In December, the National Energy System Operator (NESO) published the Clean power 2030 action plan, saying that it would be possible to achieve 130GW of total renewable capacity by the end of the decade – enough to meet all UK demand and only using unabated gas 5% of the time in a year with a typical weather pattern.

However, a £40bn annual investment will be needed to meet this target. Part of this will go towards upgrading an electricity grid, that was originally built around the coal-fired power stations of the Trent Valley now all in various stages of decommissioning. Wind power is now the most significant contributor to the UK energy mix at 29.3% in 2024, most of this in Scotland.

At the same time, UK electricity consumption has increased, with significant demand emerging due to the country becoming increasingly electrified and new technologies such as data centres creating vast new demands. National Grid has therefore begun the Great Grid Upgrade; this will, among other things, create new overhead lines to transport power around the country, including the Eastern Green Link Interconnectors between the eastern coasts of Scotland and England.

Fortunately, the UK does have a surplus of stand-alone renewable energy projects that can connect into the electricity grid. In March 2025, there were 727GW of export and storage projects in the transmission connections queue, which are currently being connected on a first come, first served principle. But this has become problematic as some have failed to progress and therefore held up others behind them in the queue.

NESO is currently reforming the queue to work a first ready, first served basis, and developers will demonstrate readiness by having land rights, planning permission or both, as well as strategically aligning with national energy demand. This reform received approval from Ofgem on 15 April and the first phase of this commenced on 20 May.

Renewables prioritised but with back-up and storage

The UK is looking to deploy a variety of different renewable energy assets to meet its Clean power 2030 requirements, but each technology operates at a different efficiency and produces energy at different times. A balanced network will need to ensure that the UK has a secure and stable electricity supply in the future.

Wind is plentiful in the British Isles, although turbines require consistently high speeds to be viable and operate efficiently, meaning that storage is essential when there is little or no wind. Nevertheless, wind will be a key contributor towards meeting the clean power target, with as much as 80GW of onshore and offshore capacity needed by 2030.

Offshore wind will be the backbone of this supply. As much as 50GW of offshore wind will be constructed with approximately 14GW already built and a further 6GW currently under construction, but the UK will need to install more than 5GW every year up to and including 2030 to achieve the target. The historical average has been 1GW per year.

