.

- Natural language processing: this describes machines' ability to understand human language, both spoken and written.

- Generative models: the ability for machines to take inputs, such as text, video, images and audio, and use them to generate new content could for example be used to automate property designs by generating architectural layouts, based on given parameters such as plot size, number of rooms and local building regulations.

- Computer vision: AI's ability to derive information from inputs such as image and audio is often used in internet-of-things devices, such as sensors that monitor vehicle traffic flow, or in counting employees in an office at any given time.

It is predicted that AI will continue to inspire innovation throughout this year, transforming traditional practices and enhancing efficiency.

Examples of AI use by RICS tech partners include services provided by VU.CITY and Alice Technologies.

The former uses generative AI in city planning, by providing a generative design tool that reduces site and design feasibility risks. Its tool provides stakeholders with 3D visualisations and data-derived insights so they can better understand the impact of urban development.

Alice Technologies, meanwhile, supports construction project management with AI-powered systems. Its platform uses AI algorithms and machine learning to simulate potential project execution scenarios, enabling dynamic scheduling, resource optimisation and risk mitigation.

Support needed to keep pace with AI-related innovation

Respondents predict AI to be the primary factor in innovation in property professions this year, which has major implications for RICS, our members and the surveying profession more widely.

According to the survey respondents, these implications include more accurate and timely decision-making by surveyors and the optimisation of project planning and resource allocation.

AI tools will also support sustainability in the built environment, construction, land and property sectors by improving energy efficiency, reducing waste and minimising embodied and operational carbon.

However, as AI adoption increases, establishing professional regulatory frameworks and guidance will be crucial to ensure its responsible and ethical use, and to address concerns about data security and privacy.

RICS members will also need to develop new skills and knowledge. Training on any new technology can seem daunting, but surveyors can focus on understanding how to work with AI to make best use of its capabilities.

This could include automating tasks, analysing large datasets or predicting and forecasting trends. In addition, understanding regulations such as the GDPR is crucial when AI uses data that includes personal information.

A respondent commented: 'AI should not be viewed as a threat to current jobs, but instead as a tool for automating mundane tasks to allow surveyors to focus on higher-value activities.'

For example, building surveyors could automate tasks such as measuring building dimensions or checking compliance with regulations, freeing up their time to focus on complex site assessments and client consultation.

Digitalisation helps progress on sustainability

'The regulatory requirements surrounding ESG will continue to be the main driver of digitalisation in the real-estate sector in 2024,' a tech partner commented.

As green technologies become more widely adopted, they will play a significant role in achieving sustainability goals, with many firms using them to help implement the current edition of RICS' Whole life carbon assessment for the built environment.

With growing regulatory pressures around ESG and sustainability, the demand for organisations to improve the quality of their data is increasing.

Generally, bad data will result in a bad output even if the technology itself is advanced. Therefore sustainability agendas are encouraging organisations to take a step back and create a foundation of good data.

RICS tech partner Firstplanit provides an example of how AI can be used to aid sustainability. Firstplanit supports its ESG strategy in planning and development by providing a platform that allows users to compare sustainable materials and products, assess the environmental risks of a location and map decisions to green targets.

In construction, RICS tech partner Qualis Flow uses AI to automate material tracking and predict regulatory exceedances. This ensures that construction projects meet their sustainability, compliance and carbon-reporting goals.

From a materials science perspective, technological approaches such as self-healing concrete can reduce embodied and operational carbon.

By adding self-healing agents into concrete, cracks can be repaired, not only enhancing structural durability but also decreasing the need for repair and replacement over an asset's life cycle. In turn, this significantly reduces costs and improves sustainability.

'With growing regulatory pressures around ESG and sustainability, the demand for organisations to improve the quality of their data is increasing'

Initial costs distract from potential savings

Survey respondents were asked what have been the main barriers to the adoption of data and technology across the built and natural environment during 2023. One notable answer referred to a lack of understanding of the value of tech, a lack of vision, short-term thinking and high set-up costs.

According to a survey respondent, the high initial costs for implementation sometimes deter organisations from adopting new technology, and this is even more prominent in smaller businesses with limited budgets.

Investments in infrastructure, software licences, staff training and ongoing maintenance are seen as barriers when there is no clear short-term return on investment.

However, the opportunity to lower costs is at the same time seen as a significant incentive for adopting new technologies. Over time, streamlined processes, improved productivity and better decision-making result in financial savings and increased profitability.

A common observation by respondents, however, was the need for firms and organisations to identify business issues first and then select the appropriate technology to deal with these.

'The cost of data-driven technologies has been steadily decreasing, making them more accessible to a wider range of organisations in the built environment sector,' said a tech partner. 'This is encouraging the adoption of these tools, particularly among smaller businesses and municipalities that may have been hesitant in the past due to perceived cost barriers.'

Despite the initial set-up costs, our findings suggest that the price of technologies are decreasing as adoption increases. This trend indicates a shift towards greater affordability and accessibility of technologies, leading to broader adoption and innovation across the sector.

By contrast, while mainstream construction material costs may be relatively affordable, they are not sustainable. With 11% of carbon emissions coming from building materials and construction, the industry needs more sustainable products.

Culture critical to encouraging adoption

Survey respondents were asked what will be the main barriers to the adoption of data and technology across the built and natural environment in 2024. Resistance to change was identified as a significant issue.

The built and natural environment sector is seen by many as having a conservative culture, with inertia and tradition often preventing the adoption of technology.

There is also a fear of making the wrong decision – which is understandable, given the potential risk and experiences of failed technology adoption projects in the past.

Organisations regularly implement advanced technologies and find that they did not turn out as expected. This is frequently because either the technology wasn't best suited or the baseline data was of poor quality.

Instead, organisations need to take a step back and address the problem first before investing in technology; in many cases there is a simple solution for a simple problem.

Even within organisations, there can be issues around slow decision-making and a lack of understanding of technology.

In addition, large organisations can be disjointed: staff don't collaborate as best they should and data is often in silos. How can decisions around tech adoption then be made if organisations are slow to make even simple decisions?

The surveying sector also needs to encourage more collaboration and innovation, and address long-standing issues with data quality, transparency and standardisation.

In this changing business landscape, there is a greater need for real-estate companies to take a look at their strategies. To support this, a chief technology officer (CTO) can manage technical operations in an organisation to enhance business operations and promote innovation.

The main responsibilities of a CTO include:

- developing and implementing their company's technology strategy

- overseeing the development of new products and services

- ensuring that implemented technology aligns with company goals

- creating policies around technology infrastructure

- building quality assurance and data protection processes.

Compared with the previous survey, more respondents recognised the role that organisational culture and leadership attitudes play in adopting technology.

This suggests that a top-down approach is essential, where leaders create an environment that encourages innovation and adaptability.

'The surveying sector needs to encourage more collaboration and innovation, and address long-standing issues with data quality, transparency and standardisation'

Proactive engagement will let tech fulfil potential

The built and natural environment sector continues to digitalise, with generative AI and related advances destined to improve efficiency, sustainability and innovation.

RICS and the surveying profession must exploit these advances and the opportunities they present while at the same time managing and understanding the risks they may entail.

Overcoming the barriers to and understanding the value of adopting new technology will help to navigate this transforming landscape.