The 2022 Real Estate Benchmark data from environmental, social and governance (ESG) analyst GRESB saw the largest ever growth in the number of participants.

There are now 1,820 entities participating worldwide, covering $6.9tr of gross asset value across 74 countries. Most growth came from the Americas region, which recorded a 30% year-on-year increase in participation with 111 new entities, and Europe, which recorded a 16% year-on-year increase with 123 new entities.

In Europe specifically, Germany emerged as the fastest-growing market for ESG uptake, passing the 100-participant mark with a 34% increase in involvement, followed by Italy with an increase of 15% to cover 83 entities in 2022.

While the Italian ESG market may be less mature than others in Europe, government incentives have promoted real-estate energy efficiency in particular. GRESB's data also shows that not only was Italy the second fastest-growing market in Europe last year, it was also the fastest-growing market globally in 2021.

In absolute terms, however, the UK remained the most represented country in the European benchmark in 2022, with more than 260 entries – accounting for almost 30% of all those in Europe.

Greater reporting indicates pandemic impact

GRESB scores are a valuable metric to measure and monitor ESG performance in real estate. These scores consist of two main components: one for management and another for performance.

The management component accounts for 30% of the overall score and focuses on qualitative ESG metrics such as risk management, stakeholder engagement and policies. The performance component makes up the remaining 70%, and looks at quantitative metrics such as energy use and greenhouse gas (GHG) emissions.

In 2022 the average GRESB score increased by a percentage point to 74% for the standing investments benchmark at a global level compared to the previous year, indicating a positive upward trend in the sustainability performance of real estate. These improvements are also reflected in Europe, where the average GRESB score went up by two points to 73% last year.

When it comes to the different aspects that make up the GRESB score, 2022 saw a slight decrease in participants' performance on energy, GHGs and water, as a result of real-estate portfolios reverting to the way they operated before the pandemic.

This is also visible in the underlying performance metrics, with GRESB observing increases in like-for-like consumption. The increase in energy use is most significant in Europe, at 3%.

In contrast, Oceania is the only region where recovery from the pandemic has not resulted in an increase, and participating organisations there were able to continue to showcase significant like-for-like reductions across energy, GHGs and water.

In Europe, participants are making strides in obtaining asset performance data, which is the prerequisite for any decarbonisation strategy. The average percentage of energy data coverage for European assets has now reached 71%, an increase of 5% compared to the previous year.

GRESB participants do face several barriers to accessing data, whether because the kinds of lease they have don't allow them to collect this from tenants, or tenants themselves are resistant to providing data.

There may even be legal limitations to the type of data that owners and fund managers can request, depending on the country and sector. This figure of around 70% is likely to represent a best effort to get the data for assets, with remaining barriers being much more difficult to overcome.

In 2022, GRESB also observed accelerating efficiency measures, with 74% of all European assets implementing at least one such measure in the past three years.

In terms of renewable energy generation, 35% of all European portfolios have on-site facilities installed. While this figure sounds encouraging, those portfolios still have a long way to go because only 3% of their total energy consumption is met by such facilities.

On the GHG front, GRESB saw a steep increase in participants reporting zero-emissions targets that they have set, and even observed a small pool of assets and portfolios that have already achieved such targets.

