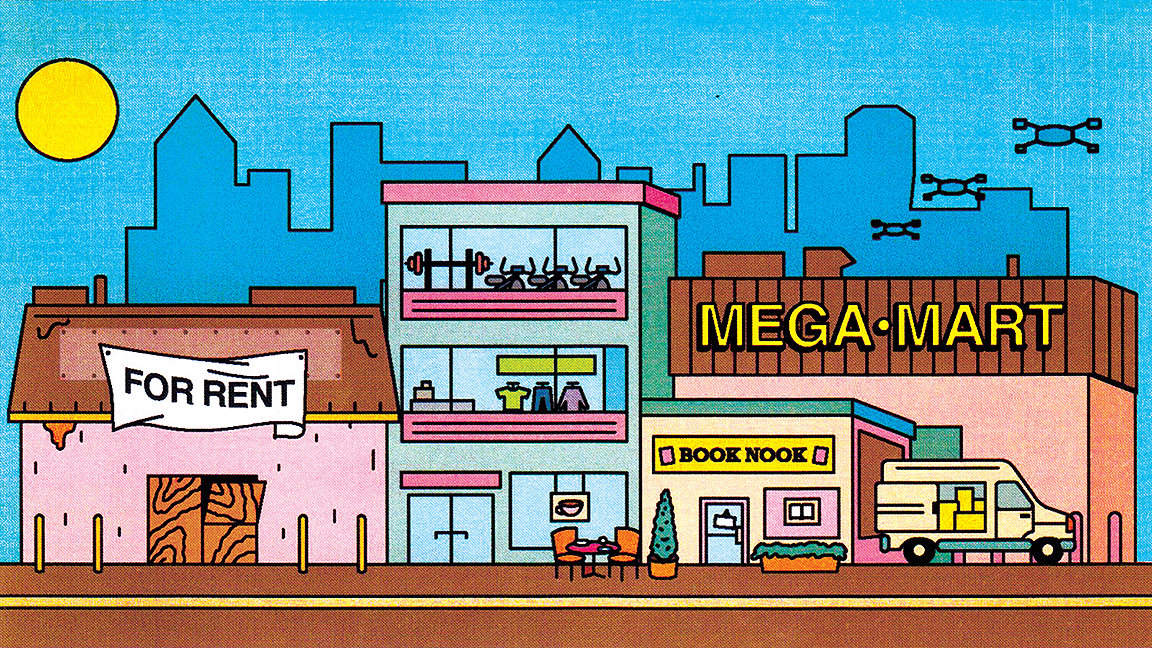

Illustration: George Wylesol

Covid-19 has supercharged online sales growth and lockdowns have closed non-essential shops in many countries, with the consequence that some physical retailers face a bleak future. Assessing value as a sector goes through a period of radical change and deep uncertainty, has thrown up some particularly thorny issues for appraisers advising the owners of retail property.

1: Assessing the damage

Not all markets and sub-sectors of retail have fared badly during the pandemic. While shopping centres have been hardest hit, supermarkets, convenience stores and retail parks have held up well, observes Claire Macken MRICS, UK co-head of retail valuation at JLL. “In valuation terms they have not suffered to the same degree as enclosed city centre schemes that are primarily fashion driven.”

In the US, which is burdened by an excess of retail space per head, the price of many malls has been marked down, says Tim Gifford FRICS, head of CBRE Capital Advisors Latin America. However, in Latin America the outlook for the sector is rosier. “Retail is not the favoured asset class in any market, but in Latin America shopping centres are one of the few safe places you can take your family at the weekend. Some of the malls in Mexico City get over 20 million visitors per annum. I do not think COVID-19 will cause a fundamental change on how investors in Latin America price retail.”

2: Operating in a frozen market

In the less-favoured parts of the sector there is little transactional evidence upon which appraisers can base their valuations. Macken calculates that £350m of UK shopping centres traded in 2020 compared with a 10-year average of £3bn. “If you own a shopping centre you wouldn’t bring it to the market without being forced to at the moment. You would do asset management to improve the property and make it more marketable,” says Marcus Badmann FRICS, managing director of real estate valuation at German adviser Bulwiengesa.

Valuing without comparable sales data requires more legwork and imagination, observes Bruce Kellogg FRICS, Atlanta-based managing director at MG Valuation. “You have to interview people in the market like brokers and then base your appraisal on that information even if you have no sales. Appraisers are being challenged right now to do their homework and come up with conclusions that they never had to before.”

3: Appraising turnover rents

As a result of the pandemic landlords are increasingly accepting a share of the downside risk with retailers, either through COVID clauses in leases, that reduce rents in the event of government-mandated shutdowns, or through charging turnover-based rents. That poses a challenge for valuers, says Sara Duncan, UK head of valuation and advisory services at Colliers International. “The difficulty with valuing on turnover rents is that there is not much information out there. But it is possible. We need a standard approach so that there is a market tone, and we have to see some deals so we can understand what multipliers are being paid.”

Factory outlet centres commonly use a turnover model, notes Andrew Skinner MRICS, valuation director at Savills in London. “That is very successful and if landlords and tenants can get comfortable with it, there is a more positive future. In the meantime, our valuation challenges will be around lack of evidence, lack of transparency on turnovers, and how you calculate estimated rental values.”

4: Monitoring retailer resilience

As the first COVID-19 lockdown took effect, valuers struggled to process a huge amount of information on retailers’ sales, footfall and rental collection, as well as assessing the effect of bankruptcies, says Macken. “A big part of the challenge was to digest that and come up with an approach that represented the risk.”

With more failures inevitable, appraisers need to keep an eye on the health of retailers to determine whether income streams are secure, suggests US-based valuation expert Noëlle Brisson FRICS, co-founder of real estate cybersecurity platform CyberReady. “Are they going to go bankrupt? Downsize? Will they re-purpose and adapt so they have a higher likelihood of staying? People need to be more granular otherwise they will use wrong assumptions in their valuations.”

5: Valuing alternative uses

“Shopping centre owners are all in the regeneration game, whether they like it or not,” says Skinner. “The reality is the worst is yet to come. Government support will end and it will take a long time for tourism to come back. One of the challenges we have is how we re-value surplus space.”

Valuations of secondary shopping centres now need to take into account alternative uses, argues Duncan, but there can be an upside. “The future for a lot of those is the local authority will partner with the owner or a developer on a regeneration scheme. There will probably be an element of build-to-rent residential and the retail will have to be downsized and refocused. It can sometimes come out at a higher price point.”

-29-Mar.jpg)