Official estimates now suggest the UK economy fell into a technical recession – defined as two consecutive quarters of falling output – during the second half of last year.

Placing substantial stress on households' finances, consumer price growth averaged 7.4% in 2023, with intense inflationary pressures prompting considerable tightening in monetary policy from the Bank of England.

Given the significance of this, it is somewhat surprising that consumer spending managed to avoid an outright contraction, although the meagre 0.3% rise over the past 12 months represents the softest annual increase since 2011; excluding the sudden drop during the first year of the pandemic.

Although the UK economy's overall momentum was at best sluggish last year, the mild recession that occurred could still be classified as a relatively soft landing given the steepest rise in policy interest rates set by the Bank of England over a two-year period since the late 1990s.

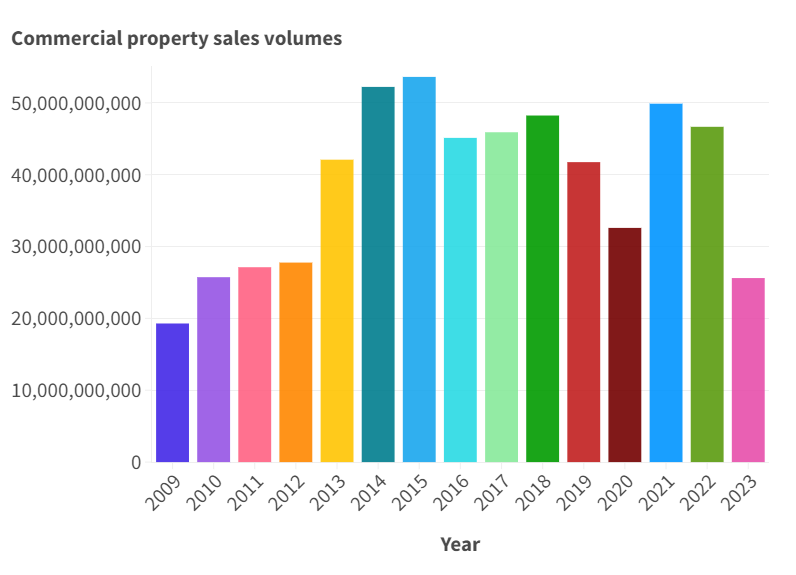

This – arguably – resilient picture was, nonetheless, not mirrored across commercial property markets. Data from CoStar shows total volumes came in at £26bn during 2023, the weakest annual trend since 2009 and down around 46% compared to 2022.

Figure 1: UK commercial property sales volumes. Source: CoStar

This dreary outcome was not unique to the UK of course, with rising interest rates in many parts of the world placing strain on commercial real-estate markets. In the US, for instance, commercial property investment levels sunk 56% year on year in 2023.

UK market decline universal in 2023

Turning attention back to the UK, all three mainstream sectors of the commercial property market suffered steep declines in buyer activity compared to 2022. Retail volumes were down by around 30%, while office and industrial investment both slumped by around 50%.

Alongside the drop-off in activity levels, capital values also fell noticeably in 2023, with month-on-month declines being recorded throughout the entirety of the second half of last year – slipping by a total of 3.5% across all sectors.

This brought the cumulative decline in headline values since mid-2022 to 22%, according to CBRE. That said, not all mainstream sectors saw valuations retreat further during 2023, with the industrial sector posting a small recovery of 1.4%. However, this followed what had been a sharp fall of 21% during 2022.

Meanwhile, across the retail sector in aggregate, capital values slipped by a further 4.2% last year, extending on a decline of 8% registered the year before.

The largest decline in values, however, came in the office sector, which chalked up an 11.5% drop over 2023 following a 12% decline back in 2022.

These unquestionably weak trends are also reflected in the share prices of many real-estate investment trusts, with British Land and Land Securities down by a respective 30% and 15% compared to the start of 2022.

Easing inflation could prompt retail and logistics investment

On a slightly brighter note, there are a few reasons to take a modestly upbeat view of the market. For one, barring any major surprises, base interest rates peaked a short while ago at 5.25%, with the Bank of England's Monetary Policy Committee voting to keep policy on hold at the past several meetings.

This is because inflation is now widely expected to fall back in line with the 2% target over the coming months. Crucially, hitting the inflation target for the first time in three years would offer scope for interest rate cuts to begin in the second half of the year.

This narrative has already been priced in across financial markets, meaning the lending environment is by now a little less restrictive than throughout much of last year.

Just as importantly, more moderate inflation should ease the burden on household budgets, which could in turn support a recovery in retail spending. Such developments would then provide a better backdrop for the retail sector and could also prompt renewed momentum in demand for logistics or distribution centres.

In keeping with this notion, although views remain mixed, the largest share of respondents to the latest RICS UK Commercial Property Monitor – 33% – now sense the market has reached the bottom of the current cycle.

Admittedly, the outlook for the economy remains subdued in the near term, with consensus forecasts for GDP to rise by just 0.5% in 2024: the ten-year average sits at closer to 1.6%.

That said, 2025 is anticipated to see a more meaningful acceleration in economic growth, back towards the historical trend, and this should be accompanied by a continued positive shift in demand for commercial real estate.

Modest recovery predicted though impact will vary

For now though, the broad assessment for the coming year is that total commercial real-estate investment volumes should recover modestly compared to last year, although with this coming from such a low base, buyer activity will likely remain subdued when viewed in a longer-term context.

Meanwhile, headline capital values – while potentially coming under some further downward pressure over the first half of this year – should then stabilise towards the end of 2024.

Indeed, the net balance for 12-month capital value expectations, again taken from the RICS UK Commercial Property Monitor, stands at just –7% across all sectors. This reading should be interpreted as respondents envisaging a virtually flat outturn for the year to come.

Of course, not all portions of the market exhibit the same prognosis for the year ahead. With the industrial sector still displaying solid occupier fundamentals – even if tenant demand is unlikely to regain quite the same exuberance of previous years – this should provide a firm foundation for a recovery in buyer activity.

Indeed, industrial rental growth is running at an annual pace in excess of 5%, signalling that the sector continues to display strong income-producing potential for landlords.

Meanwhile, although the office and retail sectors have also posted positive rental growth over the past 12 months – 2% for the former and 1% across the latter – the underlying picture is a bit more complicated.

For one, rising incentive levels across both – as reported continuously by RICS members in recent years – are masking trends in headline rental indices, at least to a certain degree.

Moreover, there remains a huge divide between the so-called prime portions of these sectors and the secondary ones. At the prime end, occupier demand is generally holding up well. Knight Frank research for instance shows nearly 85% of office take-up last year was accounted for by new or grade-A space.

Conversely, both secondary office and retail properties continue to see rising vacancy rates amid the ongoing challenges presented by the shift towards remote working and online shopping. As such, RICS members in aggregate anticipate further falls in rents, and capital values, across these types of property.

Therefore, even though the general market is likely to begin to recover slowly as cyclical macroeconomic pressures ease, there will remain significant structural weakness in certain sectors for the foreseeable future.

'Total commercial real-estate investment volumes should recover modestly compared to last year'