_5%20Apr?$article-big-img-desktop$&qlt=85,1&op_sharpen=1)

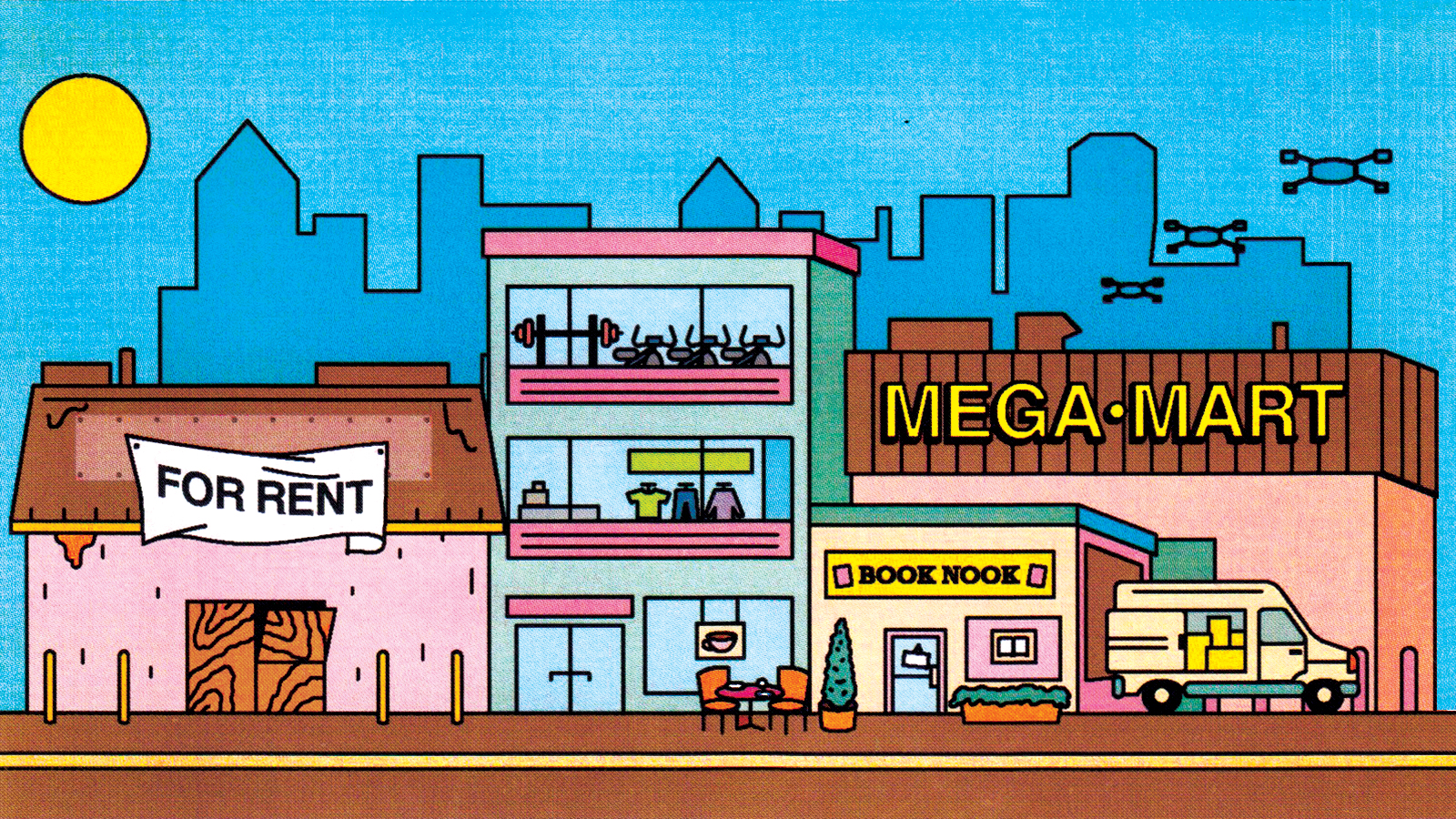

Last year, the boom in ecommerce saw global sales rocket by 16.5%, to reach a value of almost $4tn – which has inevitably led to an unprecedented demand for warehousing space. The growth has undoubtedly been accelerated by COVID-19, but most trends apparent now were not only in evidence before the pandemic gripped, they had been widely foreseen by consultants. It is these predictions, whether they involve the use of automation or the need for sustainability and social equality, that landlords and developers are happy to pay for.

