The wave of COVID-19 sweeping India in 2021 has disrupted every industry and every walk of life. Real estate is no exception, with construction hit hard by lockdown and a lack of labour.

However, after India’s economy suffered its worst ever contraction of 7.3% for the 2020 to 2021 financial year, it was construction that played a big part in its recovery, when it grew by 1.6% from January to March this year. Once the infection rate is under control, construction seems set to resume that role.

International investors have sustained their interest in Indian real estate despite the pandemic and are still striking deals. The first destination for foreign capital in India was commercial space. Historically, one of the factors putting investors off any sector was the disjointed nature of title on buildings, where ownership had often been divided among multiple owners, requiring collective decision making to push through a sale.

One solution to this is to buy a newly developed office project from a single prominent developer. It also puts large amounts of money to work in stable, cash-yielding assets. Between 2018 and 2020, 55% of total property inflows in India went into office space, according to Colliers, with institutional investors taking up the 35m ft2 average annual supply in India’s ‘big six’ cities: Bengaluru, Chennai, Delhi’s broad National Capital Region (NCR), Hyderabad, Mumbai and Pune.

In these cities and many others, international investors are now looking beyond offices as their presence in India matures. Industrial and logistics sectors are garnering “maximum attention” from investors, says Siddhart Goel, senior director and head of research at Colliers in India. Similar interest should return to offices once the COVID-19 pandemic passes. For investors looking long term though, the “underserved” market for mid-range and affordable housing and other asset classes such as hotels and rental housing for students and young professionals moving to cities should benefit from strong domestic demand, Goel adds.

While India is unlikely to become a market for huge third-party data centres serving other nations, Goel notes that the requirement for locally generated data to be stored inside India creates a massive homegrown market. Data centres will justify attention for the next decade, anticipating that developers and investors could convert strong portfolios into Real Estate Investment Trusts (REITs) over the course of the next 10 years.

“Despite the high rate of mobile penetration and increasing internet usage and data generation, we still need to catch up with the per-capita rates in the ‘developed’ world,” Goel says. “We expect the data-centre markets in India to be extremely attractive. Initially we expect institutional investors to deploy capital in partnership with Indian developers and professional data-centre operators. However, once the data-centre portfolios are scaled to larger sizes, achieve optimum operation and generate regular incomes, we expect a REIT market to develop for these.”

Colliers also believes investors should look at “last-mile” debt financing for residential projects. That allows them to gain exposure without assuming development risk or deploying equity capital.

The home market may benefit from a return in demand as the economy recovers from COVID-19, amid relatively low interest rates. “The residential sector in India is expected to bounce back after the pandemic because demand-supply imbalances still exist,” says Goel.

Investors should be able to put money to work with reputable developers, with more certainty that they will deliver on projects and plans. There’s a gap for funding thanks to a financial shakeout, and overseas investors can team up with the winners emerging out of industry consolidation.

“Unorganised and stressed developers need to clean out their balance sheets by offering their land banks and viable projects to large, well-funded, well-managed and reputable developers, which will result in the whole sector becoming more organised,” Goel adds.

Investors expect high standards

You could create a complex map out of the links between India’s leading developers and the major international investors that are backing them. The bottom line is that many of the world’s largest private-equity managers, as well as pension funds and sovereign wealth funds, have fronted up billions in backing to form partnerships with India’s most-prominent developers in each sector.

Private equity will help shape which developers thrive in the years ahead. “Their investors expect world-class construction and development quality and best practices in operations and property management,” says Vinamra Srivastava, the CEO for business parks at CapitaLand India. “They aim for high sustainability and wellness standards, and attract highly qualified professionals into the industry. All of these make the industry more mature, sophisticated and better-run.”

Having begun investing through ‘blind pool funds,’ in which the institution had little to no say in how the money was put to work by the developer, international investors are increasingly leaning toward creating platforms and joint ventures that give them greater say in strategy and deployment of capital. There was an eight-fold increase in the amount of money invested into platform and joint venture deals between 2012 and 2018, with $7bn now invested in that manner, notes JLL in its report, Institutional Flow of Funds to Indian Real Estate. Investors now prefer to have direct oversight over the use of their funds.

As they have become comfortable with the Indian market, investor attitudes to risk have also become more expansive. The first institutions to arrive looked only for income-producing, stabilised and high-quality projects. Now they are comfortable with taking on development risk. “Investors are willing to put their skin in the game,” says JLL, indicating they’re in India for the long term.

Now that investors such as Warburg Pincus can exit investments (by selling on its portfolio or recycling capital into new projects), and the equity market provides another option to sell out of holdings, the institutional investment is completing a cycle. Any capital that is recycled could form a virtuous loop sustaining the industry for years to come.

“Confidence begets more confidence,” says Shobhit Agarwal, managing director and CEO of Anarock Capital. “Since it is known that these players do rigorous due diligence not only at their end but also through credible consultancies in India, their plays on Indian soil show that they can invest with confidence and also provide other players with a roadmap on where to invest.”

