The logistics sector is experiencing a renaissance. The sector's growth, which is related to an increasing population and changes in consumer patterns, requires additional land and premises. However the sector is being overlooked in terms of policy from both an economic and planning perspective. Without the necessary support, operators in the sector – including retailers, parcel couriers and third-party logistics suppliers – will not be able to position themselves in the most efficient locations or help create the sustainable communities that the National Planning Policy Framework supports.

Key to this sustainability is acknowledging and understanding logistics' relationship with housing. As the country's population increases and our housing requirement grows, there is a direct effect on the demand for logistics and the real estate it requires. When government, whether national or local, plans for new homes it should also be considering the demands these place on logistics.

In March 2019, the Industrial Committee of the British Property Federation (BPF) published research by Turley exploring the relationship between homes and warehousing, What Warehousing Where? It aimed to clarify the fundamental link between homes and warehousing, and raise the profile of logistics with government at the level of the national, the subnational – planning authorities, combined authorities and local enterprise partnerships – and the local. The hope is that this will stimulate the necessary economic and planning policy to support the logistics sector in creating sustainable places.

- why: understanding the nature of modern logistics and the demand for it

- what: identifying the necessary ratio of homes to logistics

- where: location planning

- how: examples of effective planning for homes and warehouses.

The why

The logistics sector is experiencing unprecedented change. Employment growth in warehousing is forecast to exceed the national average, and its productivity measured as gross value added is projected to grow by 83% by 2035.

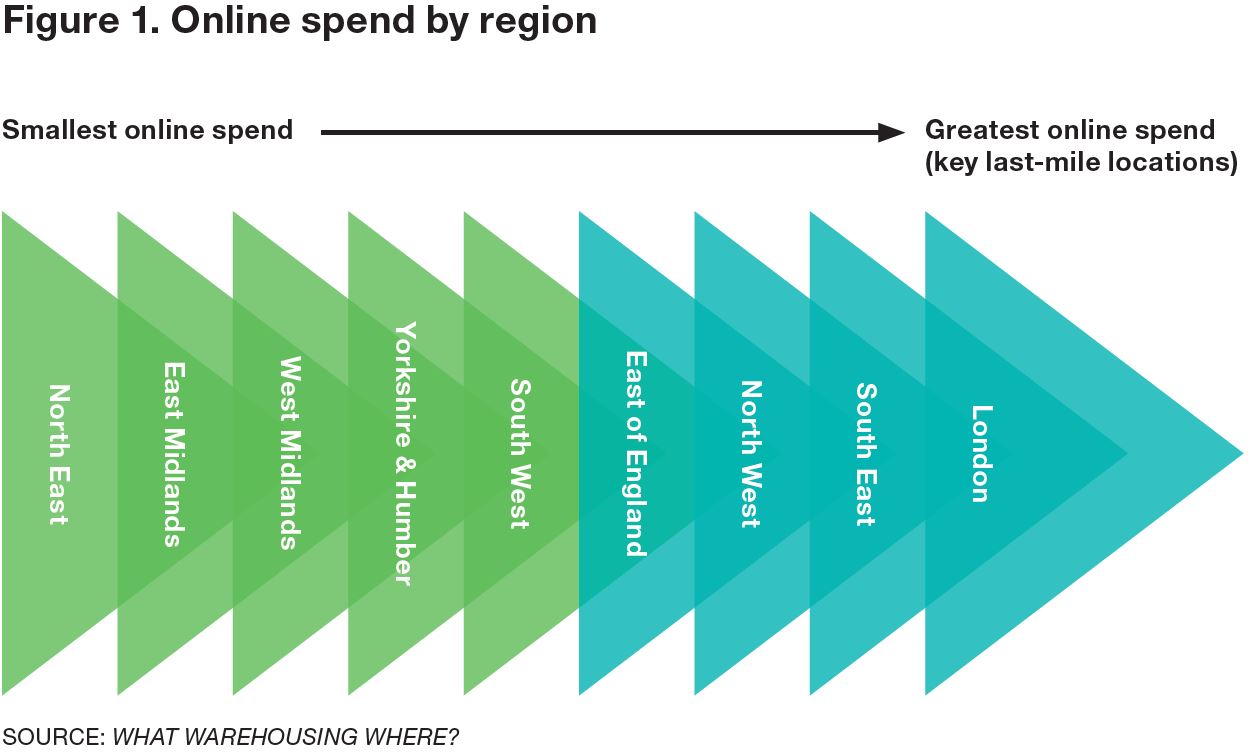

Much of the sector's growth and transformation is prompted by consumers' relationship with retail. While in-store retail will remain dominant, the growth in online retail is leading to changes. For example Ocado, the technology-led online grocery retailer, is recording double-digit year-on-year growth. Online expenditure has particular geographical trends (see Figure 1) with London, the South East, the North West and East of England having the greatest current and projected online spend.