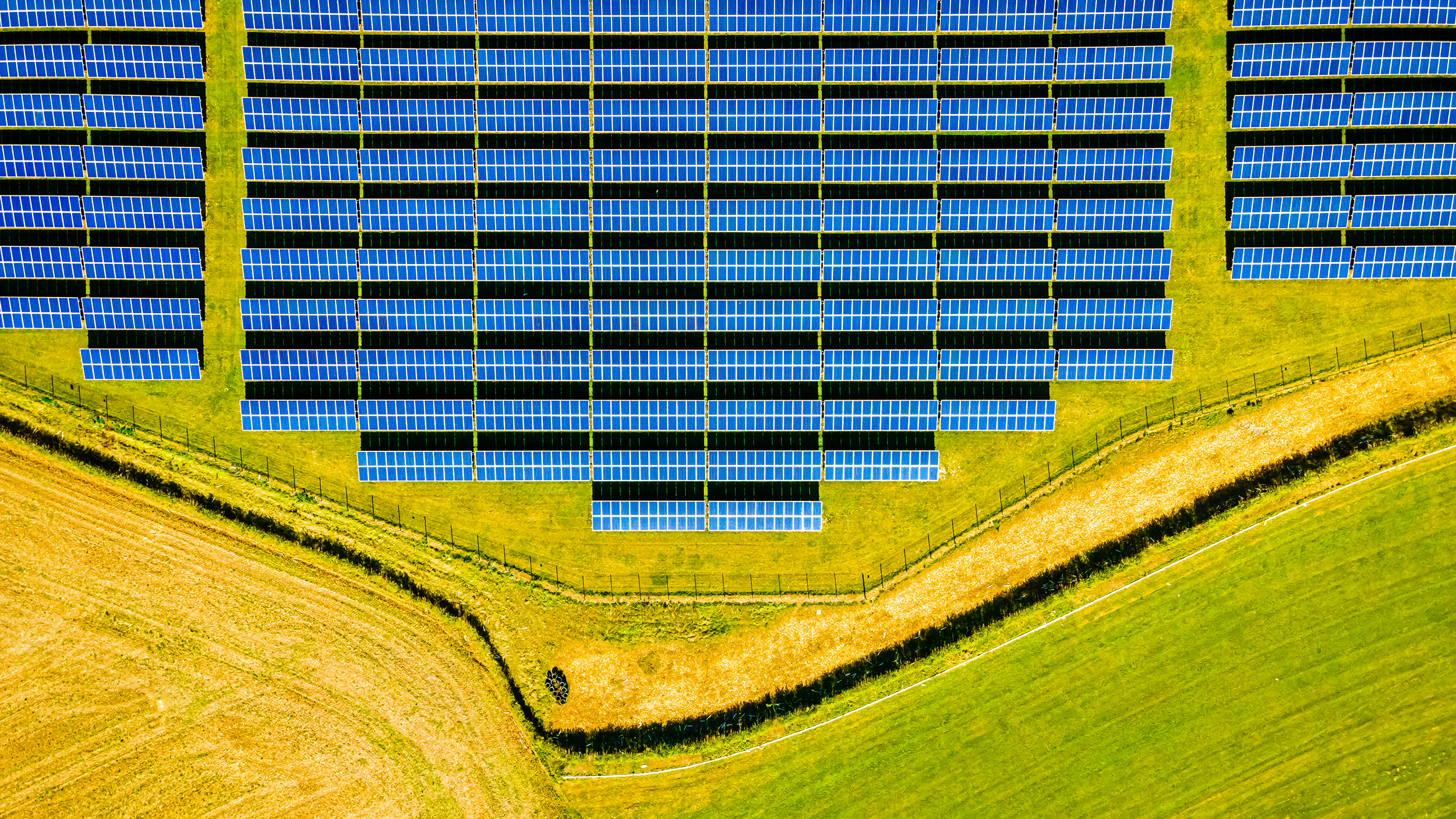

Solar farms will also be key to a clean power supply, but they only produce electricity during daylight hours. Solar panels are most productive during the summer when days are longer and the sunlight more intense. Since taking office as secretary of state for energy security and net zero, though, Ed Miliband has approved 2.7GW of large-scale solar farms, which will help meet the 47GW target by 2030.

Nuclear power will still be used to provide baseload supply to the energy grid. In addition, many large power users are considering developing small modular reactors to supply their own power.

Gas-fired power stations will also continue to feature in the UK's energy mix under the action plan, but only when there is a lack of supply from other sources. NESO estimates that 35GW will be required to provide the necessary security, which is as much as is currently operational in the UK.

Energy storage will be critical to improving the UK's energy security and grid stability. NESO will need a mix of up to 33GW short- and long-term storage. Lithium-based batteries are the asset of choice for the former – usually offering one- to two-hour export duration – but vanadium-flow and iron-flow technologies are also being developed.

Meanwhile, pumped hydro, liquid air and advanced compressed air technologies will be used to provide between eight and 24 hours' export of stored electricity to satisfy the long-duration requirements.

Rooftops offer private wire and solar potential

Most businesses and properties buy their electricity from suppliers that provide it from the grid. The private wire concept offers an alternative for off-takers.

Such parties can enter agreements directly with generators to connect a renewable energy asset straight to their property, referred to as a private wire or behind-the-meter connection. These connections involve Power Purchase Agreements (PPAs) between the off-taker and the generator.

The PPAs usually fix the electricity price for a time, with agreed rent review mechanisms. That price will depend on the funder's level of investment and the length of the agreement, but will be more than the wholesale cost but less than the retail cost. This means the off-taker will be able to forecast the saving it makes on its electricity, while the generator can sell power for more than if it sold directly to the grid.

