Decarbonising buildings is key to achieving the UK's ambitious goals to mitigate climate change. Over the next few years, landlords and tenants will need to install more low-carbon technologies and meet sustainable building standards. However, these investments should not be seen as dead costs, but rather as opportunities to add value to a building and create new income streams. In this article, we discuss the relevant technologies, the possible benefits and the future developments that will affect this area.

Low-carbon technologies offer landlords the opportunity for several wins. Starting with the obvious, concerns about the environment are no longer the preserve of just a few engaged citizens, and the green agenda has started to make inroads with many companies and institutions such as pension funds. Meeting sustainability targets has become a key performance indicator for many asset managers, and low-carbon technologies offer a tangible way of achieving this goal. Sustainability is also an increasing concern for tenants given rising awareness of staff and customers.

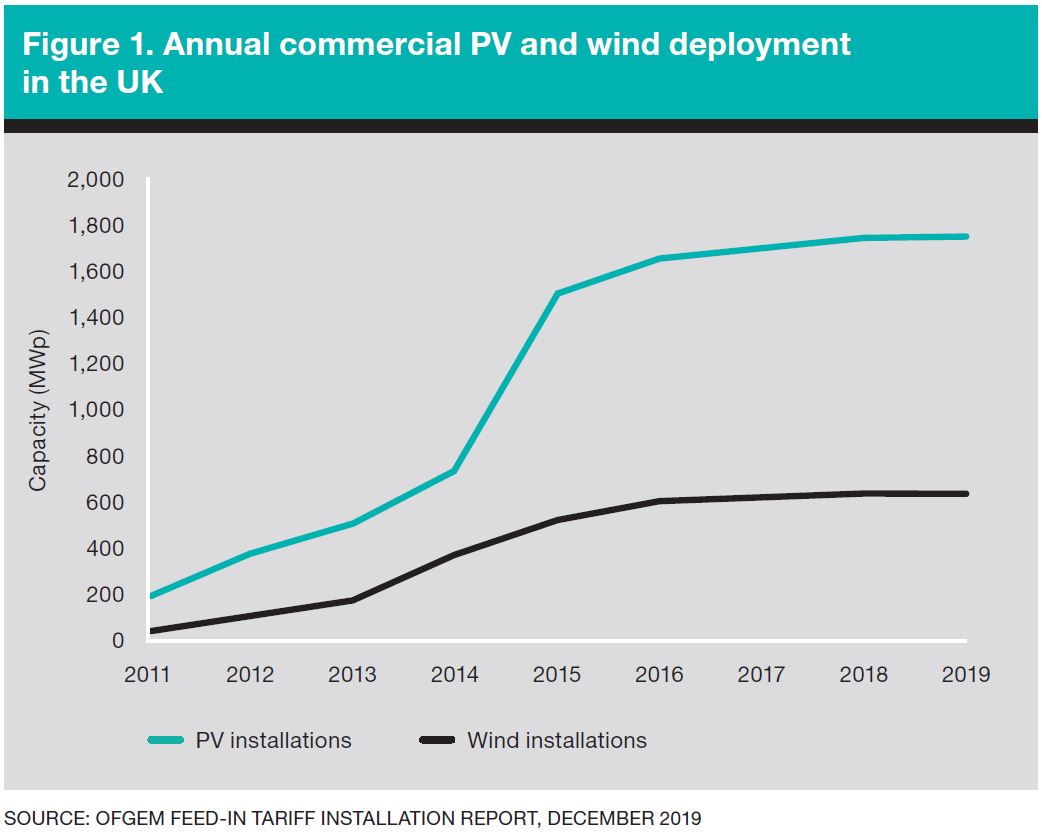

Solar photovoltaics (PV) is the most established of the renewable energy technologies installed on properties. More than 14GW of peak capacity has been installed in the UK since 2010, during which time the cost of doing so on a commercial scale has fallen by 75 per cent. It is one of the cheapest renewable technologies in the UK with close to 30,000 installations on commercial properties between April 2010 and December 2019 according to a recent Ofgem report.

Straightforward to install, PV systems are connected to a building's distribution board and the electricity generated is used on site before any excess is exported to the grid, which can therefore greatly reduce the occupier's grid electricity consumption. Solar PV also has practical advantages that make it a good option for landlords.