Between 2018 and 2020, 55% of total property inflows in India went into office space

New regulations bring stability to India’s property market

The foundations for this newfound stability were laid in 2016, with the implementation of the Real Estate (Regulation and Development) Act (RERA). This landmark piece of legislation, three years in the works, set much-needed standards across the property industry, particularly for developers.

Projects and property agents must now be registered. This has tamed the ‘Wild West’ nature of what had been a cowboy industry. Developers in India are now also required to hold 70% of the cash deposited by prospective owners during presales in an escrow account. This, with one swoop of the pen, undid the previous practice of using cash from residential sales to fund existing construction or even the next project, which caused consternation among buyers, and no shortage of developments that collapsed without ever delivering on their promises of property.

That’s not to say the transition has been easy. RERA “has changed the dynamics of the real estate sector in India,” says Ashwani Awasthi, managing director of the RICS School of Built Environment. “While the sector found it difficult to align with the reforms and changes brought in by RERA, these measures helped instil transparency, accountability, and fiscal discipline enhancing the credibility and progressive growth of the sector.”

Many developers struggled under the new cash-flow restrictions. By the 2017-18 fiscal year, once RERA’s rules went into full effect, the number of developers across India plunged by 50.7%, according to a report from PropEquity Research. Since the start of the decade, their numbers were whittled down from 3,538 companies to 1,745. Chennai saw the worst attrition, with more than three-quarters (77.3%) of developers shutting down. In Bengaluru and Hyderabad, two-thirds went out of business.

Equally, the tough transition has been necessary. Thanks to RERA’s structural changes and a greater awareness among buyers, “most unscrupulous developers and their activities have ceased to exist,” says Agarwal at Anarock Capital. “The ones that remain are largely serious players who understand the business and are accountable.”

Before RERA, plan deviations were the most-common problem. Some developers launched pre-sales on projects without having clear land title or the necessary construction approvals in place. Then there were problems in execution: shoddy construction quality, lack of clarity on the ‘carpet area’ of projects, and the inevitable delays.

“Most unscrupulous developers and their activities have ceased to exist.” Shobhit Agarwal, managing director and CEO of Anarock Capital

A necessary step forward for Indian property

With a newfound focus on actually completing properties and adhering to best practices, developers with strong track records are flourishing. A high rate of project launches between 2010 and 2013 had mainly ended up in the hands of investors, creating the illusion of demand, and spurring an even greater number of launches. A liquidity crunch put a sudden and brutal end to an unsustainable cycle.

PropEquity founder Samir Jasuja described it as a “perfect storm” of rising financial distress, incompetent project execution, overbuilding, excessive land banking, unjustified price appreciation and a lack of proper infrastructure that brought the industry crashing down. Forcing bad players out of business or into the arms of larger, credible competitors was a necessary step forward for Indian property, particularly residential.

“The RERA act has brought much-needed trust, transparency and security into the residential sector in the country, and has been a big boon for end customers,” Srivastava at CapitaLand India says. “It has cleaned up the industry significantly and boosted investor confidence in return.”

There’s further to go on the industry side, as well as necessary government change to advance the industry now. Statutory approvals could be easier to acquire, as could land. Srivastava believes that government policy can encourage datacentre development, new energy and other emergent sectors.

The strong flow of funds into Indian property is compressing cap rates and is sustaining valuations at historically high levels. While that presents a challenge for investors, the industry has benefitted greatly from the greater professionalism that international interest has demanded.

That private-equity money may prove crucial, however. COVID-19 has created an unexpected event that is testing an industry already challenged by two years of woes at India’s non-banking financial companies (NBFCs). This shadow-banking sector had supplied the shadier parts of the property industry, but was shaken by a defaults scandal, rapidly rising interest rates, and a crisis of confidence.

“Once the COVID-19 crisis fades away, it will leave a lot to ponder, especially for a less-organised sector like real estate in India,” says Awasthi at the RICS School of Built Environment. Risk management policies and practices are sure to get an overhaul, not to mention business continuity. “This crisis has also delivered a very strong message that during such uncertain times only a robust cash-flow management can help ride over the tide,” Awasthi concludes.

Investment from private equity

It has been private equity that has dominated the international presence in India. Between 2009 and 2018, international private equity accounted for 83% of the total international capital in the country’s property sector, according to Jones Lang LaSalle. The first five years of that span was slow, with only $9.4bn put to work. That accelerated to $20bn between 2014 and 2018, with foreign investors accounting for 70% of the total institutional money invested, up from 31% earlier in that 10-year spell.

The world’s largest private-equity investor, the Blackstone Group, deepened its presence in mid-May this year. Blackstone agreed to buy Embassy Industrial Parks, a 10.6m ft2 portfolio of logistics and warehouse space set up in 2015 as a joint venture between India’s largest developer, Embassy Group, and Warburg Pincus, one of the earliest American investors to put money to work in India. The portfolio is concentrated in Bengaluru, Delhi, Hyderabad and Pune. Blackstone didn’t disclose the price, but local media had reported that the private-equity giant had offered $700m when the deal was first proposed in February.