Many businesses are exploring the potential for installing private wire connections on rooftops to improve their energy performance certificate ratings and achieve net zero by 2050 or earlier. There are two main routes – self-development or a third-party funded option. Property and business owners should consider upfront capital outlay, maintenance costs and liabilities, and the price of the electricity when deciding which option to go for.

In November 2023, the UK government changed permitted development rights legislation to ease regulations on rooftop solar projects. Its aim was to cut red tape, encouraging less solar development in the countryside and make more use of commercial roof spaces: the UK has some 2.5bn square metres of south-facing commercial rooftops.

The changes removed the 1MW limit for permitted development rights for rooftop solar projects, and also allowed those panels to be installed on roofs facing highways. Carport-style solar panel arrays can now also be installed as permitted development in off-street, non-domestic car parks, provided they are more than 10m from residential buildings. These types of arrays can power electric vehicle charging stations and buildings if needed.

'Many businesses are exploring private wire connections on rooftops to improve their energy performance certificate ratings and achieve net zero by 2050 or earlier'

On-site power could help meet data centre demand

Meanwhile, more data centres are being built to support the increasing global use of AI. Several providers – including Google, Microsoft and Amazon – have identified the UK and Ireland as optimal locations for centres to serve Europe because of good connectivity, cheap and readily available electricity, and a business environment that supports significant investments.

However, data centre servers draw large amounts of power, with those that use graphics processing units requiring ten times the amount of power that traditional central processing units use. In 2023, data centres in the Republic of Ireland and Northern Ireland combined used 21% of power generated on the island, more than all urban households combined. This is set to rise to 27% by 2028.

The scale of this consumption has forced Irish transmission operator EirGrid to impose a moratorium on construction of new data centres. In August, a Google data centre in south Dublin was refused planning permission due to a lack of on-site renewables being installed to power the site.

In contrast, the Silicon Sands data centre near Blackpool is using a local 20MW solar farm that will supply it with renewable energy, and also meet 75% of Blackpool Airport's electricity needs.

On a smaller scale, BT announced last year that it has trialled a self-powered mobile site in the Shropshire Hills. This telecoms mast uses a combination of solar, wind, batteries and a green-fuel-burning generator to service mobile phones.

The solar and wind is expected to generate 17,000kWh of electricity a year, which equates to 70% of the power demand and will result in a saving of £10,000 per year. The remaining power is supplied by a generator that runs on hydrotreated vegetable oil derived from waste and residual oils. Self-powered mobile sites such as these will allow telecoms operators to consider more remote locations that do not have cost-effective or viable grid connections to provide network coverage.

Additional energy innovations contribute to targets

The excess heat from data centres could be repurposed for heat networks as well as providing additional income. This can also be used to increase the benefits of the heat network in the local environment, and is already widely used in Nordic data centres. At present, heat networks are an unregulated market but the Energy Act 2023 named Ofgem as the regulator of such networks in Britain.

The UK is also seeing increased investment from the Green Heat Network Fund, which announced £57m for five projects in September. In November, the South Westminster Area Network (SWAN) was announced, which will provide heat to various government buildings and museums using the River Thames and the London Underground as heat sources. SWAN aims to create 500 jobs and save 75,000 tonnes of CO2 every year, but will need £1bn in investment over ten years.

The UK is mobilising to meet its objectives of decarbonising its electricity network and achieving net zero by 2050. Significant investment will be required to meet this ambitious target, but NESO is in the process of charting the course that developers must follow.

At the same time, legislation has been amended to enable increased adoption of distributed energy through private wire PPAs making use of vacant space in the built environment such as rooftops and carports. Finally, while data centre growth is putting big demands on power, the sector stands to gain from the increase in investment in renewable energy and in turn will be able to contribute to local district heat networks.