“[Agents who] see what keeps the customers awake at night, see their concerns, and what direction they are going in five, 10 years’ time, help us formulate thinking behind our development pipeline in terms of shape of the portfolio and the product we build,” says David Binks MRICS, senior director leasing & markets with one of the UK’s largest industrial developers St Modwen.

_5-Apr.jpg)

The best agents also, “leverage data, collaborative insights and the wealth of knowledge and experiences that their unique position as intermediaries affords them, to help deliver successful results,” says Jason Tolliver, managing director, Investor Services, Cushman & Wakefield, US.

Throughout the world, one overriding trend is clear: the need for more sheds becomes almost insatiable. “The pandemic accelerated the already strong growth of ecommerce, increasing occupier demand for logistics real estate and condensing several years of online sales penetration into 2020 alone as many global consumers shifted [to the internet] for a variety of goods,” says Tolliver.

Amazon, whose gross profit for Q4 2020 alone was $46.271bn, an almost 40% increase year-on-year, is building its first southern hemisphere robotic fulfilment centre in west Sydney, Australia. Set to be completed this year, it stretches over four levels, covers 200,000 m2 – the size of New York’s Grand Central station – and it will be staffed both by humans and robots.

_5-Apr.jpg)

In India, third party logistics (3PL) and ecommerce demand for warehousing was so high, it made up 60% of the country’s total acquisitions in 2020, followed by the manufacturing sector at 24%. Meanwhile the growing number of firms in the industrial and warehousing markets last year saw investments of more than $1 billion, says Srinivas N MRICS, managing director, industrial and logistics, Savills, India.

The Indian manufacturing sector has gone through major transformation helped by significant government reforms. In a push to domestic manufacturing, the government has slashed the corporate tax rates of new manufacturing companies to 15%, the lowest in southern Asia. It has also identified large land parcels across several states that could potentially be offered to new manufacturing entrants. This, together with the relatively recent innovation of a goods and services tax and low labour costs, is encouraging foreign companies to relocate their production bases to India, creating unprecedented demand for industrial and warehousing space nationwide. “The industrial sector is set to benefit as multinationals seek to diversify their manufacturing locations,” says Srinivas. “India is emerging as an alternative manufacturing investment destination to China.”

China’s impact on the industrial market is far from diminishing, however, with its ambitious 2021 GDP target of 6% growth compared to 2.3% in 2020.

What European-based agents, including George Unwin, director at Savills, UK are carefully watching is the escalation of Chinese-based sellers who, using Amazon’s European marketplace, have almost doubled in number in the past five years.

In India, demand for warehousing was so high, it made up 60% of the country’s total acquisitions in 2020

_5-Apr.jpg)

Unwin says Savills is also “tracking the major Chinese businesses and how they are growing across the UK. We will be looking at the UK, and European import and export patterns over the next year to see how that changes as we come out of COVID-19 lockdowns.”

Brexit and its impact on the flow of import and export is also being closely monitored over the coming months and years. The UK officially left the EU in January 2020, entering a “transition period”, which kept all existing legislation in place until 1 January 2021 when the UK broke all ties with the trading bloc.

“Some companies are seeing disruption because of additional paperwork required at borders,” says Binks. “Certain manufacturers will also be considering issues around points of origin and thinking about either storing or making [their goods] in the UK… which will all drive demand for logistics and industrial space.”

Binks adds that reshoring also addresses the “sustainability agenda about shortening the supply chain, part of the resilience thinking”.

Sustainable strategies form a part of environmental, social and governance (ESG) criteria that has been gaining ground in the industrial market for the past few years and is set to increase in relevance. Gordon Reynolds MRICS, international partner, Cushman &Wakefield, UK, believes that, for occupiers, the need for sustainable features within their buildings is two-fold: it affects their operational costs, and their brand. “ESG won’t be the sole driving factor of an occupier’s decision-making process, but it is a differentiator.”

The bigger challenge is around second-hand and much older stock, says John Allan, director, Avison Young, UK. “Can an existing facility be adapted, or does it reach obsolescence sooner? For many occupiers, particularly those of [medium and small units], operating on tighter margins, there are competing priorities, such as availability and immediate cost considerations,”

Availability is, indeed, key for while there is no question that this sector will continue to grow, can it keep pace with the tearaway global success of online retail?

Has COVID-19 changed how retail space is valued forever?

The pandemic has supercharged online sales growth and has thrown up some particularly thorny issues for appraisers advising the owners of retail property. Read full story