At the beginning of 2021, lots of predictions were made about the shift to more flexible working practices and the impact of that on the value of corporate real estate. Some commentators heralded the end of the traditional office, while others believed working from home full-time wouldn’t suit most people.

Either way, with people spending more time working remotely, it was expected to have a damaging effect on office rents and the demand for premises that hold large numbers of staff. Will our offices ever be full again and has the value of corporate real estate changed for good?

The table above shows the factors that make employees want to come into the office. Socialising is top, followed by team brainstorming – showing that face-to-face interaction is something many employees miss when working remotely.

A recent report on the future of remote work, by management consultancy McKinsey, found the potential for a large proportion of the population to work from home is closely tied to how advanced a country’s economy is. By analysing 2,000 tasks across 800 job roles, it concluded that in the UK up to 33% of the workforce could potentially work remotely without any loss of productivity. In Germany and the US, it’s closer to 30%, while in China and India (considered to be ‘emerging’ economies), it is only 16% and 12% respectively.

“Business and financial services are a large share of the UK economy, for example, and it has the highest potential for remote work among the countries we examined,” said the report. “In emerging economies, employment is skewed toward occupations that require physical and manual activities in sectors like agriculture and manufacturing.”

“Although India is known globally for its high-tech and financial services industries, the vast majority of its workforce of 464 million is employed in occupations like retail services and agriculture that cannot be done remotely.”

