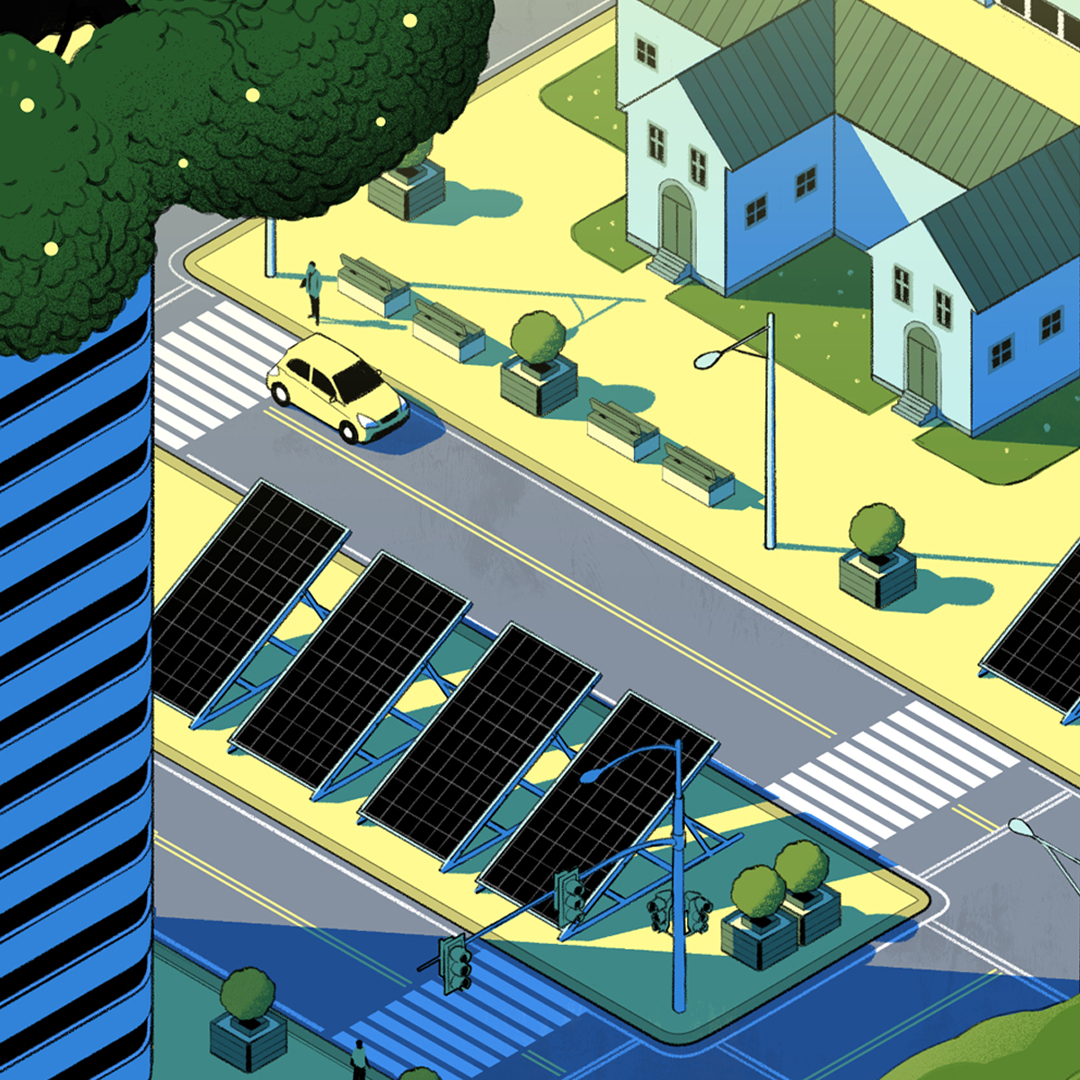

Illustration by David Salmerón

‘Greening’ residential buildings has long been seen as an effective reputation booster for developers and investors and a way for environmentally savvy homeowners to cut their bills and carbon footprints.

Better understanding and awareness of the benefits of higher energy performance in new builds and retrofits is ramping up demand and translating into a ‘green premium’, with higher sales prices and rental incomes.

Proof of the existence of a green premium – a higher return on investment – remains difficult to identify and factor into valuations due to a lack of consistent data. The market for commercial offices is arguably more advanced due to a push from investors, occupiers and legislation to ensure the green premium becomes universally recognised.

A key challenge in the residential sector is the fact that relatively few homes have been built to high energy efficiency standards. For example, the UK government scrapped its planned zero carbon homes standard for new builds in 2015 and as a result most homes built since then have less stringent emissions standards.

Current targets call for all homes to have an EPC rating of C or above by 2035, equivalent to an approximate 30% drop in CO2 emissions on current standards. “A green product in the market is a relatively recent thing so your average residential occupier is still learning how to buy. They’re a less mature market, but learning quickly,” explains Sam Carson, head of sustainability in CBRE’s Valuations & Advisory Services team.

Buyers will pay more for green homes

Despite slow progress on policy, recent analysis of the market reveals homebuyers are willing to pay more for more energy efficient homes. A 2022 survey of over 2,300 UK-based homebuyers, owners, estate agents and mortgage brokers by the bank Santander found that buyers place an average 9.4% premium on homes that have been retrofitted.

That equates to a £26,600 increase on the UK’s average house price of £283,000, which according to the bank is around twice the average £10,000 it costs to implement energy efficient upgrades. Homes with high energy efficiency standards were the most desirable, with estate agents reporting buyers paying an average of 15.5% more, rising to 20% extra in some cases.