"Much of the sector's growth and transformation is prompted by consumers' relationship with retail"

The logistics sector is metamorphosing, providing new types of logistics to meet the changing needs of the retail and other sectors. This in turn requires new types of site and location.

The what

To assert the connection between homes as a proxy for people, and warehouses, the land component of logistics, the relationship between the two needs to be quantified. The current average ratio of warehouse floorspace to homes is 6.4m2 (69 sq. ft) per home. However this figure is neither universal nor static.

It changes by location, from more than 9.3m2 (100 sq. ft) per home in locations with a national logistics focus, to less than 4.2m2 (45 sq. ft) in areas where the focus is predominantly on local logistics. The ratio also changes with time, and has risen by 1.5% over the past 6 years, coinciding with a rise in online retail sales.

Application of the ratio to the governments' target of 300,000 new homes annually in England means 1.9 million m2 (20m sq. ft) of additional logistics floorspace would be needed a year to serve these homes. In providing this floorspace across the country, a location's current and emerging role in the national logistics network would need to be reflected.

The where

How are decisions made as to the placement of new warehousing space?

- the locational requirements for different elements of the fulfilment response

- the location of population as both a driver of market demand and source of labour.

It is therefore not only the scale of housing growth being planned across the country but also its location that will influence the logistics response and, in turn, where it is placed.

- are positioned in the centre or along the spine of the country

- have direct access to the national transport network

- are in close proximity to labour

- have a large power supply.

For example, Magna Park at Lutterworth in Leicestershire, developed and managed by Gazeley, is located in the so-called golden triangle between the M1, M6 and M69 and covers 220ha. Companies across its 850,000m2 (9.1m sq. ft) of occupied space include Asda, BT, DHL and Britvic.

Regional distribution centres are more common among food and traditional high-street retailers and therefore tend to align with established logistics networks. For example, Logistics North at Bolton, developed and managed by Harworth Group, is located between the M61, M62 and M60 in Greater Manchester, lying within a two-hour drive of 20m people and 60% of the UK's businesses. Tenants include Amazon Aldi and Lidl, as well as third-party retail logistics supplier Whistl.

- concentration of population

- trends in online spend

- labour force characteristics

- sustainable access and transport.

For example, the white goods and technology comparison retailer AO.com operates 17 last-mile facilities or outbases, each within 4.5 hours drive of its national distribution centre at Crewe. Outbases are chosen for their proximity to markets and labour forces.

The ability of logistics developers and operators to find appropriate sites can, however, be limited by a lack of sites suitable for development and stock of premises, often as a result of the planning system or land designations such as green belt, which tends to be near centres of population. This results in longer travel distances, reducing companies' ability to meet customer delivery demands, while increasing costs and carbon emissions.

"The ability of logistics developers and operators to find appropriate sites can, however, be limited"

The how

Creating a supportive policy environment is essential if the nation's logistics companies are to continue to respond to business and consumer needs.

- Whetstone Pastures Garden Village at Blaby Leicestershire aims to provide 3500 homes and 4m sq. ft of logistics space that will create 5000 jobs.

- Magna Park at Harborough also in Leicestershire is focusing on sustainable communities by providing homes for the parks employees.

- The draft New London Plan proposes a policy for no net loss of industrial floorspace, which would be achieved by an intensification and co-location of uses.

- A number of so-called logistics hotels in Paris integrate rail-connected facilities into metropolitan areas and are focused on last-mile deliveries. Logistics is considered as an infrastructure requirement for all new homes in the city in the same way as schools and healthcare.

Recommendations

To enable the provision of more than 1.9 million m2 (20.6m sq. ft) of additional warehouse floorspace a year and support the creation of sustainable communities, new thinking will be required.

- National government should provide strategic policy support, among other things, recognising the role of the logistics sector in the UK Industrial Strategy and updating planning practice guidance in line with this to provide an effective steer to plan-makers at the local level.

- Subnational government should plan effectively for logistics provision through evidence-based strategic and site-specific plan-making for all new settlements and town centres.

- The private sector should proactively engage in policy consultation public-sector relationships and collaborative working.

Meeting these objectives would improve developers' ability to support the needs of logistics operators, retailers and other businesses, and be a central part of the sustainable growth of the country's communities and economy.

Amy Gilham is head of logistics and director of economics at Turley amy.gilham@turley.co.uk

Related competencies include: Planning and development management