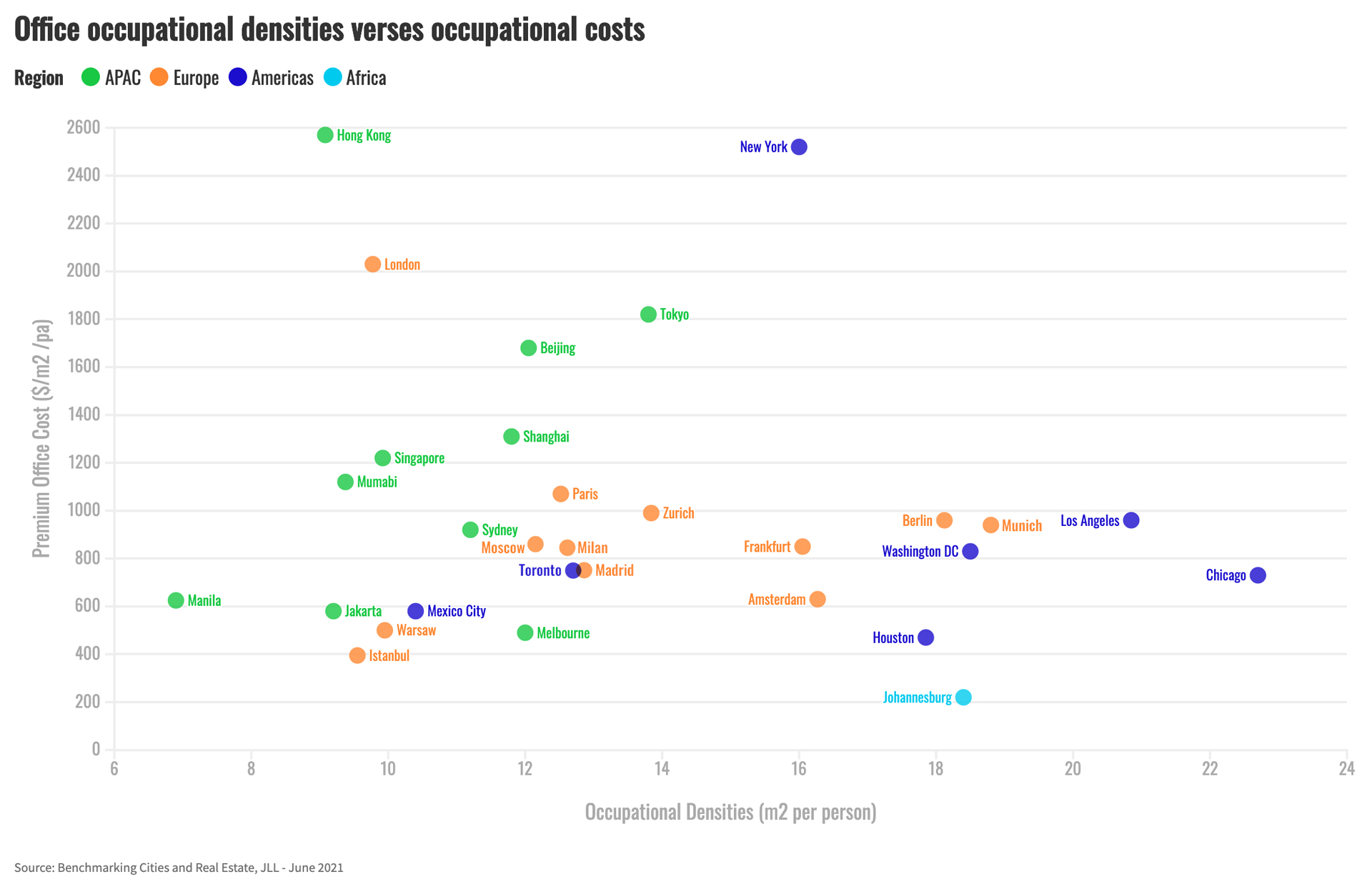

Before the pandemic, the average office in Manila, the capital of the Philippines, was the most crowded in the world. For each employee there was only 6.9m2 of office space. The leader in that field was Chicago, with a much more spacious 22.8m2 for each employee, far above the global average of 13.3m2.

Now, many companies are following COVID-19 social distancing regulations and making sure everyone is well spaced out. And with millions of people all over the world opting not to go into the office at all and work from home where possible, demand for office space has plummeted. In the fourth quarter of 2020, demand for offices in the Americas was down 63% and it was down 62% in Europe.

“Valuers must look at what kind of office space will be needed in the future", said Neil Axler MRICS, managing director at B. Riley Advisory Services in New York. “Suburban offices will get a new lease of life, and the tertiary cities will do better because remote working means businesses can hire from around the country.”

In the fourth quarter of 2020, demand for office space in the Americas was down 63% and it was down 62% in Europe.

Back in February, Marcus Badmann FRICS, managing director of real estate valuation at German advisors Bulwiengesa, predicted that the pandemic would have only a short-term impact on office occupancy rates. “At the end of COVID-19 we will go back to what we had as normal before. People seek the culture of city centres,” he said.

As the year progressed, it became apparent that flexible leases for office spaces could be crucial for the sector. “We will see divergence between long-let core assets that trade at really low yields, and a more operational model of shorter-term let buildings where management is much more about creating tenant retention through service,” said Chris Valentine MRICS, head of West End office leasing at JLL in London.

“Business and financial services are a large share of the UK economy, for example, and it has the highest potential for remote work among the countries we examined” McKinsey report – What’s next for the future of remote work?

Companies looking to reduce their carbon footprint may find downsizing their office space is the best way to do this. Big offices take a lot of energy, water and waste infrastructure to run – if large numbers of staff want to work from home, some employers may see this as a win-win situation. And that’s before the savings on rent from a smaller premises even come into the equation.

Although it’s by no means certain that more people working from home is better for the environment, as lots of home working means lots of homes that need to be heated and lit. In some parts of the US during lockdowns, average home electricity consumption rose more than 20% on weekdays.

There's also the ongoing debate about workplace culture to consider. As Andrew O’Donnell, UK real estate and workplace director at JLL, put it: “Our most recent people survey tells us that almost 80% of our younger staff want time in the office. This is driven by their social nature, the lack of space to work at home and the need to learn from colleagues and network with them. They want to feel part of the culture and organisation, which is something you simply can’t achieve remotely.”