_12-Apr?$article-big-img-desktop$&qlt=85,1&op_sharpen=1)

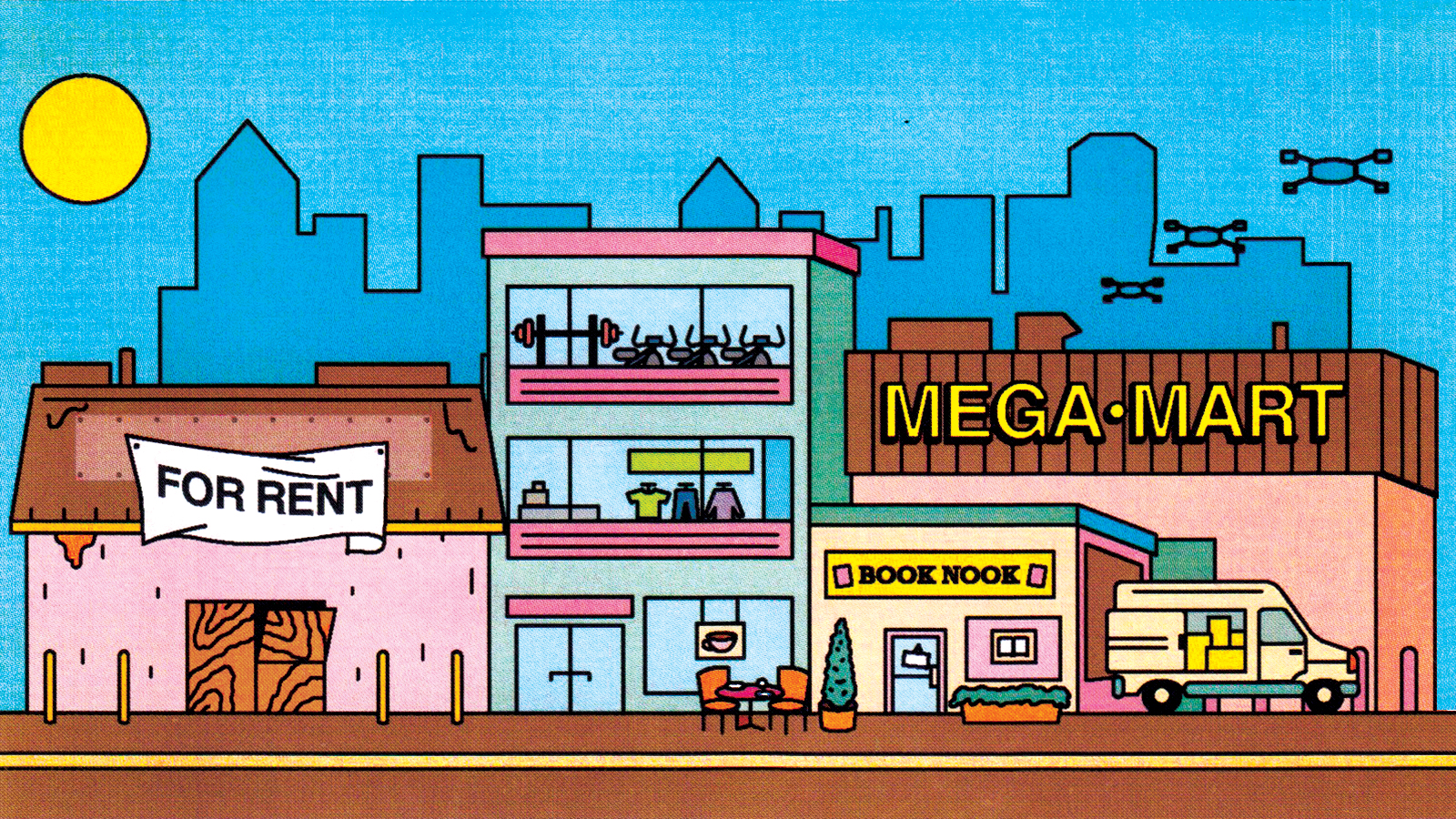

Illustration: George Wylesol

“Home” has been one of the central themes of the coronavirus pandemic. Staying home, working from home and home schooling have expanded the role housing plays in the lives of most people. Meanwhile, in the residential property market, the virus has given rise to a number of trends with potentially significant implications for valuation.

