-29-Mar?$article-big-img-desktop$&qlt=85,1&op_sharpen=1)

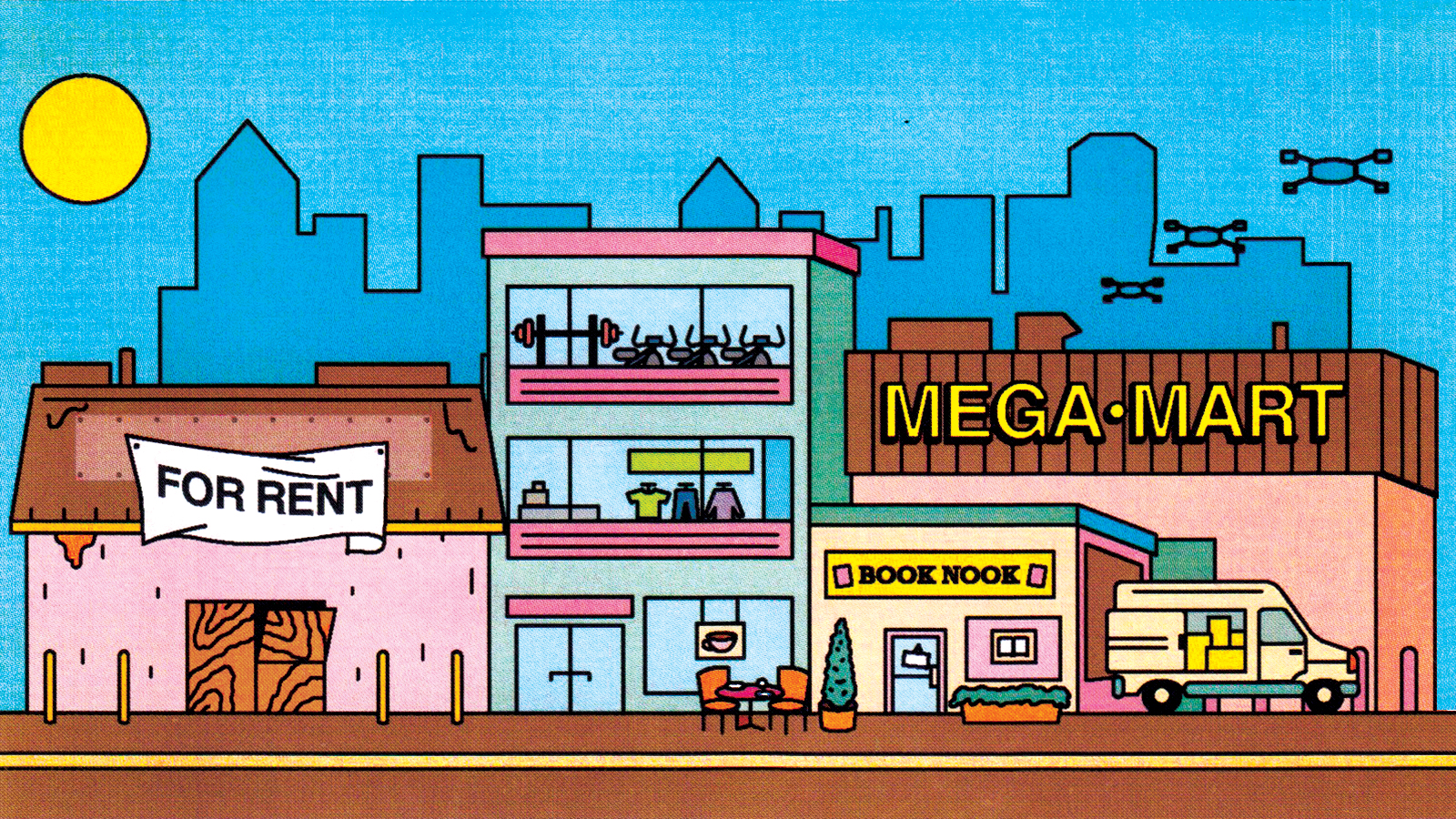

Illustration: George Wylesol

In many parts of the world, social distancing has had a calamitous effect on hospitality and leisure as hotels, restaurants, bars, and cinemas are forced to close their doors. For the sector’s investors and their advisers, the crucial deciders of property values depend chiefly on how quickly and comprehensively trade returns.

