Construction has a plastics habit.

Its addiction to polymers used in products like flooring, insulation, paints, windows, doors, pipes and single-use packaging, is fuelling the climate crisis and adding to the litter of plastics in the ocean.

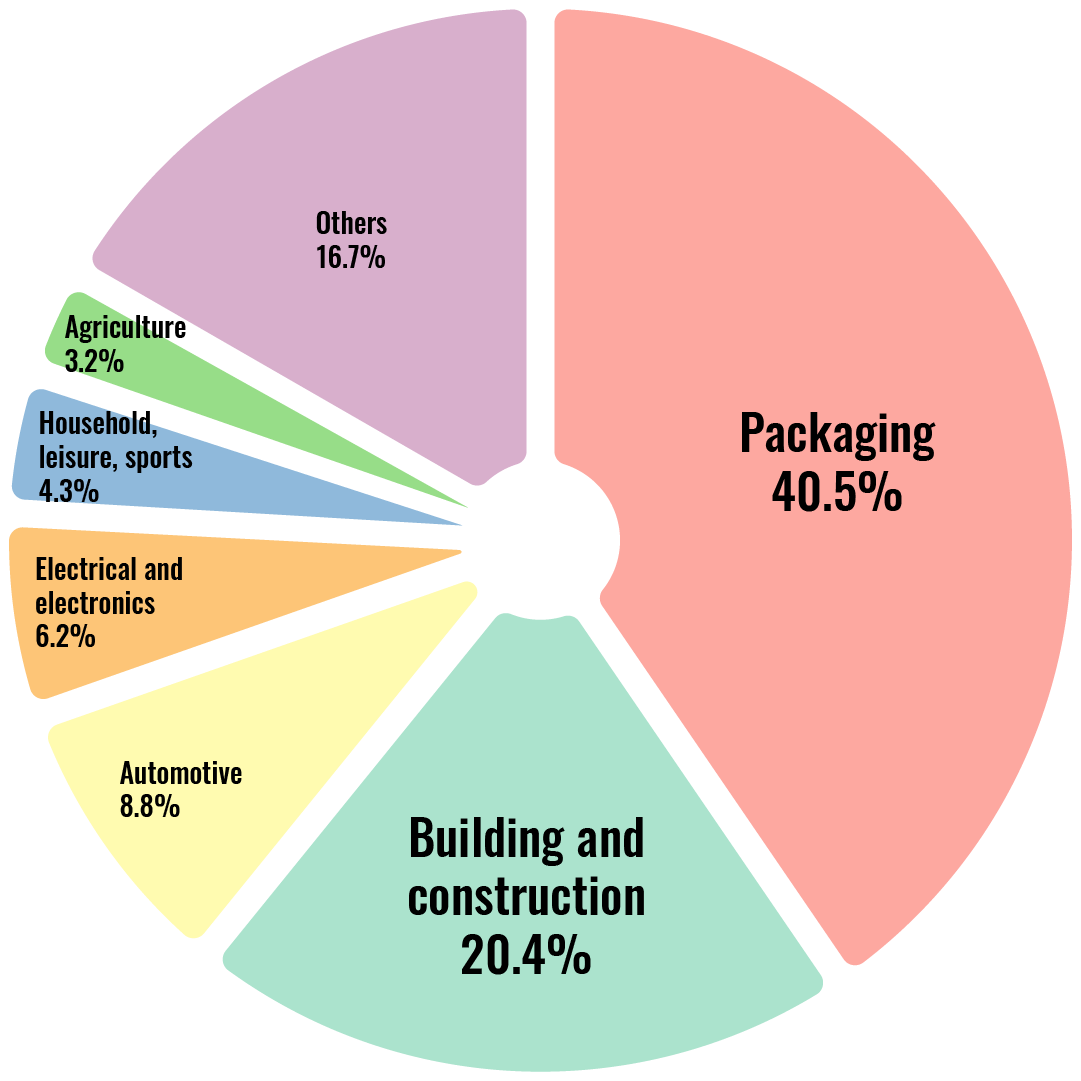

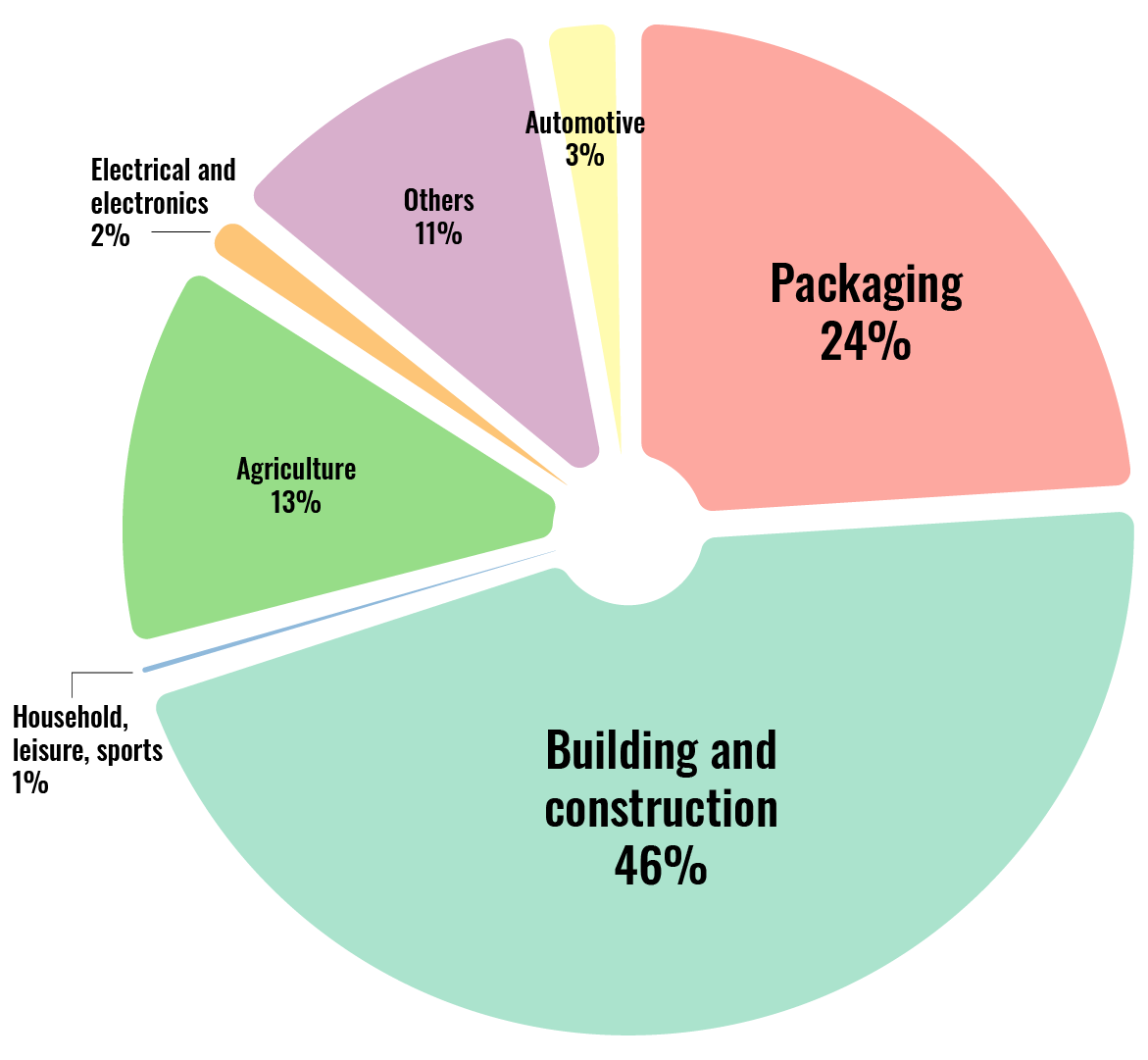

Of approximately 51m tonnes of plastic demand across Europe, construction is responsible for about 10m tonnes, or just under 20%. That makes it the second biggest market after packaging, according to figures from trade association Plastics Europe. A percentage of that packaging also feeds into construction, further increasing the sector’s impact.

Statistics for the UK show that around a third of construction plastics are recycled, while a third go to landfill, and a third are incinerated. However, the situation is considerably worse in many other countries given that fewer than 10% of plastics are recycled globally.

Six different plastic types account for around 90% of all plastic waste generated, with PVC being the most common material, comprising about half of all waste plastics, followed by polyethylene and polypropylene.

Construction has had little impetus to directly tackle plastic waste, partly because the material is lightweight compared to other waste streams and therefore subject to lower landfill tax, minimising the impact on a contractor’s bottom line. Environmental certification schemes, such as BREEAM and LEED, don't directly tackle plastic, although they do feed into certain material and waste credits.

However, a growing industry focus on material reuse and recycling, embodied carbon and the circular economy has helped shift the debate and accelerate efforts to eliminate plastic waste.

Six different plastic types account for around 90% of all plastic waste generated, with PVC being the most common material.

Taxing plastic

Among the factors informing waste policy is a new EU Plastics Packaging Levy imposed on all non-recyclable plastic packaging waste handled by member states. In the long-term this is likely to be passed on to producers and users of plastics packaging, potentially including construction supply chains.

The UK’s Plastic Packaging Tax, a separate tax to the EU levy, is due to be introduced in April 2022 and will apply to all plastic packaging manufactured in, or imported into Britain, that does not contain at least 30% recycled plastic.

Other initiatives include an ambitious plan set out by America’s Plastic Makers to make 100% of plastic packaging recyclable or recoverable by 2030, and 100% of plastic packaging reusable, recyclable or recoverable by 2040.