1: Investors demand resilient income. Before the pandemic, with the property market appearing close to its cyclical peak, “beds and sheds” – housing and logistics – were already sectors in high favour among real estate investors. But the robust rental collection statistics they have demonstrated during the crisis have since helped them to shoot to the top of almost every fund manager’s target list, with a corresponding rise in values.

“Residential has proven itself as one of the more resilient sectors during COVID-19. There is a portfolio being transacted at the moment where the investor is paying a huge premium because it has shown resilience over the past three years,” says Andrew Skinner MRICS, valuation director in Savills’ London office.

“You could put it down to the pandemic, or to the type of investors active in the market, but there is certainly a focus on sustainable income, particularly given where we are in the cycle,” says Stuart Osborn MRICS, head of European residential investment transactions, at Knight Frank. “Mid-market housing provides secure, long-term income for institutional capital.”

2: City centres shaken while suburbs rise. In the pandemic, the hollowing out of some of the largest and densest-populated world cities has been strikingly evident. “There are a lot of issues with New York multifamily housing right now. Rents have dropped, landlords are giving three or four months rent-free, kids are moving back home with their parents and breaking their leases,” says Neil Axler MRICS, managing director at B Riley Advisory Services.

Matthew Green MRICS who leads the development and investment valuation team at JLL in the UK says he does not believe that cities such as London will suffer abandonment in the long term, but they may see a redistribution of population. “Some people with younger families are sacrificing commuting convenience to find a location more suited to their needs. Our research shows proximity to a railway station has fallen down the list of priorities, so we may see an increase in sales and rental growth in some suburban locations which have previously been overlooked.”

3: Student and senior housing recovery expected. Student accommodation and care homes for the elderly were both negatively impacted by the pandemic, but valuers expect pricing to recover. Neil Armstrong MRICS, a partner in Knight Frank’s student property team, says: “In valuation terms, it is all about the risk around the next nine months’ income, then we are assuming that the world will return to some sort of normality. Any deals we now see are being done with the benefit of a rent guarantee. The challenge for the valuer is to work out what the cost of that guarantee will be.”

Yields for care homes, which had been tightening before the pandemic, flattened off as operators were faced with lower occupancy and higher operating costs, says Adam Lenton MRICS, head of the UK healthcare team at Colliers International. Vaccinations and better procedures have now turned the market around. “The expectation is that it will be just as good as it was and that yields will come in a little bit,” he claims.

4: Single family market heats up. The market for individually-rented houses has benefited from strong tenant demand during the pandemic. “People are just going crazy for single family [homes] in the US because they are moving out of New York, Chicago and Los Angeles, where local governments are shutting everything down, to places like Texas and Florida where they have more space,” says Tim Gifford FRICS, head of CBRE Capital Advisors Latin America.

Although it is less well-established on the other side of the Atlantic, the sector also looks set for growth in Europe, suggests JLL’s Green. “With families attracted to spacious and flexible accommodation, and wanting high quality private outside space, there is a real opportunity for investors and developers to work together to deliver a well-managed rental product to tenants.”

5: Design evolution accelerated. More people are expected to spend some of their week working from home after the virus subsides, so there will be increased demand for housing that meets both work and leisure needs, notes Osborn. “In some apartments developers are creating flexible living space where one of the walls is moveable so you can create a separate office.”

Sustainability has also moved up the agenda for investors in build-to-rent housing, says Green. “We will increasingly see a more transparent link between good ESG and valuation. I am aware of one residential project where scoring highly on sustainability was the factor that pushed the sale over the line at a very difficult time during the pandemic.”

-29-Mar.jpg)