Longer-term engagement improves performance

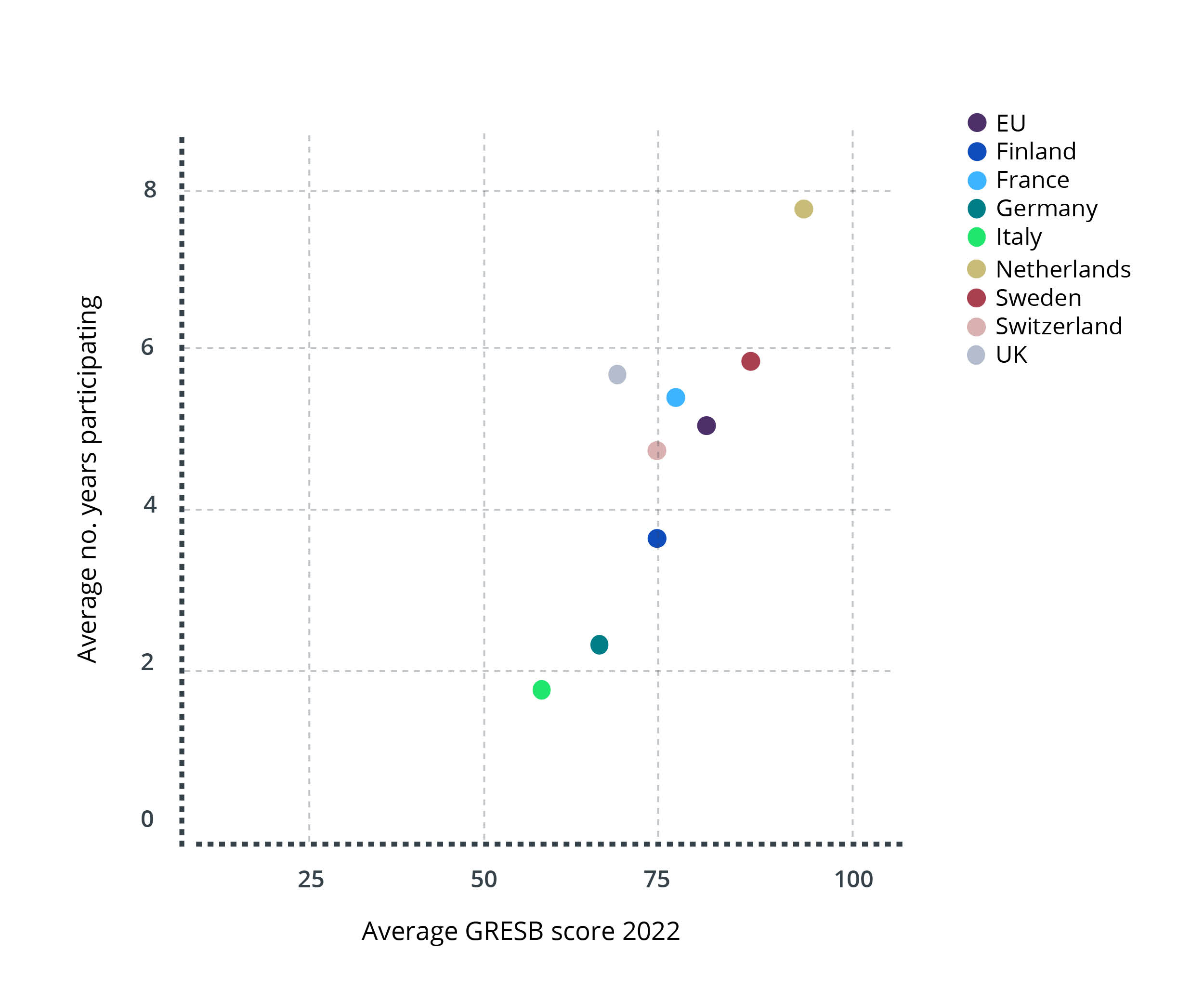

On average, participants see a 10% increase in their score in their second year of reporting. When comparing entities that have been part of GRESB for ten years to first-year participants, we see a gap of more than 20%.

On the whole, European entities have been participating in GRESB for an average of five years. At the country level, Netherlands-based participants have been engaging with ESG practices and participating in GRESB for eight years on average, and tend to outperform the European benchmark with an average score of 85.

In contrast, the fastest-growing markets of Italy and Germany have on average a two-year presence in the benchmark and obtained an average score of 60. This implies that, as expected, there is a positive correlation between the time invested in ESG engagement and sustainability practices and the performance verified by GRESB (see Figure 1).

Figure 1: Correlation between years of GRESB participation and ESG performance by market

EU legislates on assets and assessments

Despite ongoing economic uncertainty and an unstable geopolitical scenario, the value and importance of ESG is becoming increasingly established in the European market.

In October 2022, EU member states agreed a common position on the commission's proposed revision of the Energy Performance of Buildings Directive 2018/844/EU. The next stage will involve negotiations with the European Parliament.

The proposed revision will introduce requirements for member states to achieve certain levels of efficiency in their building stock, to reach the shared goal of zero emissions by 2050. The measure affects all buildings, with residential buildings having longer to achieve these levels than non-residential buildings. All new buildings are to be zero-emission from 2028.

In addition, measures to cut energy consumption by around 25% by 2030 will be introduced through the use of thermal insulation, replacing windows and doors, and fitting new condensing boilers and solar panels.

Furthermore, because sustainability assessments can vary significantly between rating agencies – particularly as social and governance assessments are more qualitative than environmental ones – the European Commission has recently proposed regulating ESG agencies, to limit conflicts of interest and foster consistency.

The EU aims for large-scale ESG interventions, aligning all stakeholders and defining strict road maps, focusing primarily on the environmental component.

Italy exemplifies emerging ESG market

The Italian real-estate market is clearly starting to address ESG considerations, with the current emphasis on environmental requirements prompted by:

- investors, especially those from overseas

- banks, which are more inclined to finance certified assets

- tenants, particularly big companies that have already implemented ESG initiatives.

Milan is undoubtedly the leading city in Italy in this respect, with the highest number of certified assets in retail, followed by offices and logistics. But based on market feedback, landlords across the country are recognising the need to improve their properties due to increased investor appeal, bank inclination and energy cost savings.

Although operational guidelines are currently lacking, the real-estate valuation profession is actively mapping and assessing operations related to certified assets to quantify the impact of improvements on property values.

Market analysis of the sale of properties also shows that there was an increase in demand, despite a one-third decrease in sales when comparing the first quarter of 2022 to the first quarter of 2023, and that such properties achieve occupancy levels of above 60% even before construction or renovation work has been completed.

In the residential sector, the demand for assets that meet EU ESG requirements has led not only to a considerable increase in sales values – by an average of 25% in Milan – but also to the number of sales of entire complexes.

Ongoing analysis of the real-estate market also aims to benchmark the costs of achieving different certifications based on the property's construction date, structure, maintenance condition and when it was most recently renovated.

This ongoing analysis by valuers also aims to identify the effect of meeting ESG goals on costs in discounted cash-flow analysis valuation models – particularly costs borne by landlords for energy-efficiency investments and administration related to governance and social aspects.

However, quantifying these is still challenging at present: while discussions between valuers, investors, landlords and ESG experts are ongoing, the market is not transparent. Information about the exact amounts for obtaining certifications is not in the public domain, much less easy to find.

Although there are not many benchmarks in Italy as yet, valuers are certainly more attentive than ever about collecting data and rationalising the elements that contribute to the most accurate definition of the market value of certified assets.

Numerous working groups are currently active in investment management companies and consulting firms, some of which were organised by RICS Italy, with the aim of developing consistent approaches and methodologies among valuers and GRESB.

Sustained growth, the implementation of ESG measures in real estate and the spread of GRESB approaches are expected in the near future. Rome and Milan in particular will continue to represent concentrations of demand, and ESG interventions are expected to be more pronounced in logistics, residential, hotel and office asset classes, particularly for portfolios and properties owned by institutional entities.

Manuela Di Marino MRICS is senior director strategic sales at Rina Prime

Contact Manuela: Email

Related competencies include: Property management, Sustainability