These days, works of art regularly sell for more than a million dollars at auction but it hasn’t always been so. Once upon a time, this was a record-breaking amount to pay for a painting.

That million-dollar barrier was first smashed in 1961 by Aristotle with a Bust of Homer by Rembrandt, which realised $2.3m at auction. It was bought by New York’s Metropolitan Museum of Art and the only reason it’s not the first million-pound painting too is because of the pound-to-dollar exchange rate in 1961 (when £1 would get you $2.80).

The first work of art to sell for more than a million pounds at auction was Portrait of Juan de Pareja by Diego Velázquez, also bought by New York’s Metropolitan Museum of Art, for $5.5m (£2.3m) in 1970. And the record for most expensive painting ever sold at auction stands at an eyewatering $450m, paid in 2017 for Leonardo da Vinci’s Salvator Mundi.

Now million-dollar sales at auction are common enough to warrant being collectively labelled the ‘high-end’ art market. That market is the subject of two reports by the auction house Sotheby’s, which has compiled data on $1m+ art sales from its own auctions along with Christie’s and Phillips.

Modus has picked out the highlights from those reports, alongside expert member commentary from Elin Lake-Ewald FRICS, president of O’Toole Ewald Art Associates and Alvah Beander FRICS, president of Melanin Art Appraisals.

What’s the value of the $1m+ art market?

The $1m+ art market grew to a five-year high in 2022, with global sales of $8.15bn from 1,352 lots sold. As you might expect, there was a big dip in 2020 when the pandemic struck but the market has recovered strongly.

As a percentage of actual lots sold, $1m+ art work only account for around 4%. But in terms of sales value, they account for nearly 78%.

Which artists are collectors spending $1m+ on?

The first table below shows what Sotheby’s has called its ‘power ranking’, which is the artist’s influence in the market today, based on the most recent full year it has complete data for (the second half of 2022 and first half of 2023).

That influence is measured by five factors: total value of $1m+ lots sold; number of $1m+ lots sold; average price of $1m+ lots sold; performance of $1m+ lots, based on their hammer price against pre-sale low estimates; percentage change in sales value and lots sold for $1m+ lots.

This creates a very different looking top 20 to the table that follows, which is purely based on the value of sales by artists between 2018 and the first half of 2023. That table is led by Pablo Picasso and Claude Monet, titans of the art world whose vast back catalogue of paintings consistently sell for millions.

While the table above shows the artists that are currently hot property for art collectors, the table below is a more matter-of-fact list of which artists work have made the most at auction over a five-year period.

As Lake-Ewald points out, tastes change over time and so do the current favoured artists. “Every school of art that passes through history has a large group of favourites to whom collectors flock, but if you look back at that school from a viewpoint of 25 or 50 or 100 years later, perhaps only three or four names will be known to the world anymore,” she says.

“Popularity does not endure, and today that is a thousand time more true. My partner left behind lots of copies of prestigious art magazines that go back as far as the 1930s and occasionally I go through them to see which highly touted artists [of the time] are still remembered today. Picasso and Miro yes, 90% of the rest – no.”

Beander says most of her clients are motivated by personal preference and owning appreciable assets: “They buy art they connect to, but they strongly consider the investment value of the artwork. Both factors play a significant role in their decision-making process.”

Andy Warhol, who sits at fourth in the table above, once said: “Being good in business is the most fascinating kind of art. Making money is art and working is art and good business is the best art.”

How dominant are paintings as the most popular medium in the art market?

Paintings aren’t the only way to express yourself artistically, but they do outsell every other medium combined. The data below shows that, of the 3,002 contemporary (artist born since 1930) works sold for more than $1m between 2018 and 2022, 82.4% were paintings. Their value was $12bn out of a total of $13.6bn.

Annual change in the value of art sales globally 2009-2022

The table below shows two very noticeable dips and recoveries in the art market – the global recession of 2008-2009 and the pandemic in 2020. In both instances, the value of art sales bounced back strongly.

“The global recession in 2008 seemed to have been more of a shock to the market than the effects of the pandemic, which was expected,” says Lake-Ewald.

However, Beander takes a different stance on this point. “The global recession in 2009 was a financial crisis that affected various markets, including art,” she says. “However, the recession's impact on the art market was limited in duration, and there were no restrictive mandates. The pandemic in 2020 created disruptions across the global economy, and caused art fairs to be cancelled, galleries to close, and auctions to be postponed or moved online. The disruption affected the entire art industry, artists, galleries, collectors, and auction houses.”

Of the market’s growth between 2021 and 2022, the Sotheby’s report says “Global art sales increased by 3% year-on-year to an estimated $67.8 billion, bringing the market higher than its pre-pandemic level in 2019.