The research chimes with analysis of property pricing data by high street bank Halifax in 2021, which found that homes in England and Wales with the highest energy ratings are worth up to £40,000 more on average compared to less sustainable properties.

Changing priorities

The COVID-19 pandemic fuelled a trend towards buyers wanting a bigger garden or a home office to cope with the new pressures of lockdowns and working remotely. But more recent soaring energy costs caused by volatility in the global wholesale market and the war in Ukraine are driving interest in energy efficient homes.

“The push to try and reduce bills has been brought into sharp focus over the last six months,” says Timothy Bannister, director of data services at online property website Rightmove. “If people understand what energy efficiency features can do to reduce the cost of running their home it’s a big draw, which will filter through into the value of the home when they are looking to sell. A home that’s cheaper to run should be more desirable and give support to the valuation.”

Rightmove’s research into the impact of greening homes on property values found that homes with improved EPC ratings typically sold for more, even taking into account market trends.

It compared pairs of sales for individual properties over time to assess how much energy efficiency improvements had impacted on values. Increasing the energy rating by two bands, for example from EPC E to C, was found to result in an average 12% rise in value, above and beyond local house price growth over the period between sales.

The change was even more significant for a three-band jump, with values up by 20% and a four-band jump resulted in a 22-23% increase.

The figures aren’t totally watertight, says Bannister, because in addition to green features many homes in the cohort will have had general refurbishment work, such as new kitchens, which could have impacted on sales prices. “More work is needed to pull those kinds of elements out, but this is the first sign that there really is something there regarding what people are willing to pay for homes with improvements to energy efficiency,” he says.

Anecdotal evidence also suggests a rental premium attached to the highest performing buildings that are zero energy in operation. CBRE has been tracking levels of green influence on the UK market and, according to Carson, one suburban build-to-rent zero energy in operation scheme featuring solar panels and home batteries, was recently let “in the blink of an eye” and attracted a 10% uplift in rents.

“They were shocked at how fast it was let, it was literally hours after being marketed,” Carson says. “Everyone is happy in that scenario - the landlord gets increased value, due to higher rental income and the occupier has lower cost volatility.” They may be paying extra in rent, but the additional cost is consistent compared to fluctuating energy costs, he adds.

“The push to try and reduce bills has been brought into sharp focus over the last six months” Timothy Bannister, Rightmove

Solar searches

Research has yet to pinpoint how much value is added by including specific energy efficiency features in a home, but there is evidence of the importance homebuyers now attach to them.

Rightmove ranks the popularity of keywords used in its property search engine over time and found that the term ‘solar panels’ had risen from 500th position in November 2020 up to 65th in August 2022. The term ‘heat pump’ rose from 1,000th position to 130th during the same timeframe.

“It’s quite a dramatic change in a relatively short space of time and these terms were rising up the list before the current situation with energy prices,” says Bannister. On the supply side, builders, agents, and sellers are also including more green terms in property adverts on the website to get more hits in Rightmove searches.

Growing interest in energy efficient homes from businesses, owners and home buyers, is expected to mean bigger green premiums going forward. A stronger focus on Environmental, Social and Governance (ESG) criteria by developers and landlords, coupled with the prospect of more stringent environmental regulations, means many are paying particular attention to sustainable investments and strategies on the path to net zero carbon.

A ‘do nothing’ scenario increases the risk of creating stranded assets that are unable to meet future energy efficiency standards or market expectations. They would require significant future investment to bring them in line with energy performance requirements.

Underperforming homes may increasingly be sold at a ‘brown discount’, the opposite of a green premium, a situation that’s already occurring with prime commercial real estate, says Carson: “It would be very risky for investors to build offices in central London without green features now, the market demands it.”

Non-green buildings will depreciate at an accelerated rate as the cohort of interested buyers shrinks, he adds: “In five years, the pool of buyers and occupiers will be smaller because everyone else will be looking for buildings with green credentials to manage their future risk,” he says.

“The landlord gets increased value, due to higher rental income and the occupier has lower cost volatility” Sam Carson, CBRE

Survey signals

The process of preparing pre-acquisition surveys, used to notify a purchaser of any significant issues and risk with a building, can provide a key indication of which aspects are most important to them.

Chartered building surveyors Earl Kendrick carry out residential pre-acquisition surveys for commercial landlords and individuals and has noted much more interest from clients in EPC ratings.

Phillipa Burgin MRICS, associate director in the retrofit division of Earl Kendrick says: “We deal in particular with refurbished blocks of flats and listed buildings. If they are underperforming and it’s obvious that some money needs to be spent – it could be quite a considerable amount depending on how thermally insufficient that property is – that’s going to be factored into the price the buyer is willing to pay. They don’t want to be trapped with a property that needs thousands of pounds worth of work they can’t afford or the prospect that they can’t rent it out.”

Under current Domestic Minimum Energy Efficiency Standard Regulations in the UK it is unlawful to let domestic private rented properties with an EPC rating below band E, but this is scheduled to increase to EPC B by 2030.

“Maybe you are buying a property to flip it and don’t care about the short term, but the longer you leave it and the closer you get to those minimum standards increasing, the harder it is going to be to sell on without improving the rating somehow,” says Burgin, who has also noted “a lot more conversation” around thermal performance and the cost of heating homes.

“If homes are underperforming and it’s obvious that some money needs to be spent, that’s going to be factored into the price the buyer is willing to pay” Phillipa Burgin MRICS, Earl Kendrick

Why green commercial property is more valuable

Rising demand is making retrofitting profitable

Read more