Environmental and cost-related incentives for reducing plastic consumption are having an impact on some manufacturers. Brickmaker Wienerberger has set itself a target to reduce plastic packaging in the UK by 30% compared to 2019 levels, by 2023. That should prevent 180 tonnes of plastic entering the construction sector supply chain, says the firm.

Research carried out with its partners has led to some quick wins over the past 18 months, such as the ability to standardise thickness specifications and introduce a standard specification for UV protection – needed to prevent packaging from breaking down in the sun. The company has also trialled alternative pack formats including a 'bay band' that reduces packaging by around 65%.

Cutting back on plastic

Scaling back the use of single-use plastics is one thing, but what about adopting cleaner alternatives that don’t require fossil fuels to manufacture?

That is a more challenging proposition, says Stephanie Palmer, head of sustainability at Wienerberger: “We are investigating biodegradable alternatives and have also considered some bioplastics, but it's quite a minefield. Firstly for technical performance: we need it to be strong enough and be stable in sunlight and rain for several weeks. Secondly, because of end of waste treatment: bioplastics can cause issues if they are recycled with traditional plastics. Bioplastics and biodegradable materials often need to be treated in specialist facilities, which have limited capacity in the UK.”

Major contractors also play a big role in driving down reliance on single-use plastics across supply chains, for example by updating permitted specifications and contractual requirements.

In a move to reduce the 3,000 tonnes of plastic waste it generates every year, contractor Mace launched a campaign in 2019 to cut its consumption of single-use plastics on sites by 20% in 12 months. The target was achieved and trials of solutions on sites, from interior fit outs to large-scale mixed-use developments, have enabled the contractor to grow and share resources across the business.

A suppliers alternative list is now used by all project construction teams, plus operations and facilities management, and updated roughly every six months. Lynne Potter, senior sustainability manager at Mace, says: “Our sustainability team share it with tier one contractors in pre-start meetings to show the sorts of things we've tried and tested, where it's worked and why we'd like to see it replicated.”

Contracts for tier one contractors now include items that stipulate the need to avoid single-use plastics “at all costs” and to carry out as much upfront work as possible to avoid them coming to site. Where single-use plastics are specified, contractors must fill out a justification form stating the name of the product, why it’s needed and the reason it can't be swapped for an alternative.

However, there are hurdles to changing attitudes in the wider supply chain, says Potter: “Our contract is with tier ones, but with further tiers and suppliers it’s more challenging because of the extent of the supply chain.”

‘Permanent’ plastic products used in buildings, such as insulation and pipes, cable sheathing and flooring are another major source of waste – during construction and at end of life when they are stripped out as part of refurbishment or demolition.

Where are recyclates used most in Europe? 2020

46% of recyclates in Europe are used in building and construction applications that require high-performance and durable products. The longer the life span of a product, the greater its contribution to resource efficiency and circularity.

Source: Plastics Europe

An ambitious plan set out by America's Plastic Makers in the US aims to make 100% of plastic packaging recyclable or recoverable by 2030.

Different kinds of plastic cause problems

Some manufacturers offer closed loop take back schemes for products, but efforts need to accelerate, says Dr Anna Braune, head of R&D at the German Sustainable Building Council: “In recent years, the recycling rate for plastic components of buildings, such as PVC, has been reported as 100%, which sounds like a great success. However, only 25% of it was actually recycled. Around 70% was used for energy in incineration plants and 5% ended up in landfill.”

The sheer variety of polymers in circulation poses an issue for waste management, adds Katherine Adams, technical & research associate at the Alliance for Sustainable Building Products (ASBP): “It can be difficult to understand which types have been used in which applications, and therefore how to manage them as a waste stream... After 30-40 years some components may contain chemicals we don't even use today.”

Arguably a more proactive solution is to eradicate products containing plastics during the design stages. What’s understood to be Europe’s first “virtually plastic-free” mainstream residential property is currently being built on a site in Redditch, in the UK.

Fewer plastic parts in homes

The block of 12 one-bedroom apartments is designed and built by Green Square Accord Housing Association, part-funded by the EU’s Interreg North-West Europe programme as part of the CHARM (Circular Housing Asset Renovation & Management) initiative.

The building is estimated to contain around 80% fewer plastic parts and components than the equivalent traditionally built development. Finding non-plastic equivalent products wasn’t always easy – designers were forced to specify plastics for items including intumescent strips, used to seal off areas to stop smoke ingress, and a plastic membrane that protects against radon gas.

Sometimes warranty providers refused to accept alternatives to plastic products, even when designers tried to justify their choices. Carl Taylor, assistant director of new business and growth at Green Square Accord says: “It is important that properties are able to be warrantied and come with the guarantees people would expect of newly built homes. Warranty providers need to provide more sustainable and ethical component lists.”

This and other barriers will come to the fore in the years ahead as the industry seeks a robust and timely solution to the problem of plastic waste.