“After a strong recovery in sales of 31% in 2021 from the pandemic-induced low point the previous year, results were more mixed in 2022, with variations in performance by sector, region, and price segments resulting in more muted growth.”

As Lake-Ewald points out, this article might look quite different if we were able to include private art sales too: “There are extraordinary prices paid privately for certain rare and highly valuable works of art. The truth is that some of the highest prices paid for art will never be publicly known.”

Popularity with different age demographics

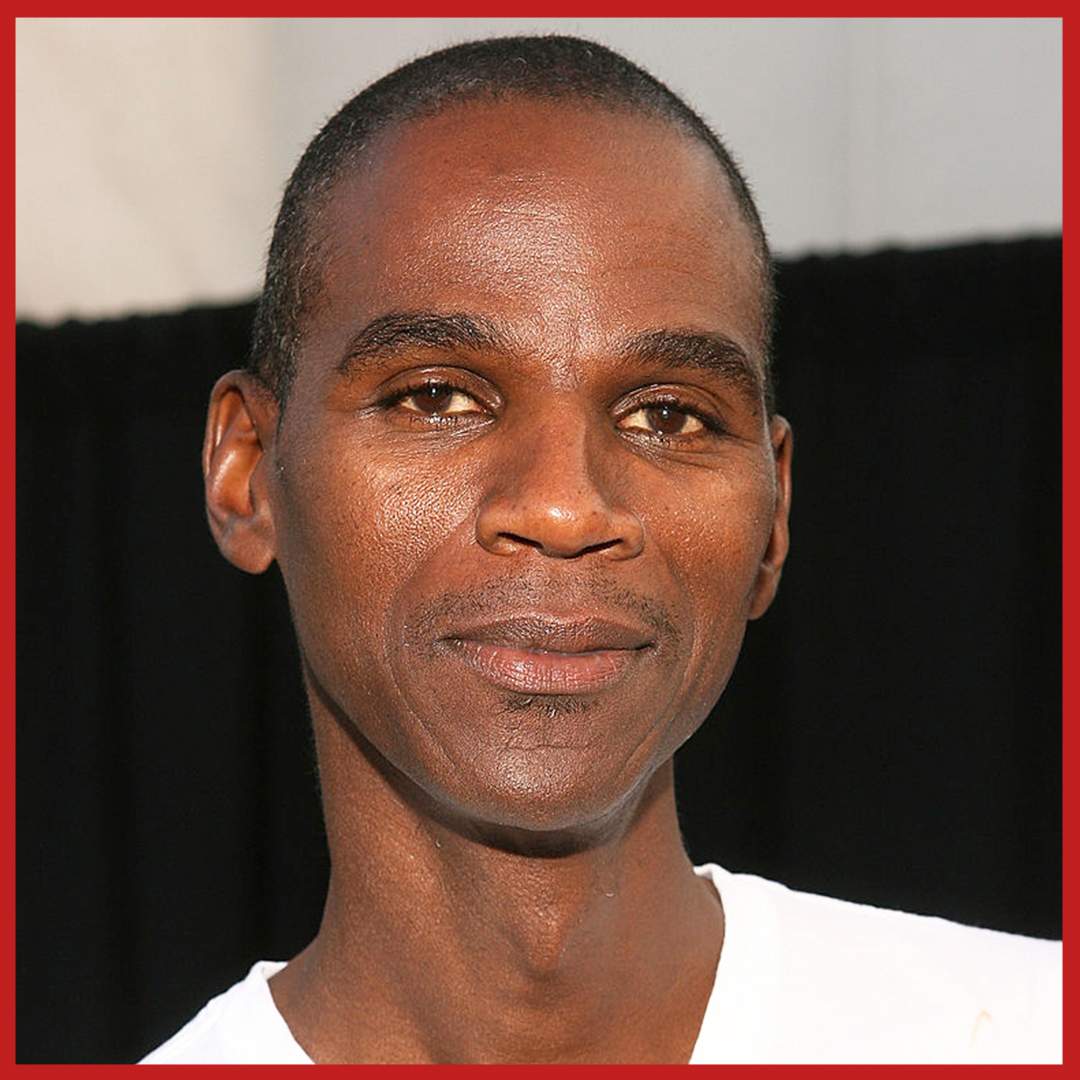

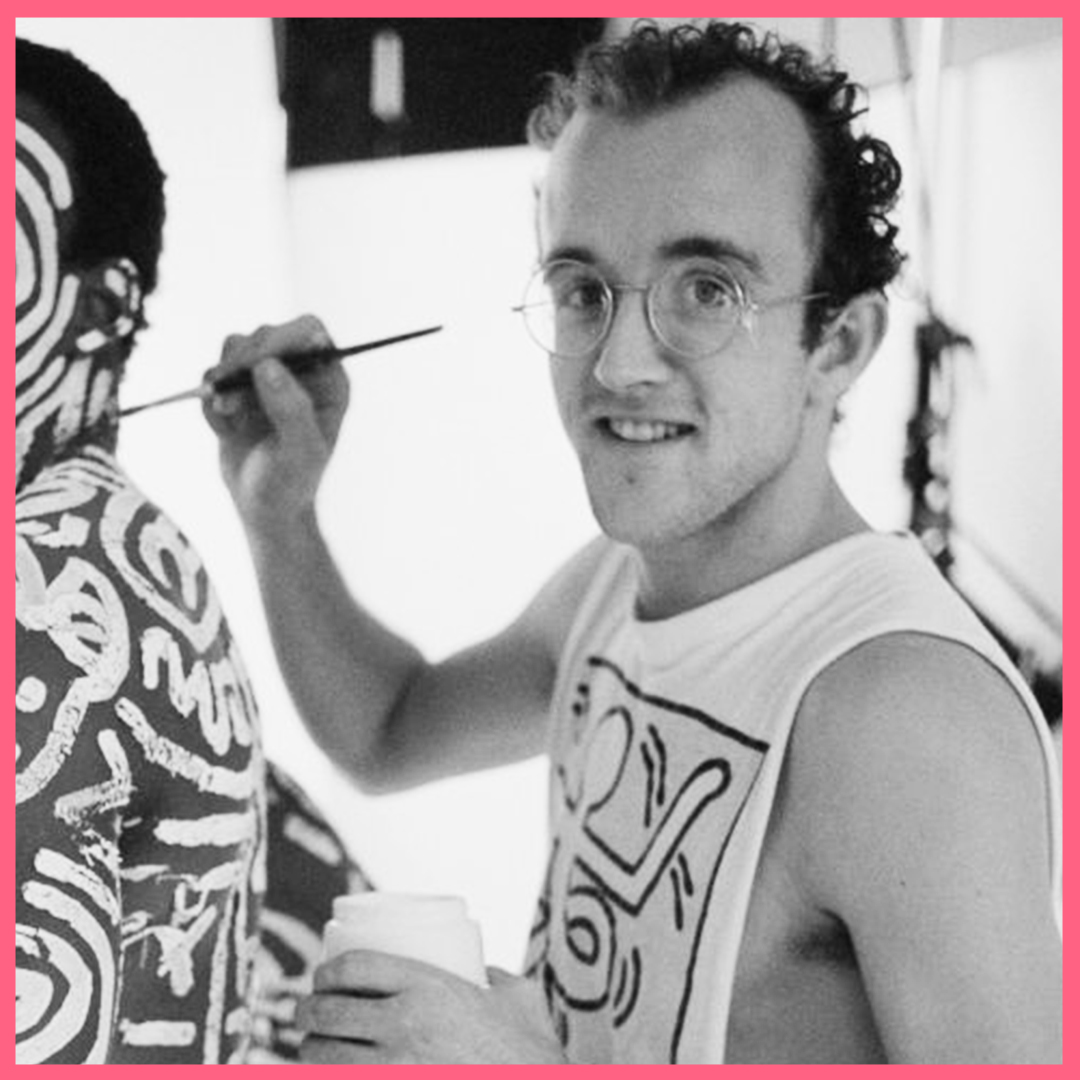

Images: Henry Moore, Mark Bradford, Keith Haring, Kaws courtesy of Getty. Zao Wou-Ki courtesy of Thierry Ehrmann, Flickr.

The popularity of different artists among different demographics of bidders can be partly attributed to taste, but Lake-Ewald says it also a question of the current art market bearing a resemblance to the stock market.

“A hundred years ago collectors were far more serious and involved in their collecting,” says Lake-Ewald. “The art market currently reflects the stock market, its method of buying and selling in the same way, and holding when waiting for a big jump in the near future.

“One might live with a Raphael for a lifetime, but today might not feel the same way about KAWS. We no longer look for a lifetime of love when it comes to the arts. We want to be entertained, and that does not mean staring at a painting for long period at a time.”

Beander says it’s not out of the question that NFTs (non-fungible tokens), the digital assets whose rise in value was as quick as its fall, could make a comeback. “The millennials and the age demographics following will be comfortable with the NFT concept,” says Beander. “The art market is diverse and dynamic, and collectors have different preferences and perspectives on what constitutes valuable art. Based on available data and analysis, the increase of NFTs will be in the forecast.”