Embassy is a popular partner – it also has a $500m office platform (to fund acquisition and development of sustainable business parks) that it set up with Ivanhoé Cambridge, the property-investment arm of the Canadian pension fund the Caisse de dépôt et placement du Québec. Canada’s other major institutional investor, the Canada Pension Plan Investment Board (CPPIB), is backing the Indian warehouse developer IndoSpace, injecting $500m to take a majority stake in their logistics partnership IndoSpace Core.

The CPPIB also deepened its joint venture with Indian shopping-centre developer Phoenix Mills at the end of May, providing $77m in backing for the construction of Mindstone Mall with as much as 1m ft2 in Kolkata. The Canadian pension plan first partnered with Phoenix Mills in 2017 and has now invested $273m to take a 49% stake in the company’s mall-development venture, Island Star Mall Developers, which has a portfolio of properties across six major cities. Phoenix Mills has also secured backing for other subsidiaries from GIC, the Singapore sovereign wealth fund.

Blackstone first entered the Indian warehouse market in December 2019, through a $350m joint venture with the Mumbai developer the Hiranandani Group. It also invested $54m to take a stake in the warehouse business of Mumbai-listed Allcargo Logistics, with an eye on co-investment.

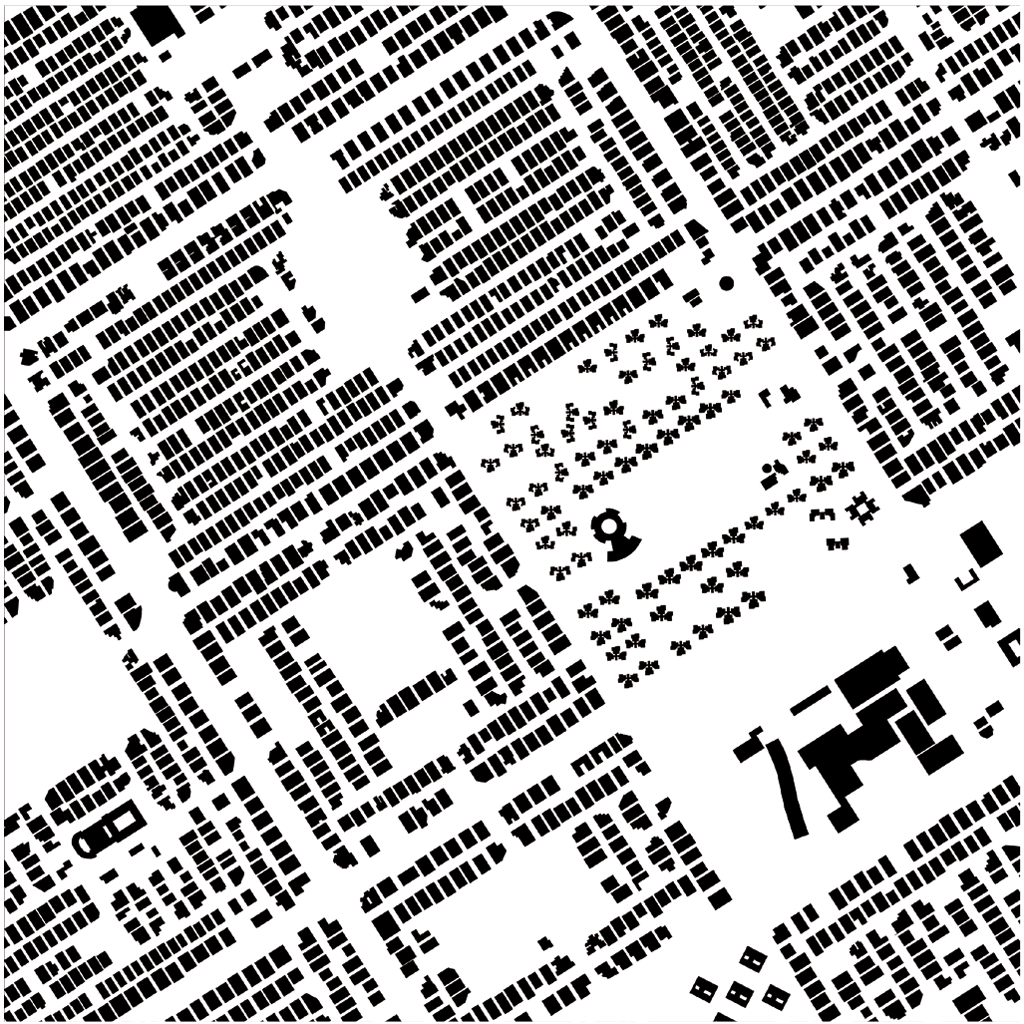

Blackstone believes India is ready for new retail and e-commerce, and the infrastructure to serve it. Although Bengaluru is India’s chief e-commerce hub, for instance, it has only 30m ft2 of Grade A and Grade B warehouse space, compared with the 1.2bn ft2 you’d find in Chicago.