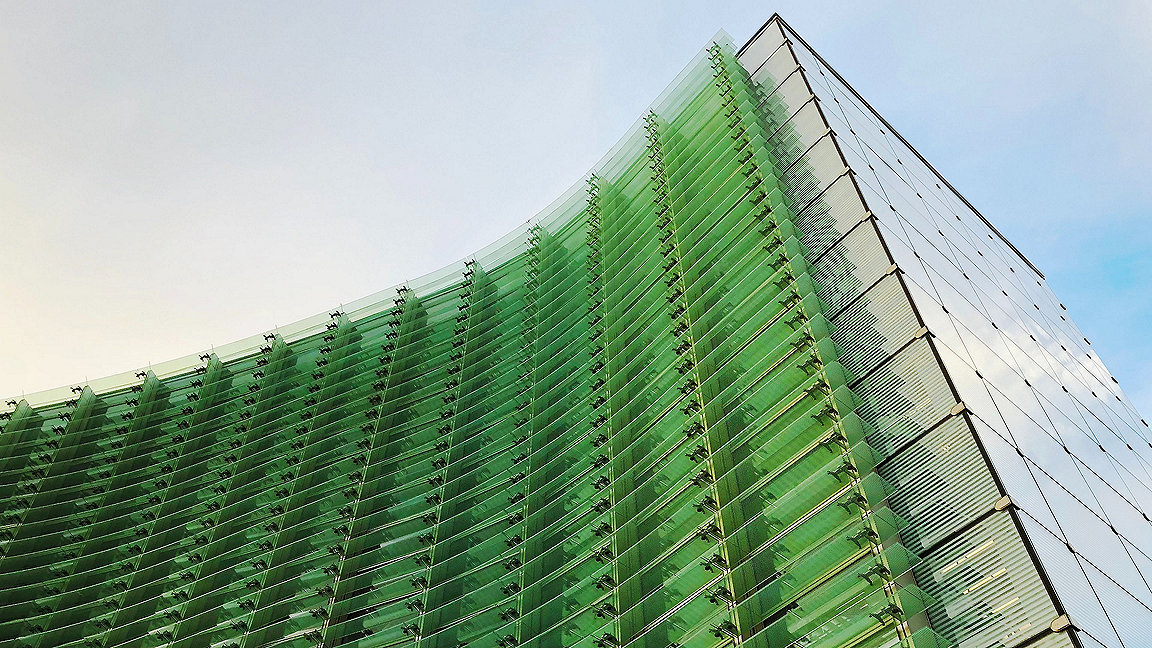

The clock is ticking down to 2030, by which time a raft of legislation has committed the UK to a 68% drop in carbon emissions compared to 1990 levels, and Germany to 65%. Other economies have similar targets: the US aims for a 56% reduction of 2005 levels, Australia for 26% and, in Japan, the figure is 46% of 2014 emissions. The work then continues towards net zero by 2050.

The promises made in Paris in 2015 are nowhere near being reached in the built environment which, globally, accounts for about 40% of CO2 emissions. The report finds that occupier demand for sustainable buildings is still moderate in many countries – and actually falling year-on-year from 2021 to 2022 in the Americas and Asia Pacific (58% to 45% of respondents reporting rising demand in the Americas and 56% to 49% in APAC). Europe is, by some measure, the region that is most enthusiastic about sustainable buildings: demand rose from 67% to about 75% in the past year.

This may be partly because European countries have particularly rigorous and far-reaching legislation around climate change which mandates energy-efficiency benchmarks. European citizens are also accustomed to seeing energy performance certificates (EPC) when they do anything from visit a public building, to buy or rent a home or purchase a new electrical appliance. This familiarity with the amount of energy being consumed is far patchier in other regions – often provided voluntarily or not meaningfully enforced. Australia, for example, is only now developing its equivalent of EPC which will be mandatory just for commercial property.

“The EU action plans, including initiatives such as its sustainable finance plan, Green Deal, the Energy Performance of Public Buildings directive and so on, have had an impact,” says Kisa Zehra, RICS global sustainability lead and the author of the report. “These plans came well before COVID-19, the messaging has been around for a few years and we’re seeing the benefit.”

High energy costs

It is also worth noting that Europe has very high energy costs per unit compared to many countries and higher demand for energy, given its often dense populations which might explain the demand for greener buildings. In March 2022, the cost of electricity per kw/h was significantly higher in most large European countries (Denmark $0.48; Germany $0.46; UK $0.33; Italy $0.31 – France was an exception at $0.19) compared to similar economies in other regions (Japan $0.23; Australia $0.21; US $0.16; Canada $0.11).

It is the same story with natural gas: in March 2022 average prices for gas were $0.42 for the Netherlands, $0.22 for Germany, $0.17 for Italy, $0.12 for France and $0.10 for UK compared to $0.07 for Australia, $0.04 for US and $0.03 for Canada. All these prices were recorded before the Russian invasion of Ukraine which has had such dramatic consequences for European supplies of gas.

“Investors are more interested in putting money into reducing carbon in Europe partly because of the high energy prices,” says Zehra. “It makes sense to make your building more energy-efficient in, say, the UK because of the costs associated with operating it.”

Measuring sustainability

One of the most disappointing aspects of the report is how hampered professionals feel by the slow adoption of digital tools to measure sustainability. While 47% of respondents always or often complete environmental assessments digitally, almost the same number (45%) never or rarely do. This figure becomes alarming when respondents answered questions about whether they measure operational carbon in the life cycles of the projects on which they are working.

Across the globe, the proportion of professionals not measuring this is 72%, rising to 80% across the Americas. Europe fares slightly better at 75% but the region leading the world on this index is APAC where the figure is down to 60%, a 10% drop on 2021.

But it is often embodied carbon that means the built environment’s carbon footprint is disproportionately large. Further digging through the data reveals that a growing number (25% in 2022 compared to 18% in 2021) want to measure embodied carbon in their projects – which could lead to far greener building materials being used, for example – but believe that they are being held back by a lack of standardised approaches for doing this.

“RICS has introduced standards on the reporting of carbon but it doesn’t seem to have had that much impact yet,” says Zehra. “I was quite taken aback.”

In fact, about half of respondents blame their reluctance to measure on a lack of tools, databases, benchmarks and guidance, once again putting the ball firmly in the legislators’ and regulators’ court. Only about 11% of respondents felt that there was no tangible “green premium” that would encourage them to make their projects more sustainable.

“Investors are more interested in putting money into reducing carbon in Europe partly because of the high energy prices” Kisa Zehra, global sustainability lead, RICS

Skills gap

What is worrying is the proportion of respondents blaming lack of progress on using embodied carbon on gaps in knowledge and skills shortages, as well as cultural issues and established practices. In Europe, the region most often reporting this as a barrier, it is a key factor for 40% (cultural) and 33% (skills) of respondents. In the Americas, by contrast, it is significant for less than 25% of professionals surveyed.

This problem can be seen in more detail in the UK-specific Decarbonising Real Estate report released by RICS in November: “In terms of embodied carbon, the complete lack of regulation creates a situation where an increasingly significant part of real estate emissions is not only uncontrolled, but not even measured. The Sustainability Report responses told us that clearly there is something amiss in the sector,” says Zehra.

The rise of the chief sustainability officer

RICS members tackling big environmental challenges