-

Low-disruption installations

PV can be installed on existing buildings with minimal disturbance during construction and operation using roof space that would otherwise remain empty.

-

Low-risk investment

PV outputs can be accurately forecast over the course of a year, and investor returns are generally reliable if systems are properly maintained.

-

Simplified landlord–tenant agreements

As projects have become more common, agreements for landlords to supply electricity from low-carbon sources to tenants have been standardised.

Although less common due to planning restrictions, onshore wind can be installed near major commercial properties such as large industrial estates with high energy usage. This is currently the cheapest renewable technology and can generate strong returns. Being both predictable over its 25-year lifetime and reliable if well maintained, onshore wind offers similar commercial possibilities to solar PV. However while the market in Scotland continues to grow, England and Wales are still waiting for planning policy to catch up. Figure 1 shows the deployment of both technologies in the UK in the past decade.

Commercial opportunities

In addition to being more environmentally conscious, landlords and property managers should also view low-carbon technologies as commercial opportunities. Solar PV has a long-term levelised cost of less than 5p to generate 1kWh, whereas grid electricity costs are now generally more than 12p/kWh. PV and wind energy can be sold at a lower rate than grid electricity, and provide both an income stream for landlords and significant savings for tenants.

"Low-carbon technologies can also be used as incentives in the letting process"

- landlords sell the power to tenants at a lower cost than the grid electricity

- electricity not consumer on site is sold via a power purchase agreement (PPA) with an electricity supplier, or can receive a Smart Export Guarantee (SEG) Tariff

Low-carbon technologies can also be used as incentives in the letting process, when they can be advertised as a modern service provision that contributes to reductions in operational costs, or a negotiating tool to help meet the tenant's green goals. There are important details to consider when providing a system for a tenant and these need to be managed to avoid high operational costs. For example, business rates relating to solar PV and costs resulting from poor upkeep.

One early-adopter landlord that Syzygy has worked with is Aberdeen Standard Investments. Dan Grandage its head of sustainability says: "Since 2011 we have been investing in low-carbon technologies and looking at how they can be integrated into our buildings. Installing rooftop solar PV has been a win-win, allowing us to meet our ambitious environmental social and governance goals by creating an income stream that is valued on sale, as well as reducing a tenants energy costs."

There are many other low-carbon technologies that will provide further opportunities to add value to buildings in the coming years. One is electric vehicle (EV) charging points. The market is growing quickly, prompted by the decreasing price of electric cars, government incentives and new policies restricting circulation of fossil-fuelled cars in certain areas.

Developing a wide and efficient EV charging network is key to this transition. More than 20,000 public charging bays have already been installed in the UK at the time of writing with in excess of 40 per cent on commercial buildings such as offices shopping centres and industrial properties. By providing a service that will soon become essential to occupiers and visitors, EV charging installations ensure commercial properties are moving with the times. They also represent an opportunity to generate an income stream by effectively reselling electricity suitable for EVs to users.

"EV charging installations ensure commercial properties are moving with the times"

Other low-carbon technologies expected to grow in importance over the next few years include renewable heat sources. More than 20 per cent of carbon emissions in the UK are the result of heating buildings and 84.2 per cent of properties still rely on fossil fuels for warmth. In order to achieve a net-zero energy system by 2050, a significant shift is needed in this area. One technology leading the way is the heat pump, which uses naturally-occurring temperature differentials to extract heat from water ground or air. Combined with low-cost on-site renewable electricity, heat pumps can lower carbon emissions and costs when compared to a gas boiler.

Installing low-carbon technologies in both new and older buildings will be essential for accelerating the transition towards buildings with a net-zero operational carbon footprint. The focus on developing these kinds of building is expected to intensify as the standard for new builds increases. For net-zero buildings, energy demand should be met by renewable technologies as much as possible. The intelligent electrification of everything from heat to transport will be combined with on-site renewable generation to create smart and sustainable buildings.

Jamie Baxter is a project manager and Cecile Bousquet is a data analyst at Syzygy Consulting jamie@syzygyconsulting.eu cecile@syzygyconsulting.eu

Related competencies include: Sustainability