Predicting future cashflow

“We have always used discounted cash flows as a method for valuing hotels, so there has always been an element of predicting the future, but that uncertainty was heightened by the pandemic,” says Sabrina Gardner MRICS, vice president of the hotels and hospitality valuation advisory team at JLL in London.

“You have to model all kinds of scenario for when trade will return,” advises US-based appraiser Noëlle Brisson FRICS, co-founder of real estate cybersecurity platform CyberReady. “After the vaccine is deployed, when does business ramp up and how quickly? What if people don’t act like they did before? You show a methodology and assign probabilities.”

Factoring in short-term cash flow interruption may cause a relatively small fall in value, says Marcus Badmann FRICS, managing director of real estate valuation at German advisers, bulwiengesa “That makes the yields a bit higher. In the good-quality hotel properties being transacted at the moment, the change might be 0.5%.”

An uneven recovery

Demand for accommodation aimed at some travel markets may return quicker than others, with implications for hotel cash flow. “With the uncertainty on when international travel will recover, a heavy dependence on foreign demand has now become a business risk,” says Penthida Srisawang, head of valuation and advisory services at CBRE in Thailand. “Local demand currently comprises a key group of customers that hotel operators need to consider longer term.”

Tim Gifford FRICS, head of CBRE Capital Advisors Latin America suggests that while “sun and sand” hotel trade will rally within 24 months, for corporate business travel, the recovery could take four years or more. “The hotel industry is debating whether there will be a permanent loss of 15-35% occupancy associated with corporate conventions. What will be completely lost to Zoom, and what percentage will come back?”

Balancing risk in leases

Some hotels are let on conventional leases at a fixed rent, while other operators pay rent to landlords on the basis of their business turnover, and there are also a variety of hybrid models that combine the two. In the pandemic haggling has intensified over the share of occupancy risk allotted to landlord and tenant. “We are seeing tenants moving to more of a fixed rent plus a variable rate lease structure. For landlords, looking at rental affordability against the underlying cash flow will be a key focus to ensure rents are sustainable in the future,” says Gardner.

Most large hotel chains in Germany are still paying rent to their landlords on fixed-term leases, but many have negotiated short-term rental holidays to see them through the worst of the pandemic, says Andreas Röhr FRICS, executive director in JLL’s German valuation and transaction advisory team. “A valuer could easily model a rental holiday within a hotel’s predicted cash flow, although whether one is in place or not, they would still have to take into account the risk to the sustainability of the income in the longer term.”

Distressed pricing

Investment managers, often backed by opportunistic private equity money, are keeping an eye out for forced sales in the hotel sector, but to date they have been largely disappointed.

There is still a gap, however, between buyer and seller expectations on pricing, says Gardner. “Debt lending to buy hotels is scarce at the moment, and owners are holding unless they are forced to sell. We are expecting to see some distress but that has not come to market yet.”

In some countries, governments have adopted novel approaches to keep operators afloat. Keng Chiam Tan MRICS, head of valuation and advisory at Colliers International in Singapore, observes: “Government here has been quite creative, giving all adults SG$200 (£107) to go for a staycation. Probably 2-2.5 million people have spent that money. And COVID-19 cases are also being put into hotels.”

Food and beverage expected to bounce back

Consumers’ increased tendency to spend on experiences rather than goods was an important economic driver before the pandemic. That trend will re-establish after vaccines allow normal life to resume, predicts James Shorthouse FRICS, head of alternative markets at Colliers International in London. He points to the swift, if temporary, return to healthy trading for many UK outlets during the easing of restrictions last summer as evidence.

“There is no real substitute for going to a pub, restaurant or hotel - you can’t do that online. Most investors have been pricing in short-term loss of cash flow and a small discount related to the holding costs of licensed assets during that period. But there has not been a shift in overall confidence and yields that would affect the market when it starts operating normally.”

Investment managers are keeping an eye out for forced sales in the hotel sector, but to date they have been largely disappointed